the Powerpoint file

advertisement

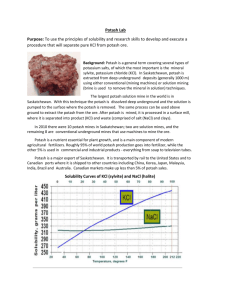

The Sintoukola Potash Project Technical Overview of Potash Mining Paul Kluge March 2013 ASX: ELM, TSX: ELM 0 Agenda ● About Elemental Minerals ● The Potash Market ● Potash Basics ● The Sintoukola Potash Project Geology Mining Processing Infrastructure Economics ● Summary & Conclusion 1 About Elemental Minerals ● Exclusively focused on the 93% owned Sintoukola Potash Project in Republic of Congo (Brazzaville) ● Listed on the ASX and TSX ● Management Team based in Dainfern, South Africa ● Global group of consultants from Vancouver, SRK Denver lead engineers Perth to ● Key Milestones so far: ● Start of drilling – Sep 2010 ● Maiden resource – Apr 2011 ● PEA – Aug 2011 ● IPO in Toronto – Aug 2011 ● PFS completed – Sep 2012 ● ESIA and mining license application – Dec 12 2 The Potash Market Why Potash? • Potash primary use is in fertiliser, along with nitrogen and phosphorous (NPK) • Saleable product is Murate of Potash (MoP) which is pure KCl • K improves crop water retention, yield, nutrient value, taste, colour and disease resistance 3 The Potash Market Potash Supply • One third of production concentrated in Saskatchewan Canada – controlled by Canpotex • One third of production concentrated in the FSU, controlled by Belarussion Potash Corporation • Final Third of Production spread between Germany, Chile, Chine, Israel, Jordan • No supply currently from Africa, but a historic operation in RoC flooded in the 1970’s (Holle Mine) Potash Demand • Demand from agricultural users • Mature markets: USA, EU • Growth markets: China, India, SE Asia, BRAZIL • Brazilian market consumed 8.2Mtpa in 2013 (own production 800ktpa), demand projected to grow to 10.2Mtpa by 2017 4 Potash Basics ● Potash sold as 96-98% pure KCl (60-61% K2O) – Muriate of Potash (MoP) ● Potash Ores: ● Sylvinite = Sylvite (KCl) + Halite (NaCl) ● Grades typically 15%-25% K2O ● Basis for reserve at Sintoukola (21% K2O & HWS intersection at 35% K2O) ● Most of world production ● Carnallitite = Carnallite (KMgCl3·6H2O) + NaCl ● Grades typically 10%-15% K2O ● More difficult to process ● Production often in conjunction with Mg 5 The Sintoukola Project - Location ● Situated in the south west corner of the Republic of Congo ● 30km direct line of sight from the coast ● 60km north of Pointe Noire ● 1,408km2 exploration license covering the Kola and Dougou deposits – 90km2 explored to date Distance (St. Petersburg – Santos) 6,447 nautical miles Pacific NW Vancouver Portland New Brunswick NW Europe St. Petersburg Ventspils Klaipedia Hamburg USA China Middle East Distance (Ashdod – Santos) 6,411 nautical miles Distance (Vancouver – Santos) 8,491 nautical miles Ashdod Eilat Aqaba India Africa Pointe Noire Significant opportunity for Asian markets Brazil Distance (Pointe Noire – Santos) 3,560 nautical miles 6 Historic Exploration • Potash discovered in 1935. French (Potasse d’Alsace) explored coastal plain, scattered drilling, focussed at Holle. • >60 historic boreholes within basin completed by previous oil and potash explorers, most contain references to potash. >10 within SP permit area. • Within SP permit >400 line kilometres of 2D oil industry seismic data from 80’s to 2006. Plus oil exploration boreholes. • ELM acquired most historic borehole logs and 200 kms of historic seismic data through purchase and swap agreements • ELM initated exploration by twinning K6 and K18 at Kola in 2010 Kola Deposit Boreholes, seismic lines and resource outlines Historic log Strategic World Class Potash Project 7 The Sintoukola Potash Project - Resource • All exploration with consultation and sign-off by CSA Global of