A New Model for Port Development

advertisement

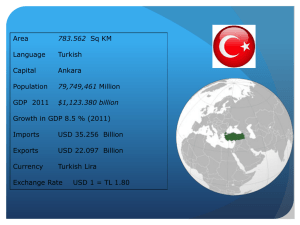

Brazilian Port Sector A New Model for Port Development Presentation by Engineer José Ricardo Ruschel dos Santos Stavanger November 2010 Brazilian Port Sector A New Model for Port Development Privatization of Port Operations 1. Information on Brazil 2. Growth of Containerization 3. Brazil Takes Off 4. Regulatory Framework 5. Brazil Invests in Its Ports 6. Fostering Private Investments 7. Conclusion Information on Brazil • Brazil is located in the north east of South America and has a geographical surface area of 8.5 million km2. • It borders every nation on the South American continent except Ecuador and Chile. • The capital is Brasilia, and the official language is Portuguese. • Brazil’s current population is estimated to be approximately 192 million, making it the fifth most populated country in the world ranking behind China, India, the United States and Indonesia. • Brazil’s population has increased steadily at a rate of 1.2% since 2004 and is forecast to continue to grow over the period from 2008 to 2012 to reach an expected population of approximately 203 million in 2012. • Brazil is a federative republic comprised of 26 states which are subdivided into 5,560 municipalities and a federal district. Brazilian Port Sector New Model for Port Development Privatization of Port Operations 1. Information on Brazil 2. Growth of Containerization 3. Brazil Takes Off 4. Regulatory Framework 5. Brazil Invests in Its Ports 6. Fostering Private Investments 7. Conclusion Brazil’s Ports Cargo Flow Cargo Handling - Development and Forecast 900 800 700 600 Tons Millons 500 400 300 200 100 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 Brazil’s Ports Cargo Flow Container Handling Development and Forecast 8,000,000 7,000,000 6,000,000 5,000,000 TEU’s 4,000,000 3,000,000 2,000,000 1,000,000 2003 2004 2005 2006 2007 2008 2009 2010 2011 Brazilian Port Sector New Model for Port Development Privatization of Port Operations 1. Information on Brazil 2. Growth of Containerization 3. Brazil Takes Off 4. Regulatory Framework 5. Brazil Invests in Its Ports 6. Fostering Private Investments 7. Conclusion • Brazil has the seventh largest economy in the world by purchasing power parity and the eighth largest at market exchange rates. • Brazil's GDP is the highest of Latin America with large and mature mining, agricultural, technology, manufacturing, and service sectors. • Rating agencies have upgraded Brazil’s long-term foreign currency sovereign debt rating. • Export products include: – alcohol, sugar, coffee, orange juice, soy, corned beef, tobacco, poultry, pork. – Niobium, iron, manganese, bauxite (aluminium), magnesite, ornamental stones, tin, graphite. – Aircraft, automobiles, steel, ethanol, textiles, footwear and electrical equipment. Agribusiness Main Products Brazil´s Position in World Ranking Producers Exporters Ethanol 1º 1º Sugar 1º 1º Coffee 1º 1º Orange Juice 1º 1º Soybean Products 2º 1º Beef 2º 1º Tobacco 2º 1º Chicken Products 3º 1º Pork Products 4º 4º Brazil The Impact of New Oil Discoveries The massive oil deposits discovered in the Brazilian off-shore pre-salt layers should provide a huge boost to the long-term outlook of the energy sector Port Operations in Brazil – a New Paradigm 12 International Reserves US$ billion * Position in Out/2010 Source: Brazilian Central Bank • Brazil’s macroeconomic fundamentals have significantly improved in recent years, and its economy is forecast to grow by an annual average of 5.5% to 2013. Brazilian Port Sector A New Model for Port Development Privatization of Port Operations 1. Information on Brazil 2. Growth of Containerization 3. Brazil Takes Off 4. Regulatory Framework 5. Brazil Invests