2012_fall_cpp_cram_for_the_exam_flsa - WMAC-APA

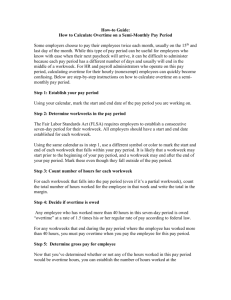

advertisement

Fair Labor Standards Act of 1938 (FLSA) 401 INTRODUCTION TO WAGE-HOUR LAW At the peak of the Industrial Revolution, long working hours and poor wages took a heavy toll on men, women, and children. In a dramatic move to revitalize the economy and relieve the suffering of industrial workers, President Franklin D. Roosevelt proposed a system of mandatory regulations for the protection of workers as part of his “New Deal.” The result was a far-reaching array of social programs and laws, including the Fair Labor Standards Act of 1938 (FLSA). The FLSA was enacted with three primary goals: (1) to ensure fair and equitable wages for the services performed by employees; (2) to discourage long workweeks by requiring that employers pay a higher rate of pay for each hour worked over 40 per week; and (3) to prohibit oppressive child labor. In its early years, the FLSA was easy to understand, but years of court cases, modified legislation, regulations, and more stringent laws at the state level have made wage-hour compliance extremely difficult, in both interpretation and implementation. This chapter explains the specific provisions of the FLSA and provides helpful guidance to ensure that pay and employment practices meet the letter and spirit of the law. Christmas dinner 1936 in the home of Earl Pauley. Near Smithfield, Iowa. Dinner consisted of potatoes, cabbage and pie. Fair Labor Standards Act (FLSA) 3 Primary Goals: - Fair & Equitable Wages - Discourage Long Workweeks - Prevent Oppressive Child Labor FLSA Governs • Recordkeeping & • Overtime Requirements Exempt vs. Non-Exempt Exempt Status Exempt Status Exempt Status Exempt Status Exempt Status Exempt Status 7. Highly Compensated Salary Test: $100,000 or more per year with at least $455 weekly Duties Test: - Sales - Professional or Administrative Exempt Status State Wage Hour Laws • • • • page 2-4 Method of Payments (direct deposit) Escheat Law (unclaimed wages) Accrued Vacation & Paid Time off Final Wage Payments (Terminated & Deceased Employees) • Frequency of Wage Payments FSLA vs. State Wage Hour Laws page 2-4 Where Federal & State Wage-Hour Laws overlap The law more generous to or protective of the employee applies FLSA-Who is Covered? page 2-4 Enterprise Coverage – Two or more employees engaged in interstate commerce or handing, selling or working on goods or materials that cross state lines – Meet an annual sales volume of $500,000 (eff 4-1-90) – Mom & Pop Exemption for family businesses employing only immediate family members. FLSA-Minimum Wage page 2-36 • Federal Minimum Wage: $7.25/hour beginning July 24, 2009 • Overtime: 1 ½ times the regular rate of pay for all hours over 40 hours in a work week FLSA-Minimum Wage page 2-36 $4.25 Opportunity Wage for employees under age 20 for first 90 calendar days FLSA-Minimum Wage Tipped Employees page 2-38 Tipped Employees: $ 7.25 - $ 5.12 $ 2.13 Federal Min Wage Employer Credit Minimum Wage for Tipped Employees earning more than $30 per month in tips FLSA-Minimum Wage Tipped Employees page 2-38 • If tips are not enough to raise the regular rate of pay to $7.25, the employer must pay the difference ensuring the employee the minimum wage for the week. • Overtime – Tip credit may not be increased for overtime hours ($3.72 maximum) – Overtime rate: The tip credit does not increase for overtime hours. Therefore, the overtime cash wage per hour for tipped employees, effective July 24, 2009, is computed as $5.76 [($7.25 × 1.5) − $5.12 (tip credit)]. THE WORKWEEK page 2-41 A Fixed and Recurring period of 168 Consecutive Hours Each Workweek Stands Alone Health Care Industry Exception (The 8/80 Rule) page 2-42 • 14 day work period instead of the 7-day work week • Agreed upon by the employees and the employer • Must receive no less than 1.5 times their regular rate of pay for