Perth. • Team of 10 local and expat geologists and technicians • Drilling of 45 exploration boreholes (15,737 metres) • Drilling of 22 hydrological boreholes (3,779 metres) • 203 line kms of 2D Seismic data over 2 phases. • 3 resource estimations (by CSA) the latest being August 2012. • Phase 3 commenced 8th Jan 2013. Mineral Resource estimate for sylvinite mineralization only at a 10% K2O cut-off grade Measured Tonnes(M t) HWS Indicated %K2O %KC l Tonnes(M t) Inferred %K2O %KCl Tonnes(M t) %K2O %KCl - - - - - - 47 34.8 55.0 Upper Seam 171 22.5 35.5 159 22.0 34.9 96 21.8 34.5 Lower Seam 93 19.2 30.4 150 19.1 30.2 107 19.1 30.3 225 17.6 27.9 475 20.4 32.3 Footwall Seam Total 264 21.3 33.7 309 20.6 32.6 8 • 80 m of limestone and dolomite. • Anhydrite and clay aquitard (5-15 m thick) rests on the ‘Top of salt’. • Salt sequence typically 400 metres thick, mainly halite and carnallitite. • Upper 50-100 metres of the salt sequence contains the sylvinite seams. • The clastic syn-rift sediments of Upper Jurassic form the FW to the evaporites. Geology Mg Top of salt 150-200 metres soft sands, clays, silts, Fe-sandstones overly; • K2O gamma Project Geology sylvinte anhydrite bischofite Typical anhydrite sequence: an aquitard anhydrite Evaporite sequence dominated by salt 10’s metres of carnallitite (<15% K2O) clay Base of salt 9 The Sintoukola Potash Project - PFS study structure Strategic World Class Potash Project 10 10 The Sintoukola Potash Project - Mining Solar evaporation from brine lakes • Approx. 20% of world production: Chile, China, Israel, Jordan • Lowest production costs • Large environmental impact • Limited new resources available Solution Mining • Approx. 10% of world production: Canada, Russia • Generally conversion from flooded conventional mines • High operating costs, power & water requirements • Amenable to deep deposits Conventional Mining • Approx. 70% of world production • Lowest environmental impact • Underground Room & Pillar Mining • Maintaining seal between mine workings and overlying aquifer is critical • Borer Miner or Continuous Miner • Requires ground freezing for shaft sinking 11 The Sintoukola Potash Project - Mining Selected Conventional Mining • Use continuous miners feeding shuttle cars • Underground conveyors to shaft • Convert 573Mt of M&I resource to 152Mt of reserve at 20% K2O • 26% overall extraction ratio • Production of 2Mtpa – 23 mine life with current resource 12 The Sintoukola Potash Project - Processing Hot or cold crystallization • In conjunction with evaporation & solution mining • Required for the processing of carnallite • Energy and water intensive Floatation • Used in conjunction with conventional mining • Chosen at Sintoukola 13 The Sintoukola Potash Project - Infrastructure Roads ● 30km road to the mine site ● 12km road to the process plant Processing Facility at Coast ● Central, scalable process plant located at the coast ● Facilitates brine disposal in ocean Material Transport ● RoM material via 36km overland conveyor to plant (6.8Mtpa) Port ● Jetty facility at Tchiboula adjacent to plant ● Transship product in barges for 10km to ocean going vessels Infrastructure ● Power transmission from existing national grid (50MW required – 200MW available) ● Water sourced from ocean and aquifer ● 80km Gas line for product drying ● Employee facilities for approximately 950 people near the process plant Infrastructure Funding ● Pursuing opportunities to fund these infrastructure packages externally Existing Camp LEGEND UP Existing Roads Existing Tracks Haulage Road New Track Service Road Existing Tracks Upgraded Under Pass Shoreline Buffer Zone Reserve Buffer Zone REPUBLIC OF CONGO UP 3.17 UP 5.26 