in Its Ports 6. Fostering Private Investments 7. Conclusion Port of MACAPÁ Port of SANTARÉM Port of MANAUS Port of BELÉM Port of VILA DO CONDE RORAIMA Port of ITAQUI AMAPÁ Port of PECÉM Port of FORTALEZA Port of AREIA BRANCA AMAZONAS PARÁ MARANHÃO Port of NATAL Port of CABEDELO CEARÁ RIO GRANDE DO NORTE Port of RECIFE Port of SUAPE PIAUÍ PERNAMBUCO Port of MACEIÓ ACRE TOCANTINS RODÔNIA SERGIPE BAHIA Port of SALVADOR Port of ARATU MATO GROSSO Port of ILHÉUS Port of BARRA DO RIACHO GOIÁS Port of VITÓRIA Port of FORNO MINAS GERAIS Port of NITERÓI MATO GROSSO Port of RIO DE JANEIRO DO SUL Port of ITAGUAÍ SÃO PAULO Port of ANGRA DOS REIS Port of SÃO SEBASTIÃO PARANÁ Port of SANTOS Port of ANTONINA Porto de PARANAGUÁ Port of SÃO FRANCISCO DO SUL Port of ITAJAÍ Port of IMBITUBA Port of PORTO ALEGRE Port of PELOTAS Port of RIO GRANDE SANTA CATARINA 34 MAIN PUBLIC PORTS RIO GRANDE DO SUL 128 Private Terminals Government confirms regulatory framework... and establishes rules for concession of new ports Brazilian Constitution, 1988 • The Federal Government is responsible for port operations, either directly or through delegation (authorization, concession or permission) – art. 21, XII, f • Legislation on ports is the exclusive responsibility of the Federal Government – art. 22, X • Port services may only be delegated through public bidding processes - art. 175 Port Modernization Laws Law 8.630, 1993 and Law 11.518, 2007 • Two modes of port operation: I – Public II – Private – Exclusive, related to throughput of own cargos – Mixed use, related to throughput of own and third-party cargos – Tourism, related to passenger transportation – Transfer stations Creation of ANTAQ Law 10.233, 2001 • National Waterways Agency responsible for regulation and supervision of port system Creation of SEP Law 11.518, 2007 Decree 6.620, 2008 • Ministry for Ports, responsible for the definition of policies, directives and public investment in the Brazilian port system • Strengthens the present regulatory framework and establishes rules for the concession of new ports Port Modernization: chosen model Privatization of public port operations and the creation of mixed-use private terminals Public use terminals Implementation Period Installations Services Manpower Regulated by ANTAq Private use terminals • Obligatory public bidding process • Authorized by Public Authority • Up to 50 years (including extension) • Obligation to render services in a continues manner. • No limit set, limited to original type of service authorized • Possibility of interruption of authorization in accordance with legal terms • Revert at end of contract • Do not revert at end of contract • Open to all • Rates charged are subject to supervision • Not open to all • Serves owner exclusively (own cargo) or mixed (own cargo, complemented with third-party cargo) • Possibility of selecting users and cargo • Hired via OGMO • No hiring restrictions • Resolution 55/2002 – Norm for concession of port areas and installations Consolidates and standardizes conditions within concession contracts • Resolution 517/2005 – Norm for construction and operation of private terminals Required to supply necessary installations and equipment to meet own cargo needs. Port Operations in Brazil – the New Paradigm Brazilian Ports Organization Chart Brazilian State Ministry for Ports (SEP) Port Authority ANTAQ Concession, authorization and permission holders Brazilian Ports Operational Chart Ministry for Ports (SEP) CAP (Port Authority Council) Port Authority Concession, authorization and permission holders End Users Brazilian Port Sector A New Model for Port Development Privatization of Port Operations 1. Information on Brazil 2. Growth of Containerization 3. Brazil Takes Off 4. Regulatory Framework 