hours worked in excess of: 8 hours per day or 80 hours in the 14-day period Changing the Work Week page 2-43 Calculate overtime pay for the old workweek Calculate pay for the new workweek Pay whichever is greater When Must Overtime be Paid page 2-43 • The FLSA requires that all nonexempt employees be paid time and one-half of their regular rate of pay for hours worked in excess of 40 hours per week • Overtime must be paid on hours physically worked, not all hours compensated for • Overtime must be paid if the employer knows or has reason to know that the employee is working overtime, even if company policy requires advance authorization to work overtime • Overtime must be paid no later than the next payday after the overtime amount can be calculated. REGULAR RATE OF PAY – page 2-44 ALL PAY FOR ALL HOURS WORKED ( Straight Time Pay ) ALL HOURS WORKED When an employee is compensated at more than one hourly rate during a workweek, the regular-rate-of-pay calculation must be an average of all rates paid This includes shift differentials & premiums for working special shifts as well as rate differences for performing different types of work Payments Excluded From Regular Rate of Pay – page 2-46 • • • • • • • • Discretionary bonus Gifts & special occasion bonuses Overtime Retirement Plan contributions Other benefit plan contributions Reimbursed business expense Pay for idle hours Bonuses paid as a percentage of total pay FLSA-Overtime Requirements page 2-49 When Overtime Must be Paid: Employees paid at 2 or more hourly rates Salaried employees Piece-rate employees Commissioned employees Employees paid a daily or weekly premium TERMINOLOGY Straight Time Pay All Pay for All Hours Worked Regular Rate of Pay Average of All Pay Rates All Pay for All Hours Worked ÷ All Hours Worked Overtime Premium Pay Extra Pay above the employee’s regular rate of pay that is paid for working overtime hours. Two or more hourly rates-exercise1 • Andy works 40 hours a week at $8.00 per hour as an inventory clerk in the warehouse • During one week, Andy works an additional 8 hours at $9.00 per hour for doing janitorial work What is Andy’s total straight time for the workweek? What is his regular rate of pay? What is his premium pay for overtime? What is his total weekly compensation? Andy works 40 hours a week at $8.00 per hour as a clerk. During one week, Andy works an additional 8 hours at $9.00 per hour for doing janitorial work Total straight-time pay for workweek Rate 1: Hours x Pay as a clerk (40 x $8) Rate 2: Hours x Pay as a janitor (8 x $9) = $320 = $ 72 Total Straight time pay = $392 Andy works 40 hours a week at $8.00 per hour as a clerk. During one week, Andy works an additional 8 hours at $9.00 per hour for doing janitorial work Total straight-time pay for workweek Hours as a clerk (40 x $8) Hours as a janitor (8 x $9) Total Straight time pay Regular rate of pay $392 48 # of hours worked = $8.17 Premium pay for Overtime $8.17 x 8 x .5 Total Weekly Compensation $392.00 + $32.68 = = = $320.00 $ 72.00 $392.00 = $32.68 = $424.68 Two or more hourly rates-exercise 2 • Barbara is paid $15 per hour for Shift A and $17 per hour for Shift B. In one week she received a $75 commission. Mon (9 hrs) 9 hours Shift A Tues (11 hrs) 11 hours Shift A Wed (10 hrs) 10 hours Shift A Thu (6 hrs) 6 hours Shift B Fri 9 hours Shift B (9 hrs) $15.00 –Shift A $17.00 – Shift B $75.00 - Commission Mon (9 hrs) 9 hours Shift A Tues (11 hrs) 11 hours Shift A Wed (10 hrs) 10 hours Shift A Thu (6 hrs) 6 hours Shift B Fri (9 hrs) 9 hours Shift B Total straight-time pay for workweek: Shift A: 30 hours x $15 = $450.00 Shift B: 15 hours x $17 = $255.00 Commission = $75.00 Total Straight time pay = $780.00 Total straight-time pay for workweek: Shift A: 30 hours x $15 = Shift B: 15 hours x $17 = Commission = Total Straight time pay = Regular Rate of pay $780.00 45 # Hours worked Premium Pay for Overtime $17.33 x 5 x .5 $450.00 $255.00 $75.00 $780.00 = $17.33 = $ 43.33 Total Weekly Compensation $780 + 43.33 = $823.33 PIECE RATE EMPLOYEES • When an employee works on a piece rate, the regular rate of pay is calculated by adding the total earnings for the workweek from piece rates (plus any other earnings) and then following the standard procedure • By prior agreement, pieceworkers can be paid at a “piece-and-ahalf” rate of at least 1.5 times their regular piece rate for work completed during overtime hours • When pieceworkers are paid a guaranteed minimum, that amount is used to calculate the regular rate of pay in weeks the worker doesn’t achieve enough piece-rate earnings to exceed the minimum • In all cases, the regular rate of pay must not be less than minimum wage Piece rate employees • Edward is paid 90 cents for each first-aid kit he packages. • He is paid a bonus of 20 cents per kit for each kit over 400 that he packages in a week. • In one 52-hour week, Edward packages 536 kits. • What is Edward’s: – Total straight-time pay for the workweek? – Regular Rate of Pay – Premium pay for overtime – Total Weekly Compensation Piece rate employees • Edward is paid 90 cents for each first-aid kit he packages. • He is paid a bonus of 20 cents per kit for each kit over 400 that he packages in a week. • In one 52-hour week, Edward packages 536 kits. Total straight-time pay for workweek (any # of hours) (536 x $.9) + (136 x .20) = $482.40 + 27.20 = $509.60 Regular Rate of pay $509.60 52= $9.80 Premium pay for overtime $ 9.80 x 12 x .5 = $ 58.80 Total Weekly Compensation $509.60 + $58.80 = $568.40 Piece rate employees • George is paid $3 for each wooden toy he builds. He receives a guaranteed minimum of $550 per week. • In one 42-hour week, George builds 179 toys • What is George’s: – Total straight time for the workweek – Regular rate of pay – Premium pay for overtime – Total Compensation Piece rate employees • Sam is paid $3 for each wooden toy he builds. He receives a guaranteed minimum of $550 per week. • In one 42-hour week, Sam builds 179 toys Total straight time for the workweek = $550.00 Premium pay for overtime $13.10 x 2 x .5 = $ 13.10 Total Compensation = $563.10 Regular rate of pay $550 / 42 = $13.10 Piece rate employees • George Jetson is paid $1.15 for every cog he produces. In a 43 hour work week he produces 250 cogs. • The same week his employer, Mr. Spacely surprises George with a $250 discretionary bonus for his input on a assembly line improvements. • What is George’s gross pay for the week? Piece rate employees • George Jetson is paid $1.15 for every cog he produces. In a 43 hour work week he produces 250 cogs. • The same week his employer, Mr. Spacely surprises George with a $250 discretionary bonus for his input on a assembly line improvements. Regular rate of pay $7.25 x 43 = $311.75 Premium pay for overtime $7.25 x 3 x .5 = $ 10.88 Discretionary Bonus = $ 250.00 Total Compensation = $572.63 Commissioned Employees • For nonexempt commissioned employees, overtime must be paid as for other nonexempt workers • If the commission is paid weekly, the calculation is straightforward; add the commission to all other compensation for the week and calculate as usual • If commissions are based on periods of longer than one workweek, the amount must be allocated to each workweek or each hour worked. Commissioned Employees • Irv, a car washer, is paid $9.00 per hour plus a commission on car-care products he sells during each biweekly pay period. When computing overtime, Irv’s employer calculates his commission at the end of the pay period and then allocates them to Irv’s hours worked. In one pay period Irv earns commission of $98.00. During one week of that pay period, Irv works 51 hours; he works 40 hours the other week. • What is Irv’s pay for the Pay period? Commissioned Employees • Paid $9.00 per hour plus a commission products he sells during each two-week pay period. When