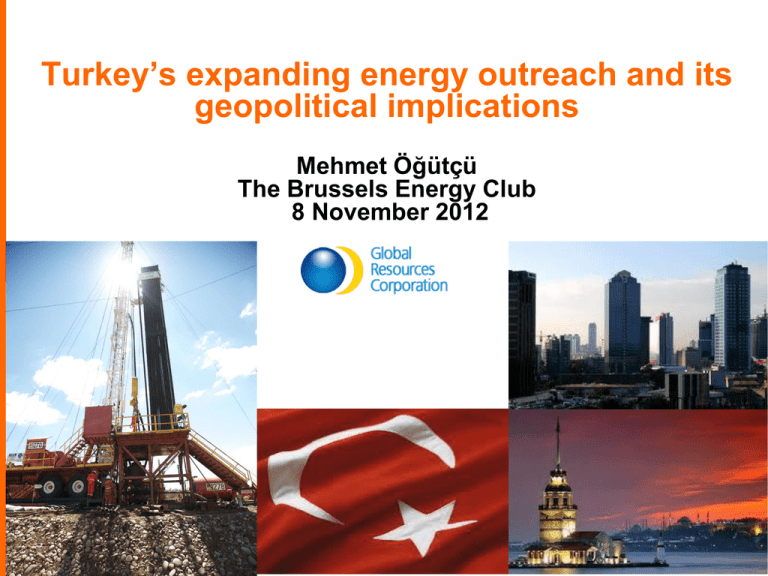

presentation - Brussels Energy Club

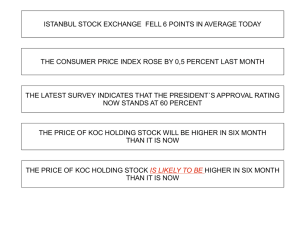

advertisement

Turkey’s expanding energy outreach and its geopolitical implications Mehmet Öğütçü The Brussels Energy Club 8 November 2012 Issues for discussion • Changing dynamics in world energy and geopolitics • Turkey’s economic fundamentals • Energy emerging as a “soft-belly” • Quest for energy security – Increased domestic production and efficiency improvements – Diversification of suppliers: Russia, Iran, Azerbaijan (and transCaspian), Iraq, LNG and others as suppliers – Fuel diversification including renewables – Overseas investment in equity oil and gas • Turkey’s EU accession and energy dimension • Turkish strategic energy priorities vs. foreign policy actions • Key messages Changing geopolitics: A new world order in the making? • The talk of a new world order is no longer a fantasy. Happening. • Failure after 9/11 to put in place an effective global policy, Iraq and Afghanistan setbacks, energy dilemma, food and water crisis, worldwide economic crisis and rise of the BRICs. • All these have created much broader balanceof-power implications. • We are back to great-power politics, shifting alliances and spheres of influence in favour of Asia-Pacific. • The West is no longer in charge alone. Russia, China, India and the rest of G-20 are set to shape the new emerging world system in finance, politics, environment and energy. 9 “Game-Changing” developments in world energy • A powershift is underway in world energy, with the rise of new consumers and changing NOC and IOC balance of interest • Tight supplies, but also new unconventional fuels, nuclear, LNG and technologies • Environmental concerns and climate change are omnipresent • Energy security, yes but for whom • Price volatility and underinvestment causing supply crunch • New geopolitical dynamics and risks unfolding World primary energy demand: up and up 5 Energy security, yes but for whom? • Various definitions, depending on who’s talking: producers, transit countries, consumers or investors. • “Reasonably priced, reliable, timely and environmentally friendly” energy. • Energy security is intertwined with the environment, economic, foreign and social policies of an economy. Energy Security • Political vs. Financial costs; Opportunity vs. Risks involved. • Malacca Strait, Strait of Hourmous, Bosporus, critical infrastructure • New definition is required. 5 Natural gas as a “game-changer” • With the advent of shale gas, LNG and emergence of new producers, new pricing arrangements, natural gas is becoming a key gamechanger. • It offers key advantages for promoting energy security – Gas is available and flexible – it can meet energy needs in domestic markets or via LNG and long-distance pipelines – Unconventional reservoirs are opening up new possibilities – Many alternative suppliers dot the horizon – Fuel substitution to gas reduces emissions – New price mechanism away from oilindexation 7 EU-27 gas demand/supply outlook to 2030 (SOURCE: ENI) 8 Indicative costs for potential new sources of gas delivered to Europe, 2020 ($/MBtu) 23 Now our main topic… Ukraine in case, you do not know where it is… Romania Russia Black Sea Bulgaria Istanbul Ankara Caspian Sea Georgia Azerbaijan Armenia Turkey Aegean Sea Cyprus Syria Mediterranean Iraq Sea Strategic location Iran Sound economic fundamentals • Although economic