Rise of Keynesian State (nation)

advertisement

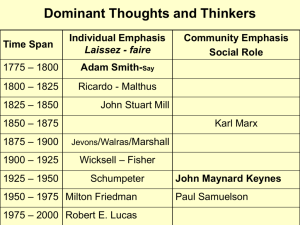

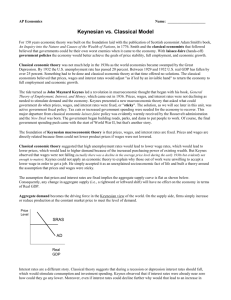

The Rise of the Keynesian State - I Nationally “Keynesian” State The term “Keynesian” derives from the name of the economist John Maynard Keynes Keynes developed an economic theory of the planning state for active government intervention Even when policy makers were not consciously Keynesian, his theory dominated policy for 30 years As Keynesian policies failed in the late 1960s both the Keynesian state & his theories entered crisis Keynesian “State” “State” usually understood as “nation” state i.e., national government But “state” can be understood more broadly governments, plus set of all institutions organizing a particular social order Keynesian “state” exists at several levels: sub-national (regional, muncipal) national supra-national Elements of Analysis in this Section Historical Sketch of Emergence & Development Social & political character of Rise See how “economic” is rooted in social & political See how “economic” is social & political Prelude & Source: Great Depression Great Depression = crisis of earlier order Earlier order involved: Business cycle as growth regulator Taylorism, Fordism to control labor Repression of trade unions More limited government regulation of economy More laissez-faire Quasi-gold standard (at int’l level) Business Cycle as Regulator when wage exceeded of productivity, profits dropped (often generated financial crisis) business cut back on I total output downturn increased unemployment downward pressure on wages restoration of profits, investment & growth Crisis of Business Cycle In Great Depression downturn didn’t produce an upturn Downturn produced Stock Market Crash of ‘29 Economic activity & prices fell, stayed down Unemployment rose dramatically, stayed high Wages fell, but increased profits din’t raise I Investment fells, stayed down Behind Persistence of Depression Depth of unemployment despair Generated a collective refusal of suffering due to impersonal forces Rise of new form of labor organization waged labor forms industrial unions, CIO unwaged, unemployed demand support unemployment compensation to finance adjustment social security in face of financial collapse New demands for full employment, rising wages Capitalist Adaptation - I At the level of theory: Keynes From classical view of wages as cost To understanding that both wages & profits can wages =costs but also demand pressure for I to raise productivity and reduce costs Economic theory extended to social sphere e.g., human capital theory, growth theory provided logic for investment in education, R&D, welfare, etc. Capitalist Adaptation - II At the level of policy: New Social Compact Progressive response (unlike Nazis, Stalinists) Accepted unions, imposed bargaining, wages Subsidized I to productivity (WWII+) Strict financial regulation (to avoid crises) Socialization of adjustment costs in UI & Social Security Capitalist Adaptation - III Post-war gifts of productive assets to private industry Full Employment Act of 1946 Fordist production, fordist education Restoration of patriarchal nuclear family Racial hierarchy on job and off (ghetoization) Cold War, Point IV Capitalist Adaptation - IV Post-1950s investment in education & central cities Post Sputnik Space Race Civil Rights Act Peace Corps & Vista Green Berets Cuban Missle Crisis Bay of Pigs --END-- The Rise of the Keynesian State II Internationally Preoccupations of US Policy Makers, During & After WWII Planning for reconstruction of world order began during WWII, Before resolution of war was clear Basis was Keynesianism rather than Nazism or Stalinism (assuming the Allies won) Primary Aim: Stability for trade & investment Stability Stability desired vis à vis instability of Great Depression Depression, int’l circulation of depression breakdown in gold standard & int’l trade Controls on capital flows Defaults on int’l debts Stability desired vis à vis WWII Disruption of int’l trade Disruption of int’l investment No Going Back Refusal to return to Gold Standard Refusal of Free Markets in Currencies Refusal of Keyne’s proposal for int’l currency to be regulated by independent global central bank Solutions: Economic & Political Bretton Woods Agreements: fixed exchange rates national foreign exchange reserves International Monetary Fund (pool of reserves) Keynesian Nation state handles adjustment GATT toward free trade Free mobility of capital (for investment) United Nations (to avoid war & foster int’l cooperation) Implementation US occupation and re-engineering of management of Germany & Japan, e.g., land reform & union busting Marshall Plan in Europe as a whole Emergence of multinational corporation as major vehicle of int’l investment Replacement of colonial empires being torn by independence movements Pax Americana & nation/elite building --END--