computing overtime, Irv’s employer calculates his commission at the end of the pay period and then allocates them to Irv’s hours worked. In one pay period Irv earns commission of $98.00. During one week of that pay period, Irv works 51 hours; he works 40 hours the other week. WEEK 1Portion of commission allocated to single week - ($98 / 2) = $ 49.00 Total straight time for the workweek Hours worked (51 x $9.00) = $459.00 Allocated Commissions = $ 49.00 Total $508.00 Regular rate of pay $508.00 / 51 = $9.96 Premium pay for overtime $9.96 x 11 x .5= $ 54.78 Total Compensation-51 hour week $562.78 WEEK 2 Hours worked (40 x $9.00) = Allocated Commissions = Total $409.00 $360.00 $ 49.00 Total Biweekly Compensation ($562.78+ $409.00) $ 971.78 SALARIED NON EXEMPT EMPLOYEES para 432, 440 • Salaried non exempt employees can be paid on the basis of a fixed workweek or a fluctuating workweek. • Under a fixed workweek, the employer pays a salary that is intended to compensate the employee for a specified number of hours each week; the salary must be converted to its weekly equivalent. • Under a fluctuating workweek, the employer pays a salary that is intended to compensate the employee for the entire workweek, regardless of the number of hours actually worked; the salary must be converted to its weekly equivalent. SALARIED NON EXEMPT EMPLOYEES • All hours, including overtime hours, are used to calculate the regular rate of pay for a fluctuating workweek, so premium pay for overtime is lower for a fluctuating workweek than for a fixed workweek. • Before using a fluctuating workweek approach, there must be a clear understanding between employer and employee that the salary is intended to cover all hours worked in the workweek. Nonexempt salaried employee, fixed workweek REMINDER: Under a fixed workweek, the employer pays a salary that is intended to compensate the employee for a specified number of hours each week; the salary must be converted to its weekly equivalent • Carl, a nonexempt salaried employee is paid a bi-weekly salary of $950.00 for working fixed 35-hour workweeks He works 47 hours in one workweek. – What is Carl’s total straight-time pay for the 47 hour workweek? – What is Carl’s regular rate of pay? – What is his premium pay for overtime? – What is his total weekly compensation? Nonexempt salaried employee, fixed workweek • Carl, a nonexempt salaried employee is paid a bi-weekly salary of $950.00 for working fixed 35-hour workweeks He works 47 hours in one workweek. Total pay for a 35-hour workweek 950 x 26 = $24,700 52 = $475.00 per week Regular Rate of pay $475 = $13.57 35 # Hours WORKED Total straight-time pay for 47-hour workweek $13.57 x 47 = $637.79 Total pay for a 35-hour workweek $950 x 26 = $24,700 52 = $475.00 per week Regular Rate of pay $475 35 Hours worked =$13.57 Total straight-time pay for 47-hour workweek $13.57 x 47 = $637.79 Premium Pay for Overtime $13.57 x 7 x .5 = $ 47.50 Total weekly compensation = $685.29 Nonexempt salaried employee, fluctuating workweek para 445 REMINDER: Under a fluctuating workweek, the employer pays a salary that is intended to compensate the employee for the entire workweek, regardless of the number of hours actually worked; the salary must be converted to its weekly equivalent. • Diane, a nonexempt salaried employee is paid a bi-weekly salary of $950.00 for working fluctuating workweeks. She works 47 hours in one workweek. – What is Diane’s total straight-time pay for the 47 hour workweek? – What is her regular rate of pay? – What is her premium pay for overtime? – What is her total weekly compensation? Nonexempt salaried employee, fluctuating workweek • Diane, a nonexempt salaried employee is paid a bi-weekly salary of $950.00 for working fluctuating workweeks. She works 47 hours in one workweek. Total straight-time pay for workweek (any # of hours) 950 x 26 = $24,700 52 = $475.00 Regular Rate of pay $475 