PPT

advertisement

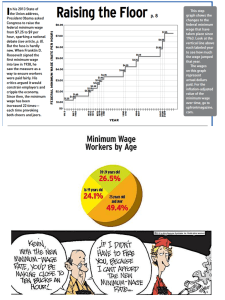

CHAPTER 8 DYNAMIC P OWERP OINT™ S LIDES BY S OLINA L INDAHL Price Ceilings and Floors CHAPTER OUTLINE Price Ceilings Rent Control (Optional Section) Arguments for Price Controls Universal Price Controls Price Floors For applications, click here To Try it! questions To Video Food for Thought…. Some good blogs and other sites to get the juices flowing: SEE THE INVISIBLE HAND Iraq 2003: Gas prices are frozen at $.05 per gallon. A good idea? SEE THE INVISIBLE HAND Getting in the way of the invisible hand? Distorted price signals cause resources to be misallocated. Price Ceilings Policy makers may respond to buyers’ complaints that prices are “too high” by enacting price controls. A Price Ceiling is a maximum price allowed by law. Price ceilings limit the price sellers can charge for their goods to the maximum price. Prices cannot legally go higher than the ceiling. BACK TO Price Ceilings Price ceilings that involve a maximum price below the market price create five important effects. 1. Shortages 2. Reduction in Product Quality 3. Wasteful Lines and Other Costs of Search 4. Loss of Gains from Trade 5. Misallocation of Resources BACK TO Shortages 1. When prices are held below the market price shortages are created. The shortage = difference between the Qd and the Qs at the controlled price. The lower the controlled price relative to the market equilibrium price, the larger the shortage. BACK TO Shortages Price Ceilings Create Shortages Price Supply Market Equilibrium Shortage Controlled Price (Ceiling) Demand Quantity Qsupplied at the Controlled Price Qdemanded at the Controlled Price BACK TO SEE THE INVISIBLE HAND A shortage of vinyl in 1973 forced Capitol Records to melt down slow sellers so they could keep pressing Beatles’ albums. Take a look….. Why do you think farmers killed a million baby chickens in 1973? Does it matter that chicken prices were subject to a price ceiling but their feed was not? Click on the picture for a short video (first 1:40 min of the clip) http://www.youtube.com/watch?v=IFbAwzU6G7s&NR=1 To next Video Reduction of Product Quality 2. At the controlled price, sellers have more customers than goods. In a free market, this would be an opportunity to profit by raising prices. But when prices are controlled, sellers cannot. Sellers respond to this problem in two ways: Reduce quality Reduce service BACK TO Wasteful Lines and Other Costs of Search 3. Price controls that create shortages lead to bribery and wasteful lines. Shortages: not all buyers will be able to purchase the good. Normally, buyers would compete with each other by offering a higher price. If price is not allowed to rise, buyers must compete in other ways. BACK TO Take a look….. How do rent-controlled apartments get distributed? Click on the picture below to find out in this clip from the “Economics of Seinfeld”. (1:20 minutes) http://yadayadayadaecon.com/clip/6/ BACK TO Wasteful Lines and Other Costs of Search Some buyers may be willing to bribe sellers in order to obtain the good. The highest bribe a buyer would pay is the difference between his max price and the price ceiling. If bribes are common, then the total price of the good is the legal price plus the bribe. BACK TO Wasteful Lines and Other Costs of Search Buyers can also compete with each other through their willingness to wait in line. The maximum wait time (translated into monetary terms) for a buyer is the difference between the max price and the price ceiling. So the total price of the good is the legal price plus the time costs. BACK TO Wasteful Lines and Other Costs of Search Bribes and waits both lead to a total price that is greater than the controlled price, (but they are different.) Bribes involve a simple transfer from buyers to sellers. The time spent waiting in line, however, is simply lost – paying in time is much more wasteful. BACK TO Wasteful Lines and Other Costs of Search Price Ceilings Create Wasteful Lines Price Supply Total Value of Wasted Time Time Cost Willingness to Pay Market Equilibrium Shortage Controlled Price (Ceiling) Demand Quantity Qsupplied at the Controlled Price Qdemanded at the Controlled Price BACK TO Lost Gains from Trade 4. Price controls reduce the gains from trade. Price ceilings set below the market price cause Qs to be less than the market Q. When Q is below the equilibrium market Q, consumers value the good more than the cost of its production. This represents a gain from trade that would be exploited (if the market were free). BACK TO Lost Gains from Trade Dead-weight Loss is the total of lost consumer and producer surplus when all mutually profitable gains from trade are not exploited. Price ceilings create a dead-weight loss by forcing Qs below the market Q. Buyers and sellers would both benefit from trade at a higher price, but cannot since it is illegal for price to rise. BACK TO Lost Gains from Trade Price Ceilings