conditions deteriorated rapidly in early 2009, the come back was very strong in 2010 • Nominal GDP (US$bn) and GDP growth (%) 8.9% 1,000 6.9% 10% 5.5% 4.5% 5.0% 4.7% 800 5% 0.7% 600 Turkey is the fastest growing economy in Europe with an 8.9% real GDP growth in 2010 400 526 200 742 (4.8%) 736 617 659 781 847 0% 913 (5%) (10%) 2006 2007 2008 2009 2010 2011E 2012E 2013E Real GDP Growth (%) Source TUIK, SPO, Medium Term Economic Programme 2011-2013, October 2010 • GDP per capita (‘000 USD) 13.5 11.4 11.5 9.2 9.5 7.0 7.5 12.2 10.6 10.4 10.1 8.6 7.6 5.8 4.6 5.5 Turkey 6.7% Luxembourg 5.0% Slovak Rep. 4.9% Hungary 4.7% Korea 0 Nominal GDP (US$bn) Top 20 OECD Countries’ Real GDP Growth (2011E2017E) 3.5 3.5 4.5% Czech Rep. 4.1% Australia 3.9% Mexico 3.8% Greece 3.6% Norway 3.5% Finland 3.2% UK 3.1% Ireland 3.1% Sweden 3.0% Spain 3.0% Iceland 2.9% Poland 2.8% Switzeland 2.8% OECD 2.6% US 2.6% 0% 1.5 '02 '03 '04 '05 '06 '07 '08 '09 '10 '11E '12E '13E Source State Institute of Statistics, Treasury 2% 4% Avg. annual real GDP growth Source OECD Economic Outlook No:86 6% 8% Macroeconomic overview • Despite a fall in foreign direct investments in the recent years current level remains much higher than historical figures • Foreign direct investment ($ in bn) Current account & trade surplus / (deficit) 20 0% 2006 (2%) 15 (4%) 25 22.1 20.2 19.5 10.0 8.4 Collé en image 1.7 1.1 (6%) (6.1%) 2.8 (8%) (10.3%) 19932002 avg. 2003 2004 2005 2006 2007 2008 2009 2010 2010E 2011E 2012E (5.9%) (5.7%) (9.7%) (9.4%) (5.4%) (9.0%) (5.4%) (5.3%) (9.3%) (9.3%) (10%) (12%) Current account balance/GDP Source Central Bank Republic of Turkey 14 11.9 11.3 12 10 8 5 4 4 3.4 3.2 MENA Latin America 2 0 World Euro Area Developing Asia Trade balance/GDP Source SPO, Medium Term Economic Program 2011 - 2013, October 2010 Export Growth (Avg. annual growth rate 2001-2009) 6 2009 (6.3%) 8.9 0 • 2008 (2.3%) 10 5 2007 Turkey Source Turkstat, IMF World Economic Outlook, April 2011 Economic growth prospects Turkey is the 16th largest economy in the World in terms of GDP based on PPP • World’s 20 largest economies (GDP based on Purchasing Power Parity, USD trillion) 16 14.7 10.1 8 4.3 4.1 2.9 2.2 2.2 2.2 2.1 1.8 1.6 1.5 1.4 1.3 1.0 1.0 0.9 0.8 0.8 0.7 0.2 0.2 0.2 0.2 0.2 0 Turkey is the 6th largest economy in Europe in terms of GDP based on PPP • Europe’s 20 largest economies (GDP based on Purchasing Power Parity, USD trillion) 4 2.9 2.2 2 2.1 1.8 1.4 1.0 0 Source IMF, World Economic Outlook, April 2011 0.7 0.7 0.4 0.4 0.3 0.3 0.3 0.3 0.3 Demographics • By 2025 the population will have risen to 85.4m, growing with a CAGR of 1.2% over 30years Turkey has one of the youngest populations in Europe with c.26% of Turkish in the 0 - 14 age bracket The average age of the 72m people is only 29 years, against 40 years in the EU • Turkey’s population evolution (m) 90 59.8 64.3 77.6 73.0 68.6 81.8 85.4 60 30 Population breakdown by age groups (2010) Turkey Slovak Rep. Poland Europe Hungary Romania Russia Czech Rep. Ukraine Bulgaria 26% 15% 14% 15% 14% 15% 15% 14% 14% 14% 0% 20% 0 Urbanization is an increasing trend in Turkey with the share of urban population in total increasing from 44% levels in 1980 to 76% in 2010 1995 2000 2005 2010 2015E 2020E • • 100% 56% 35% 30% 25% 24% 24% 41% 65% 70% 75% 76% 76% 60% 1990 2000 2007 2008 2009 2010 60% 40% 20% 44% 0% 1980 10% 19% 22% 25% 25% 23% 20% 25% 23% 23% 40% 60% 14-60 Age 80% 100% 60+ Age Source UN Urbanization in