47= $10.11 Premium pay for overtime $ 10.11 x 7 x .5= $ 35.39 Total Weekly Compensation = $510.39 SUFFERED OR PERMITTED TO WORK - Page 2-58 • Unauthorized Overtime – If employer knows or should have known that the employee is working or has worked, the time is compensable, whether or not the employer authorized the work MEAL & REST PERIODS – Page 2-58 Meal & Rest Periods Must be uninterruped Lunch period must be long enough (typically 20 minutes) Employee must be relieved of duty TRAVEL TIME – page 2-59 Home to Work Travel - Generally not included as hours worked, unless: An employee who is on 24-hour call takes a vehicle home for specific purpose of responding to calls. For instance, an ambulance driver takes the ambulance home for the specific purpose of responding to emergencies. Employees, after working at their normal work site during the regular shift, return home and are called back to work at a remote site that is not the normal work site. Under this circumstance, the travel from home to the remote job site and from the remote job site to home is compensable TRAVEL TIME page 2-59 ONE DAY TRAVEL OUTSIDE THE NORMAL COMMUTING AREA – When employees travel outside their normal commuting area, these employees have merely substituted travel for other duties and their travel time is compensable TRAVEL TIME page 2-59 OVERNIGHT TRAVEL AS A PASSENGER ON A PUBLIC CONVEYANCE Only the travel time that occurs during the employee’s normal working hours is compensable. It is important to note that “normal working hours” refers to the hours during the day that the employee normally works and not to the days of the week the employee normally works. ON-CALL TIME – page 2-60 On call time off the employer’s premises is considered hours worked if the conditions are so restrictive that the employee cannot use the oncall time for personal activities. If employees can sleep, eat, watch tv, entertain guests, etc or if the employees carry a phone while conducting personal business the hours spent on call are not compensable ON-CALL TIME – page 2-61 24 HOUR WORK ASSIGNMENTS Employee may agree to exclude from hours worked bona fide meal periods & bona fide regularly scheduled sleeping period of not more than 8 hours. • Adequate sleeping facilities must be furnished • Employee must enjoy an uninterrupted period of sleep (must get at least 5 hours of sleep) • If sleeping period is more than 8 hours, only 8 hours can be deducted from the 24-hour workday. WAITING TIME page 2-61 Waiting to be Engaged - do not have to be on premises & can go home – do not have to be paid Engaged to be waiting -detained on the employer’s premises waiting for work. -considered hours worked and must be paid MEETINGS, SEMINARS & TRAINING SESSIONS page 2-62 Attendance at Meetings & Training Classes is Not Compensable if: – Attendance is outside the employee’s normal work hours – Attendance is in fact voluntary – The event is not directly related to the employee’s job – No productive work is performed for the employee during the period Rounding, Adjustments & Long Punching para 457 • Avoid excessive long punching ( early and late punching ) • Rounding ¼ hour increments acceptable only if administered fairly ( cannot always round in favor of employer ) FLSA-Child Labor Minors Under Age 14 Employment is prohibited Exceptions: • Employed by parents in non-hazardous occupation if parent is sole employer • Actors or performers • News Carriers FLSA-Child Labor Minors Under Age 16 Can work outside school hours in non-hazardous occupation When school is in session hours limited to 3 per day, 8 on Sat & Sun. 18 hours per week School break - maximum 8 hours per day, 40 hours per week (7 am to 7 pm --7am to 9pm June1 - Labor Day) FLSA-Child Labor Minors Under Age 18 Prohibited for working in jobs considered to be hazardous 3 Primary Goals: - Fair & Equitable Wages - Discourage Long Workweeks - Prevent Oppressive Child Labor