Reduce the Gains from Trade Consumer Surplus Shrinks to this Price Producer Surplus Shrinks to this Willingness to Pay Market Price Supply Consumer surplus in market equilibrium Market Equilibrium Producer Surplus in equilibrium Controlled Price (Ceiling) Shortage Demand Quantity Qsupplied Qmarket Qdemanded BACK TO Lost Gains from Trade Price Ceilings Reduce the Gains from Trade Deadweight Loss (lost gains Price from trade) = Lost Consumer Surplus + Lost Producer Surplus Supply Willingness to Pay Market Price Controlled Price (Ceiling) Total Value of Wasted Time Lost Consumer Surplus Market Equilibrium Lost Producer Surplus Shortage Demand Quantity Qsupplied Qmarket Qdemanded BACK TO Misallocation of Resources 5. Price controls distort signals and eliminate incentives-- leading to a misallocation of resources. Consumers who value a good most are prevented from signaling their preference (by offering sellers a higher price.) So producers have no incentive to supply the good to the “right” people first. As a result, goods are misallocated. BACK TO Misallocation of Resources Price Controls Prevent Resources from flowing to their Highest-Valued Uses BACK TO Rent Controls Rent Control: a regulation that prevents rents from rising to equilibrium levels. Rent control is a price ceiling whose effects worsen over time No one wants to build new apartments if the rents will be artificially low… BACK TO Rent Control •Example: San Francisco •Very hot home sales/rental market •Average rent close to $3000/month, highest in the country •Sustained by high tech workers who live in the city •Rent controls and renter protection by city laws •Not charging renters fair market value is “fair” aka “Social Justice” BACK TO Rent Control •SF recently passed the “Relocation Assistance Payment Ordinance” • It requires rental property owners to pay their tenants oppressive and unconstitutional sums of money before the owners can regain personal use of their property — money the tenants can use for any private purpose they wish. •Pacific Legal Foundation attorneys filed the challenge to this ordinance on the basis of Constitutional protections of property rights. BACK TO Rent Control • Lawsuit is filed on behalf of homeowners Daniel and Maria Levin, a married couple who own a small two-unit house on Lombard Street. •They live in the upper unit, but are effectively denied the right to take occupancy of the lower unit, because of the costly payment — $117,000, in their case — required by the new ordinance. •Some payments exceed $200K BACK TO Rent Control • Why would anyone own or build new rental units in SF if this ordinance stands? • What’s the likely impact on landlords? How will they react? • What’s the likely impact on rental rates? • Why would the SF City government pass such laws? • "In many cases rent control appears to be the most efficient technique presently known to destroy a city—except for bombing." - Assar Lindbeck (Swedish economist) BACK TO Rent Controls The shortage is smaller in the Short Run… Price (rent) …..than in the Long Run Short Run Supply Long Run Supply Market Equilibrium Controlled Rent Long Run Shortage Short Run Shortage Qsupplied (Long Run) Qsupplied (Short Run) Demand Qdemanded Quantity (rental apartments) BACK TO Arguments for Price Controls So why do price controls ever get passed? The general public may not understand the nasty side-effects of price controls Shortages may benefit the ruling elite… In the former USSR, the communist party elite used Blat to obtain goods. Blat= having connections that can be used to get favors. The party elite can use their connections and power to obtain goods for themselves or others. Without such leverage their power dissipates. BACK TO Universal Price Controls Just Another Day in a USSR Bread Line Universal price controls caused widespread and persistent shortages in the USSR. Average time in line for a Soviet woman? 2 hours every day, 7 days/week. BACK TO SEE THE INVISIBLE HAND Are you better or worse off when the food is included in your airfare? Price Floors Price floor: a minimum price allowed by law. not as common as price ceilings (but still important) Price floors have four common effects: 1. Surpluses 2. Lost gains from trade (deadweight loss) 3. Wasteful increases in quality 4. A misallocation of resources BACK TO Try it! If the government of the European Union sets a price floor for butter above the equilibrium market price, what will be the effect? a) Farmers will produce less butter and consumers will purchase more, resulting in a shortage of butter. b) The supply of butter will increase and the demand will decrease. c) Farmers will produce more butter and consumers will purchase less, resulting in a surplus of butter. d) The equilibrium price will rise to the price floor. To next Try it! Surplus When prices are held above the market price (price floor) quantity supplied exceeds the quantity demanded. Price Supply