Turkey 80% 0-14 Age 2025E Source Turkstat 64% 66% 64% 60% 60% 63% 65% 62% 63% 63% Urban population Population breakdown by age groups (2050E) Turkey Russia Europe Hungary Ukraine Czech Rep. Slovak Rep. Romania Bulgaria Poland 15% 16% 15% 14% 15% 14% 14% 14% 14% 14% 0% Rural population 56% 49% 46% 49% 49% 47% 47% 46% 45% 46% 20% 0-14 Age 40% 14-60 Age 29% 35% 39% 37% 36% 39% 39% 41% 41% 40% 60% 80% 100% 60+ Age Turkey’s favourable demographic outlook is a key driver of future economic growth Source Turkstat Source UN ISE Top 20 companies • Banking sector has the highest weight in the ISE100 index in terms of market capitalisation, accounting for 48% of the Top 20’s total • Market value breakdown Company 1 Mcap (USD bn) Sector breakdown of Top 20 companies by market cap Sector 4% 3% 2% 2% 1. Garanti Bank 18.6 Banking 2. Akbank 18.1 Banking 3. Turk Telekom 17.4 Telecom 4. Isbank 13.3 Banking 5. Turkcell 12.2 Telecom 6. Yapi Kredi 10.3 Banking 7. Koc Holding 9.8 Conglomerate 8. Halkbank 8.7 Banking 9. Sabanci Holding 8.3 Conglomerate 10. Enka 7.5 Construction 11. Tupras 6.1 Oil & gas 12. Vakif Bank 5.3 Banking 13. Eregli 5.1 Steel & Iron 14. Emlak Konut REIC 4.1 Real estate 15. Arcelik 3.2 Consumer durables Banking Telecommunications 16. TEB 2.8 Banking Conglomerates Real estate / construction 17. Sisecam 2.7 Glass Mining Energy 18. Turkish Airlines 2.6 Transport Industrial Production Consumer durables 19. Koza Gold 2.0 Mining (Gold) 20. Petkim 1.5 Petrochemicals Total Note 1 As of 23/06/2011 159.7 4% 7% 48% 11% 19% Transport Source FactSet Turkey’s energy: low in supply&efficiency and high in demand • Energy is Turkey’s achilles’ heel and soft-bely for the next decades to come • Limited domestic production and international investment • Liberalisation agenda, still incomplete, with heavy subsidies and taxes • Energy trade: biggest contributor to the current account deficit Turkish Electricity Sector Natural Gas is the primary source of electricity generation in Turkey. Especially, private sector relies heavily on imported natural gas. This trend should change in line with private sector’s increasing focus in hydro and coal-fired power plants. Sector Jeo + Wind, 0.3% Other, 0.1% Liquid Fuels, 3.4% Coal, 27.9% State-owned Company, EUAS Natural Gas, 49.6% Jeo + Wind, 0.1% Other, 0.0% Liquid Fuels, 2.4% Hydro, 18.7% Natural Gas, 25.2% Installed Capacity 2007 Thermal Hydro Geothermal Wind Total Sector MW 27,272 13,393 23 146 40,834 Source: EÜAŞ % 67% 33% 0% 0% 100% EUAS MW 12,525 11,349 0 0 23,874 % 52% 48% 0% 0% 100% Hydro, 33.6% Coal, 38.8% Wind Capacity and Utilisation Turkey Wind Power Capacity 433 450 400 350 300 250 MW 200 147 150 100 50 19 0 2006 2007 2008 Turkey’s Wind Atlas 18 Solar Energy Potential Average annual solar radiation:1,311 kWh/m². Average annual sunshine duration:2640 hours. Technical potential :405 000 GWh, (DNI> 1800 kwh/m2-year). Economic potential :131 000 GWh, (DNI> 2000 kwh/m2-year). Solar energy is used especially as a thermal energy in Turkey. • 400,000 Toe solar heating produced by 11 million m2 collectors, second in the world. • annual production capacity is 1 million m². Total installed photovoltaics capacity is approximately 1000 kW and But it is expected to increase PV usage next future. …and need for massive investments • Turkey needs to spend $128 billion on energy investments by the end of 2020, including $92 billion on new power generation facilities, to keep