Existing Track 1 (ET1-N6) UP 8.01 Dougou UP 13.59 UP 17.09 UP 23.98 Electrical Substation UP 27.51 Employees Facilities UP 33.70 TCHIBOULA Existing Track 2 (ET1-N5) Process Plant Jetty Existing Track 2 (ET2) 14 Study and Implementation schedule Plant Basic Engineering Phase 2 Mineral Resource Estimation Detail Engineering PFS-level Technical Report Infrastructure and plant construction Plant Production Ramp-up Full production Definitive Feasibility Study Shaft and mine construction ESIA Process Plant Com Mine ramp up Permitting 15 Capital and Operating Costs – 2.0 Mtpa mine Capital Cost by Discipline ($1.85bn) Operating Costs by Discipline ($79.7/tonne MoP) $20 $2.0 $204 $353 $0.6 $6.0 $5.1 $1.7 $27.7 $252 $116 $59 $98 $47 $42 $23.5 $536 $13.1 $125 Mine Hauling Process Plant Mining Hauling Jetty & Marine Waste & Brine Employee Facilities Process Jetty & Marine General Infrastructure Owner's Costs Contingency Waste & Brine Employee Facilities EPCM Insurance General Infrastructure G&A NI 43-101 Technical Report, Sintoukola Potash Project, Sep. 17, 2012; available at www.sedar.com Note: Capital estimates exclude sustaining capital costs 16 Benchmarking Elemental vs. Peers Capex Comparison High Grade Sylvinite Resource Mining Methodology 23% Solution Open Pit Mining Methodology (1) 22% Conventional 21% 18% 17% 16% 11% 11% 11% 10% 9% $1,471 Western Potash (Milestone) 9% $1,196 Verde Potash (Cerrado Verde) Source: Company Reports, NI 43-101 Technical Report, Sintoukola Potash Project, Sep. 17, 2012 1. Sulphate of Potash (“SoP”) production Shallow Mineral Resources Depth Conventional Solution Open Pit 1,700 $1,111 Encanto Potash (Muskowekwan Property) $1,069 K+S / Potash One (Legacy) US$/tonne of KCl Capacity Karnalyte Resources (Wynyard) Prospect Global Resources (Holbrook Basin) MagIndustries (Mengo) South Boulder (Colluli Potash) Allana Potash (Danakhil Project) Western Potash (Milestone) K+S / Potash One (Legacy) Encanto Potash (Muskowekwan Property) Elemental Minerals (Sintoukola Potash) IC Potash (Ochoa) BHP Billiton (Burr) BHP Billiton (Jansen) MagIndustries (Mengo) Mining Methodology Open Pit Solution BHP Billiton (Jansen) K2O Grade (%) 25% Conventional $1,035 Capacity (Mtpy) 8.0 2.8 1.2 2.8 2.7 BHP Billiton (Burr) $969 2.0 Elemental Minerals (Sintoukola Potash) $944 2.0 Karnalyte Resources (Wynyard) $944 2.1 Verde Potash (Cerrado Verde) $779 3.0 South Boulder (Colluli Potash) $760 2.0 $759 0.9 1,211 945 264 1,013 425 (1) IC Potash (Ochoa) 465 65 Source: Company Reports, NI 43-101 Technical Report, Sintoukola Potash Project, Sep. 17, 2012 1. Sulphate of Potash (“SoP”) production Western Potash (Milestone) K+S / Potash One (Legacy) Encanto Potash (Muskowekwan Property) Karnalyte Resources (Wynyard) BHP Billiton (Jansen) BHP Billiton (Burr) MagIndustries (Mengo) Prospect Global Resources (Holbrook Basin) Allana Potash (Danakhil Project) IC Potash (Ochoa) (2) Elemental Minerals (Sintoukola Potash) South Boulder (Colluli Potash) 56 392 950 725 (1) Verde Potash (Cerrado Verde) Mine Depth (metres) 1,500 Elemental Minerals (Sintoukola Potash) $679 2.0 Prospect Global Resources (Holbrook Basin) $664 2.0 Allana Potash (Danakhil Project) $642 1.0 Source: Company Reports, NI 43-101 Technical Report, Sintoukola Potash Project 1. Sulphate of Potash (“SoP”) production 2. Excludes capital costs of US$530mm due to infrastructure opportunities 17 309 308 307 306 305 304 303 302 301 300 299 298 297 296 295 294 293 292 291 290 289 288 287 286 285 284 283 282 281 280 279 278 277 276 275 274 273 272 271 270 269 268 267 266 265 264 263 262 261 260 259 258 257 256 255 254 253 252 251 250 249 248 247 246 245 244 243 242 241 240 239 238 237 236 235 