Controlled Price (Ceiling) Surplus Market Price Demand Quantity Qdemanded at the Controlled Price Qmarket Qsupplied at the Controlled Price BACK TO Lost Gains from Trade Price controls reduce the gains from trade (create deadweight losses) Price Deadweight Loss = Lost Consumer Surplus + Lost Producer Surplus Controlled Price (Floor) Market Price Supply Surplus Lost Consumer Surplus Lost Producer Surplus Willingness to Sell Demand Qdemanded Qmarket Qsupplied Quantity BACK TO Wasteful Increases in Quality Price controls that create surpluses lead to wasteful increases in quality. Supply Price Deadweight Loss Controlled Price (Floor) “Quality” Waste Market Equilibrium Willingness to Sell Demand Quantity Qdemanded at the Controlled Price If they can’t lower price, sellers will find other ways to compete! BACK TO Wasteful Increases in Quality Higher quality raises costs and reduces seller profit. Buyers get higher quality, but would prefer a lower price. Price floors encourage sellers to waste resources: higher quality than buyers are willing to pay for Most flyers prefer a lower price BACK TO Misallocation of Resources Price controls misallocate resources by: Allowing high-cost firms to operate. Preventing low-cost firms from entering the industry. Regulation prevented Southwest (and 79 other firms) from entering the national market BACK TO Minimum Wage •Minimum Wage Facts •Mandatory wage that must be paid to workers •Workers can not negotiate for a wage lower than the minimum wage (right of contract) •Currently $7.25/hour as per Federal law with efforts to raise it to $10.10/hr •California is at $9/hr with more than half of all states above the Federal minimum •Less than 3% of all workers earn minimum wage (tiny) •Largest group at minimum wage are suburban teenagers BACK TO Minimum Wage •Minimum Wage Facts •Less than 3% of all workers earn minimum wage (tiny) •Largest group at minimum wage are suburban teenagers •Historical fact: minimum wages originated as a means to exclude women and minorities from competing against white men •It does not reduce poverty significantly since most MW participants are not in “poverty” households •Walmart is in favor of a higher minimum wage. Why? BACK TO How are wages determined? • • • • Do companies pay workers on an arbitrary basis (i.e. they pay whatever they feel like paying)? Economic theory applies to labor markets Supply and demand determine price of labor (wages) Employers pay wages based on value of marginal product for labor • i.e. employers will not pay a worker $15/hr if the worker’s economic value (contribution) is $10/hr BACK TO How are wages determined? • Labor markets are competitive • • • Employers compete for labor, i.e. for high demand, high-skilled workers via increased wages/benefits Wages are based on worker productivity (output) Worker output is determined by skills and capital BACK TO Minimum Wage • • • • Many municipalities with much higher min wages Seattle $15/hr phase-in for 2017 Oakland - $12.25 (March 2, 2015) San Francisco – Passed by referendum with 77% voter approval • $11.05 now, rising to $12.25 in May and $15/hr in 2018 • Nevada has pending $15/hr minimum wage legislation BACK TO Arguments in favor of Minimum Wage • • • • • • Workers need a living wage, especially those that support a family of four It is “fair” Large corporations have plenty of profits to afford this, look at WalMart’s profits A higher minimum wage will not reduce employment (Card-Kruger study) Labor “deserves” higher share of profits in capitalist-type economies Higher minimum wage will stimulate economic spending, hence “pay” for the MW increase BACK TO Arguments in favor of Minimum Wage • Raising the minimum wage will reduce spending by government, i.e. less welfare & food stamps • Higher wages will increase worker productivity i.e. workers will “earn” the increase • Employers are engaged in monopsonistic behavior against low-skilled workers • Minimum wage increases are always followed by a surge in economic growth (2007 increase?) • Seven Nobel Prize winners in economics are in favor of a higher minimum wage, asserting that the loss of employment is a negligible effect BACK TO Arguments Against Minimum Wage • Employers will hire less workers • Prevents lowest-skilled workers from being hired • Workers with the lowest skills will be the first to be laid off or not hired as a result • Substitution of capital for labor (robots, automation) • Where does the money for increased labor costs come from? • • Less profits? Higher prices? – Studies show higher prices disproportionately affect lower income workers BACK TO Arguments Against Minimum Wage • Minimum wage is a training wage, allows acquisition of skills, higher productivity • Provides incentives to workers to acquire more skills • Working for a living breaks the culture of dependency and increased taxes on others • If $9.00/hr min wage is good, isn’t a $20/hr min wage better? How