pace with its rapid-growth economy, but the government can only set aside $500 million a year from its tight budgets. • Electricity demand in Turkey has increased almost 10 percent, the world’s second highest growth rate after China. And half of it produced by gas-fired power plants. • The government must spend about $4.5 billion annually on new power projects and $1 billion annually for power transmission to avoid an energy crisis. • Privatization is viewed as the key for Turkey’s future energy development. Turkey’s “regional hub” credentials Bosporus Straits are a major shipping "choke point" between the Black and Mediterranean Turkey's port of Ceyhan is an important outlet both for current Caspian and Iraqi oil exports Also, a growing gas destination for Russia, Azerbaijan, Iran and KRG as well as possibly Eastern Mediterranean Seas. But it is not yet a hub as we understand it For a genuine hub similar to Austria’s Baumgarten, much more remains to be done…regulatory framework, physical infrastucture, market liberalisation… At the juncture of energy routes Turkey's strategic location makes it a natural "energy bridge" between major producing areas in the Middle East, Russia and Caspian Sea 22 regions on the one hand, and markets in Europe on the other. Multitude of energy routes and supply sources •Turkey aims to meet growing domestic demand for energy by developing a multitude of energy routes, in particular the “Southern Corridor” •This is to ensure that sufficient supplies reach Turkey for its own consumption and that the country becomes an “energy hub” for Europe. •Turkey is expected to use 48-50 bcm of natural gas this year and around 70 bcm by 2020, making it one of the largest natural gas consumers in the world. •Russia, Iran, Azerbaijan, Qatar, Nigeria, and Algeria are the main sources of Turkey’s gas. Iraq’s KRG will add to Turkey’s gas supply in the future. •Turkey would have much to gain if gas from the eastern Mediterranean were also transported to Europe through its territory. Regional outreach in search of supply security • Why are the Turco-Russian energy links still of paramount importance? • Will TANAP and Trans-Caspian pipelines threaten Russia’s national security? • Iran: how far can Ankara and Tehran endure the troublesome energy relationship? • Crucial links with Iraq: Baghdad or Erbil? • Could the East Mediterranean controversy turn into a hot confrontation? • Any room for Trans-Atlantic and European partnership in energy? Caspian exports reaching international markets TANAP, Light Nabucco, Trans-Caspian, Bosphorus By-pass, Iran, new Kazakh shipments 22 KRG oil and gas wealth: how to reach markets TPAO was expelled from southern Iraq and Turkey set up a new national oil company for northern Iraq The Eastern Mediterranean gas discoveries: collaboration or confrontation • From the melting and resource-rich Arctic to the eastern Mediterranean, the South Atlantic to the East China Sea, legal wrangling, diplomatic posturing and military sabre rattling are all on the rise. • Cyprus, split by one of Europe’s most intractable ethnic conflicts, is now the focus of another contest, over who will control the significant natural gas wealth found in nearby waters. • Beneath the seabed of the Levant Basin near Cyprus is an estimated 122 tcf of gas, about as much as the world consumes a year. • The northern part of the basin lies in Cypriot waters, with much of the rest in Israeli