234 233 232 231 230 229 228 227 226 225 224 223 222 221 220 219 218 217 216 215 214 213 212 211 210 209 208 207 206 205 204 203 202 201 200 199 198 197 196 195 194 193 192 191 190 189 188 187 186 185 184 183 182 181 180 179 178 177 176 175 174 173 172 171 170 169 168 167 166 165 164 163 162 161 160 159 158 157 156 155 154 153 152 151 150 149 148 147 146 145 144 143 142 141 140 139 138 137 136 135 134 133 132 131 130 129 128 127 126 125 124 123 122 121 120 119 118 117 116 115 114 113 112 111 110 109 108 107 106 105 104 103 102 101 100 99 98 97 96 95 94 93 92 91 90 89 88 87 86 85 84 83 82 81 80 79 78 77 76 75 74 73 72 71 70 69 68 67 66 65 64 63 62 61 60 59 58 57 56 55 54 53 52 51 50 49 48 47 46 45 44 43 42 41 40 39 38 37 36 35 34 33 32 31 30 29 28 27 26 25 24 23 22 21 20 19 18 17 16 15 14 13 12 11 10 9 8 7 6 5 4 3 2 1 309 308 307 306 305 304 303 302 301 300 299 298 297 296 295 294 293 292 291 290 289 288 287 286 285 284 283 282 281 280 279 278 277 276 275 274 273 272 271 270 269 268 267 266 265 264 263 262 261 260 259 258 257 256 255 254 253 252 251 250 249 248 247 246 245 244 243 242 241 240 239 238 237 236 235 234 233 232 231 230 229 228 227 226 225 224 223 222 221 220 219 218 217 216 215 214 213 212 211 210 209 208 207 206 205 204 203 202 201 200 199 198 197 196 195 194 193 192 191 190 189 188 187 186 185 184 183 182 181 180 179 178 177 176 175 174 173 172 171 170 169 168 167 166 165 164 163 162 161 160 159 158 157 156 155 154 153 152 151 150 149 148 147 146 145 144 143 142 141 140 139 138 137 136 135 134 133 132 131 130 129 128 127 126 125 124 123 122 121 120 119 118 117 116 115 114 113 112 111 110 109 108 107 106 105 104 103 102 101 100 99 98 97 96 95 94 93 92 91 90 89 88 87 86 85 84 83 82 81 80 79 78 77 76 75 74 73 72 71 70 69 68 67 66 65 64 63 62 61 60 59 58 57 56 55 54 53 52 51 50 49 48 47 46 45 44 43 42 41 40 39 38 37 36 35 34 33 32 31 30 29 28 27 26 25 24 23 22 21 20 19 18 17 16 15 14 13 12 11 10 9 8 7 6 5 4 3 2 1 309 309 308 308 307 307 306 306 305 305 304 304 303 303 302 302 301 301 300 300 299 299 298 298 297 297 296 296 295 295 294 294 293 293 292 292 291 291 290 290 289 289 288 288 287 287 286 286 285 285 284 284 283 283 282 282 281 281 280 280 279 279 278 278 277 277 276 276 275 275 274 274 273 273 272 272 271 271 270 270 269 269 268 268 267 267 266 266 265 265 264 264 263 263 262 262 261 261 260 260 259 259 258 258 257 257 256 256 255 255 254 254 253 253 252 252 251 251 250 250 249 249 248 248 247 247 246 246 245 245 244 244 243 243 242 242 241 241 240 240 239 239 238 238 237 237 236 236 235 235 234 234 233 233 232 232 231 231 230 230 229 229 228 228 227 227 226 226 225 225 224 224 223 223 222 222 221 221 220 220 219 219 218 218 217 217 216 216 215 215 214 214 213 213 212 212 211 211 210 210 209 209 208 208 207 207 206 206 205 205 204 204 203 203 202 202 201 201 200 200 199 199 198 198 197 197 196 196 195 195 194 194 193 193 192 192 191 191 190 190 189 189 188 188 187 187 186 186 185 185 184 184 183 183 182 182 181 181 180 180 179 179 178 178 177 177 176 176 175 175 174 174 173 173 172 172 171 171 170 170 169 169 168 168 167 167 166 166 165 165 164 164 163 163 162 162 161 161 160 160 159 159 158 158 157 157 156 156 155 155 154 154 153 153 152 152 151 151 150 150 149 149 148 148 147 147 146 146 145 145 144 144 143 143 142 142 141 141 140 140 139 139 138 138 137 137 136 136 135 135 134 134 133 133 132 132 131 131 130 130 129 129 128 $122 128 127 127 126 126 125 125 124 124 123 123 122 122 $118 118 121 121 120 120 119 119 118 117 117 116 116 115 115 114 114 113 113 112 112 111 111 110 110 109 109 108 108 107 107 106 106 105 105 104 104 103 103 102 102 101 101 100 100 99 99 98 98 97 97 96 96 95 95 94 94 93 93 92 92 91 