Contractual Risk Review - Public Entity Procurement

advertisement

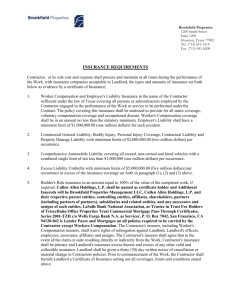

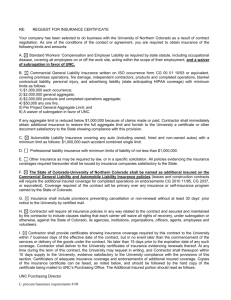

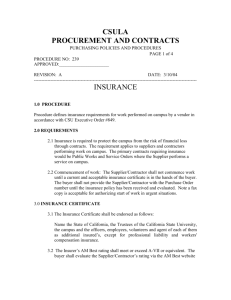

PUBLIC ENTITY PROCUREMENT Contractual Risk Review STATE OFFICE OF RISK MANAGEMENT Michelle Tooley, Senior Insurance Specialist Stephen Vollbrecht, Deputy Executive Director and General Counsel THE ESSENTIALS • Identify the Risks (Exposure) • Manage the Risks (Mitigation) IDENTIFYING RISKS Identify exposures to risk of loss in the scope of the contract: • Who are all the parties involved? • What work is to be completed and how? • What accidents or failures could occur? • Who is responsible for accidents or failures? • What is the Probable Maximum Loss for accidents or failures? • How will costs of accidents or failures be absorbed? • Is the contract legal and enforceable? . RESOURCES FOR IDENTIFYING RISKS Who should you talk to? • The contract negotiators and procurement specialists; • The entity’s risk manager; • Attorneys and other subject matter experts; • Accountants and other financial specialists; • Building managers, asset managers and other affected parties; • SORM risk management consultants and insurance specialists. . MANAGING RISK • AVOID IT - Risk avoidance is about removing a peril. Contractual risk avoidance is addressed in the standards and scope of work, as well as in contract management. • TRANSFER IT - Risk transfer is about relocating liability. Contractual risk transfer is addressed in the contract through the use of waivers, indemnification, performance measures, and insurance requirements. • ACCEPT IT - Risk acceptance is about retaining responsibility. Contractual risk acceptance is addressed through intentional retention. AVOIDING RISK • Remove Unknowns: Contract knowingly and clearly only for specified products and services – avoid surprise exposures by defining scope; • Remove Instability: Design requirements to minimize contractor modification – the introduction of non-standard variables introduces unanticipated risks; • Remove Ambiguity: Avoid “over-writing” (especially through boilerplate), without understanding what the language means; • Remove Chance: Design both fallbacks (restoration) and failovers (transition); • Remove False Imperatives: Don’t award the contract. TRANSFERRING RISK • When a contractor is better able to handle the risk; • What will happen after a loss; • Protect the State; • Because you can*. • HOW: waivers, indemnification, performance measures, insurance, etc. COMMON TYPES OF INSURANCE • Commercial General Liability; • Workers’ Compensation; • Commercial Auto; • Umbrella Excess Liability; • Crime; • Professional Liability; • Pollution Liability ; • Cyber; • Property; • Builders’ Risk; • …and may more depending on the type of procurement and exposure. . COMMERCIAL GENERAL LIABILITY • Why is it important? A CGL policy protects you against third party property damage and bodily injury claims that involve contractor property and operations. • Appropriate for most contracts, including short term lease agreements. Generally includes: • • • • • -Premises and Operations; -Personal Injury and Advertising Liability; -Products and Completed Operations; -Liability assumed under an insured contract (including tort liability of another state agency); -Independent Contractors. . CGL LIMITS AND TERMS • $1,000,000 each occurrence; • $2,000,000 general aggregate; • $2,000,000 products and completed operations aggregate; • $1,000,000 Personal/Advertising injury; • $50,000 Damage to Premises Rented to Contractor; • $5,000 Medical Payments (any one person); • liability arising from products and completed operation and liability assumed under the contract; • entity, board, trustees, officers, employees, agents, and volunteers included as additional insured; • primary and non-contributory with respect to any other insurance or self-insurance programs offered to your entity. . COMMERCIAL AUTOMOBILE • Why is it important? Covers owned, leased, hired, non-owned, and employee nonowned vehicles. • Personal Injury Protection (when applicable) . AUTOMOBILE LIMITS AND TERMS • $1,000,000 combined single limit for each accident limit for bodily injury and property damage; • If carrying pollutants/hazardous material – Request Pollution Liability coverage for automobile and Motor Carrier Act endorsements; • Contractor should waive all rights to recover against the board, trustees, officers, employees, agents, and volunteers for recovery of damages to the extent these damages are covered by the business auto liability insurance (or any other applicable auto physical damage coverage); • Your entity should be added as an additional insured on the contractor's auto policy. . WORKERS’ COMPENSATION • Why is it important? Pays for bodily injury from disease or accident and provides legal protection to the employer; • Medical expenses for injured workers, disability, death and burial – regardless of who is at fault; • Indemnifies for some lost wages while unable to work. . WORKERS’ COMPENSATION LIMITS AND TERMS • Coverage A – Workers’ Compensation (WC) (Statutory) in compliance with the laws of the state of Texas (or any state their employee is living in); • Coverage B – Employers’ Liability (EL) 1,000,000 each accident limit/$1,000,000 Disease-Policy limit/$1,000,000 Disease - each employee limit; • Contractor should waive all rights against your entity, its board, trustees, officers, employees, agents and volunteers for recovery of damages to the extent they are covered by WC and EL; • Request the contractor get a “waiver of our rights to recover from others” endorsement. Do not waive the state’s right to subrogate WC losses; • Note: Sole proprietors may not be required by law to have a WC policy. It is for employees. If you don’t ensure continuation of the WC policy throughout the project you may be liable for injuries. . CERTIFICATES OF INSURANCE • How important are they? What do they look like? How long should you keep them? . RETAINING RISK Accepting or taking risk does not mean doing nothing. There are many factors to consider in the appropriate level of risk acceptance, none of which involve ignoring exposure . • Acceptance of risk is inherent to all transactions; • Generally, risk retention involves assuring access to funds to pay for losses, either by purchasing insurance or self-insuring through financial planning; • Risk retention also includes consideration of policy terms, deductible levels, intentional uninsured status, both for the state entity and its contractors; • Retention is an active rather than passive process – potential liabilities should identified and evaluated purposefully. WHY RETAIN ANY RISK AT ALL? • One reason to transfer risk is because you can. A more important question is whether you should. • Overly-stringent or unnecessary requirements may increase costs and minimize opportunity. • Make good choices - seek excellence, not perfection; • Eliminate the implausible or impractical; • Protect against catastrophe, but maximize opportunity for success - design compliance to minimum standards based on exposure (know your true PML). FINDING THE BALANCE • Know the risks, know the contract, know the law; • Protect the state – transfer risk appropriately, minimize state waivers, and emphasize clear and enforceable indemnity provisions; • Measure performance; • Always have a Plan B. CONTACT INFORMATION Ms. Michelle Tooley Senior Insurance Consultant (512) 936-2942 michelle.tooley@sorm.state.tx.us Mr. Stephen Vollbrecht Deputy Executive Director and General Counsel (512) 936-1508 stephen.vollbrecht@sorm.state.tx.us .