to draw the line? • • When min wage goes to $15/hr, a large percentage of the labor market gets an increase (20% ?) Have we discovered the secret of higher standards of living? Or the “something for nothing” principle? BACK TO Arguments Against Minimum Wage • Who else benefits from a higher minimum wage? • • Low-skill, low pay workers are substitutes for higherskilled, higher pay workers Labor unions are labor monopolies supported by US laws such as the Wagner Act (Great Depression) • Where did all of the elevator operators, gas station attendants, and movie theatre ushers go? • Whatever happened to “equal pay for equal work?” BACK TO Impacts of Minimum Wage Increases • All labor markets have downward sloping demand curves • Raising wages results in less labor hired by employers • Employers will cut non-wage worker benefits to compensate for higher costs • Workers may be pressured to work harder or face termination • Higher earnings may result in workers asking for fewer hours due to loss of government benefits • ACA has amplified these problems • Casey Mulligan, University of Chicago labor economist BACK TO Evidence • CBO Study 2014 • Increase from $7.25 to $10.10/hour will result in the loss of 500,000 jobs • Newmark Minimum Wage Study results • Teenage unemployment rates much higher than overall U3 unemployment rate • European min wages are much higher than US and teenage unemployment rates in EU are much higher than US • Announcements in SF and Seattle of small business closings in response to $15/hr wage laws BACK TO Evidence • Special case: American Samoa • Tuna processing plants exempted from US min wage laws • Why? • Great Depression – minimum wage began at $.25/hour • Applied to Puerto Rico and cause massive layoffs BACK TO BACK TO Minimum Wage – Economic Ignorance • From 7/12/14 internet advertisement: BACK TO Minimum Wage – Economic Ignorance • What’s wrong with this? • Higher wages lead to more hiring? • Wage increases for just 3% of the labor market stimulates the economy sufficiently to produce significant job growth overall? • No other economic factors affect the job market? • What would have happened to job growth if the minimum wage increase had not been passed in these states? • Time frame: minimum wages raises occurred in early 2014 and yet by July 2014 the claimed impact had already occurred? • This is an example of “lying with statistics” - it preys upon the ignorant and harms society BACK TO Minimum Wage - Summary • The minimum wage argument is and will always be about politics and vote buying: • Pro-min wage increase is the “compassionate caring” position • People against the min wage increase are uncaring, haters • Many pro-minimum wage arguments rely on the ignorance of the (voting) public • Confusion between money and real output • Much of this goes back to bad economic theory, i.e. Marx’s Labor Theory of Value BACK TO Minimum Wage - Summary • The REAL problem with the minimum wage: • Government interference in the economy • Good intentions do not guarantee good outcomes • Minimum wage policy is part of the continual propaganda that the government “runs” the economy and knows best how to control and adjust (i.e. “creating jobs” or “Thank God for government spending” • Hayek called this – “The pretense of knowledge” • The belief that the government can improve overall economic outcomes with price controls • The collectivist belief in the “free lunch” and free riders BACK TO Minimum Wage - Summary • “Government is the great fiction, through which everybody endeavors to live at the expense of everybody else.” • – Frederic Bastiat BACK TO SEE THE INVISIBLE HAND President Jimmy Carter deregulated the price floors in much of the trucking industry. Trucks carry almost all of the consumer goods that you purchase, so almost every time you purchase something, you're paying money to a trucking company. What do you think happened in the trucking industry after deregulation? a) The price of trucking services fell. b) Truckers earned less money. c) Consumers saved a lot of money. d) All of the above are correct. Try it! If the U.S. government sets a price floor on milk, it will not always lead to a surplus. Why not? a) b) c) d) The price floor would be rarely enforced. Because price floors most commonly lead to shortages, not surpluses. The market price of milk will sometimes rise above the price floor, rendering the price floor irrelevant. Price floors cause supply and demand to change, which leads to changes in To next Try it! equilibrium price. Try it! During research for a class you find out that in the year 301, the Roman Emperor Diocletian issued an “Edict on Prices” for shoes and you want to find out if it was a price ceiling or a price floor. Further research tells you that the number of shoes sold dropped dramatically and that both sellers and buyers were very upset. Was it a: a) Price ceiling b) Price floor c) Not enough information BACK TO