5. Brazil Invests in Its Ports 6. Fostering Private Investment 7. Conclusion BRAZIL – TRANSPORT MODES DISTRIBUTION HIGHWAIYS RAILWAYS 13 WATERWAYS 3,6 0,4 DUCTS AIR 25 58 Brazilian Growth Acceleration Program – PAC I PORTS: US$ 1.9 billion – National Dredging Program = US$ 900 million – Improvements of Port Infrastructure and Land access = US$ 1.0 billion Brazilian Port Dredging Program - Law n° 11.610 / 2007 • Creates the Brazilian Port Dredging Program; • Introduces the concept of Output Based Dredging Contracts; • Establishes the competence of the Ministry for Ports to implement the Program. National Dredging Program Fortaleza Legend: Procurement to be initiated Natal Under procurement Cabedelo contracted Recife Concluded Suape – Outside Canal Suape US$ 900 million Salvador e Aratu Vitória Rio de Janeiro Paranaguá S. Francisco do Sul Itajaí Rio Grande Itaguaí – Phase 1 Itaguaí – Phase 2 Angra dos Reis Santos – Dredging Santos – Rock Blasting – Internal Canal Improvements of Port Infrastructure • Construction of berths and ramps • Mooring and V.T.M.S. systems • Port avenues • Breakwater expansion • Infrastructure modernization Improvements of Port Infrastructure Vila do Conde US$ 70 million Itaqui US$ 177 million Luis Correia US$ 21 million Areia Branca Us$ 91 million Suape US$ 53,4 million Ongoing Construction : Maceió US$ 16,4 million US$ 1.0 billion Vitória US$ 77,2 million Santos - US$ 135 million São Francisco do Sul - US$ 45 million Rio Grande - US$ 314 million GROWTH ACCELERATION PROGRAM – PAC II 48 Seaport Development Projects 21 Ports US$ 3,0 billion Projects Quantity Dredging 12 Port Infrastructure 24 Logistic Intelligence 5 Passenger Terminals – World Cup 2014 7 Growth Acceleration Program – PAC II 2011-2014 Mucuripe – Container Terminal - US$ 33.3 mi Santarém – Extension to MultiUse Terminal 1 and Construction of MUT 2 US$ 84.4 mi Itaqui – Grain Terminal Areia Branca – Dredging US$ 155.5 mi US$ 54,4 mi Luís Correia – Dredging Natal – Extension to Wharf and Passenger Terminal US$ 15.5 mi US$ 60 mi Pecém – 2 Berths for Solid Bulk Suape – Solid Bulk Terminal US$ 111.1 mi US$ 166,6 mi Maceió – Dredging - US$ 13,8 mi Salvador – Breakwater Extension and Passenger Terminal LOGISTIC INTELLIGENCE Barra do Riacho – Dredging Paperless Port National Port Logistics Plan Implementation of VTMS Intelligent Cargo Management of Solid Waste Paranaguá – Grain Silo US$ 43,3 mi US$ 111,1 mi US$ 25 mi Barra do Furado – Dredging - US$ 30,5 mi Rio de Janeiro – Wharf Reinforcements, Dredging, Passenger Terminal and Pier US$ 163,8 mi Itajaí – Berth Reinforcement and Retroarea Itaguaí – Dredging 3 and 4 US$ 80,5 mi US$ 147,2 mi Imbituba – Dredging US$ 30,5 mi Rio Grande – Porto Novo Wharf Phase 3, Dredging US$ 80,5 mi US$ 55,5 mi Vitória – Berth, Storage Area and Deep Water Port Santos – Left and Right Marginal highways, underpass, Piers Alamoa and Barnabé, Wharf Reinforcement, Dredging and Wharf Realignments US$ 795,5 bi PAC 2 Brazilian Port Sector A New Model for Port Development Privatization of Port Operations 1. Information on Brazil 2. Growth of Containerization 3. Brazil Takes Off 4. Regulatory Framework 5. Brazil Invests in Its Ports 6. Fostering Private Investments Private Investments – Infrastructure Vila do Conde US$ 859,0 million Itaqui US$ 1,5 billion Suape US$ 27 million Port of Aratu US$ 4 million Ongoing Construction : Private Terminal Cotegipe US$ 73 million US$ 15.3 billion Private Terminal Ponta Ubu US$ 167 million Ferrus US$1,4 billion Imbituba US$ 269 million Açu US$5,5 billion Rio de Janeiro US$ 366.0 million Rio Grande US$ 248 million Itapoá US$ 350 million Santos US$ 3,1 billion Itaguaí US$ 1.4 billion Brazilian Port Sector A New Model for Port Development Privatization of Port Operations Thank you!