or Lebanese waters. • So far, the EU has been eager to diversify its gas supply sources and routes, but it has been rather quiet on the eastern Mediterranean gas finds and their possible contribution to EU energy supply security, as a fifth gas corridor or as a new leg to the Southern Gas Corridor. • The question is whether the gas discovery will become an incentive for the two sides to cooperate, or yet another obstacle to reunification of the island. EU’s energy security through gas • ¾’s of the gas traded across the EU arrives and departs via pipelines. Pipeline dependency leaves the EU vulnerable to supply shocks. • Whilst supply can be met by three predictable suppliers in the long run; Norway, North Africa and Qatari LNG much still depends on the presence of a steady supply of gas from Russia. • Gas is the “simplest solution” to the EU’s energy security challenge as – Nuclear option is out of steam; construction of gas power plant is easier than alternatives; – it is relatively clean in terms of CO2 emissions; – it can be used as a back up to wind power and – it is interchangeable with coal fired plant. • Sharp decrease is expected in EU gas consumption between now and 2020, with serious implications for supplier countries such as Russia. 15 Turkey’s EU accession and energy dimension • Who wants to be a member, after all? • Better to divorce from the accession strait-jacket and develop practical arrangements? • Energy dimension of the Turkish-EU relations • • • • • • • Southern Energy Corridor Turkmenistan vs Azerbaijan and Russia Energy chapter blocked European Energy Community Iran sanctions and alignment on Russia Energy markets liberalisation and investment opportunities for EU firms Climate change A better EU approach lies in better understanding Turkey’s drives and priorities and seeking alignment for a durable, “win-win” relationship with Ankara as well as using 29 Turks’ leverage in the broader Middle East, Eurasia and Southeast Europe. Conflict with foreign policy goals? • We cannot treat energy in isolation from geopolitics as the recent history has shown. • Energy is just one, but a determinant, element of foreign and security policies as the lifeblood of the economy. • There should be no room for threats or blackmail each time a problem emerges to "cut back the flow of energy," "close down the borders" or "punish political actions by economic sanctions.” • Today’s Turkey brings a lot more foreign policy capacity to the table, but it may not be an easy fit with the US and Europe’s interest in forging common strategies on Iran, Iraq, Syria and Russia. • Turkey could face difficulties in expanding its influence without having a firm footing in the West at the same time. • Turkey’s foreign and security policies are increasingly in competition with its energy interests that require alignment with Iran, Russia, Iraq/KRG, Israel/Cyprus on East Med. Key messages • Factor in the changing dynamics in world energy system (and security) • No threats or black-mailiing to use energy • Physical and legal/institutional framework for regional hub • Investor friendly business environment • Alignment of foreign policy, energy, environment, finance, trade/investment and technology strategies • Develop “energy giants” through PPP and international alliances • Develop fresh perspectives, human capital and not get stuck in obsolete paradigms • Need for an integrated energy strategy and management