91 90 90 89 89 88 88 87 87 86 86 85 85 84 84 83 83 82 82 81 81 80 80 79 79 78 78 77 77 76 76 75 75 74 74 73 73 72 72 71 71 70 70 69 69 68 68 67 67 66 66 65 65 64 64 63 63 62 62 61 61 60 60 59 59 58 58 57 57 56 56 55 55 54 54 53 53 52 52 51 51 50 50 49 49 48 48 47 47 46 46 45 45 44 44 43 43 42 42 41 41 40 40 39 39 38 38 37 37 36 36 35 35 34 34 33 33 32 32 31 31 30 30 29 29 28 28 27 27 26 26 25 25 24 24 23 23 22 22 21 21 20 20 19 19 18 18 17 17 16 16 15 15 14 14 13 13 12 12 11 11 10 10 9 9 8 8 7 7 6 5 1.0 6 5 2.0 4 4 3 3 2 2 1 1 309 308 307 306 305 304 303 302 301 300 299 298 297 296 295 294 293 292 291 290 289 288 287 286 285 284 283 282 281 280 279 278 277 276 275 274 273 272 271 270 269 268 267 266 265 264 263 262 261 260 259 258 257 256 255 254 253 252 251 250 249 248 247 246 245 244 243 242 241 240 239 238 237 236 235 234 233 232 231 230 229 228 227 226 225 224 223 222 221 220 219 218 217 216 215 214 213 212 211 210 209 208 207 206 205 204 203 202 201 200 199 198 197 196 195 194 193 192 191 190 189 188 187 186 185 184 183 182 181 180 179 178 177 176 175 174 173 172 171 170 169 168 167 166 165 164 163 162 161 160 159 158 157 156 155 154 153 152 151 150 149 148 147 146 145 144 143 142 141 140 139 138 137 136 135 134 133 132 131 130 129 128 127 126 125 124 123 122 121 120 119 118 117 116 115 114 113 112 111 110 109 108 107 106 105 104 103 102 101 100 99 98 97 96 95 94 93 92 91 90 89 88 87 86 85 84 83 82 81 80 79 78 77 76 75 74 73 72 71 70 69 68 67 66 65 64 63 62 61 60 59 58 57 56 55 54 53 52 51 50 49 48 47 46 45 44 43 42 41 40 39 38 37 36 35 34 33 32 31 30 29 28 27 26 25 24 23 22 21 20 19 18 17 16 15 14 13 12 11 10 9 8 7 6 5 4 3 2 1 309 308 307 306 305 304 303 302 301 300 299 298 297 296 295 294 293 292 291 290 289 288 287 286 285 284 283 282 281 280 279 278 277 276 275 274 273 272 271 270 269 268 267 266 265 264 263 262 261 260 259 258 257 256 255 254 253 252 251 250 249 248 247 246 245 244 243 242 241 240 239 238 237 236 235 234 233 232 231 230 229 228 227 226 225 224 223 222 221 220 219 218 217 216 215 214 213 212 211 210 209 208 207 206 205 204 203 202 201 200 199 198 197 196 195 194 193 192 191 190 189 188 187 186 185 184 183 182 181 180 179 178 177 176 175 174 173 172 171 170 169 168 167 166 165 164 163 162 161 160 159 158 157 156 155 154 153 152 151 150 149 148 147 146 145 144 $140 143 142 141 140 139 138 137 136 135 134 133 132 131 130 129 128 127 126 125 124 123 122 121 120 119 118 117 116 115 114 113 112 111 110 109 108 107 106 105 104 103 102 101 100 99 98 97 96 95 94 93 92 91 90 89 88 87 86 85 84 83 82 81 80 79 78 77 76 75 74 73 72 71 70 69 68 67 66 65 64 63 62 61 60 59 58 57 56 55 54 53 52 51 50 49 48 47 46 45 44 43 42 41 40 39 38 37 36 35 34 33 32 31 30 29 28 27 26 25 24 23 22 21 20 19 18 17 16 15 14 13 12 11 10 9 1.2 67812345 309 308 307 306 305 304 303 302 301 300 299 298 297 296 295 294 293 292 291 290 289 288 287 286 285 284 283 282 281 280 279 278 277 276 275 274 273 272 271 270 269 268 267 266 265 264 263 262 261 260 259 258 257 256 255 254 253 252 251 250 249 248 247 246 245 244 243 242 241 240 239 238 237 236 235 234 233 232 231 230 229 228 227 226 225 224 223 222 221 220 219 218 217 216 215 214 213 212 211 210 209 208 207 206 205 204 203 202 201 200 199 198 197 196 195 194 193 192 191 190 189 188 187 186 185 184 183 182 181 180 179 178 177 176 175 174 173 172 171 170 169 168 167 166 $162 164 165 163 162 161 160 159 158 157 156 155 154 153 152 151 150 149 148 147 146 145 144 143 142 141 140 139 138 137 136 135 134 133 132 131 130 129 128 127 126 125 124 123 122 121 120 119 118 117 116 115 114 113 112 111 110 109 108 107 106 105 104 103 102 101 100 99 98 97 96 95 94 93 92 91 90 89 88 87 86 85 84 83 82 81 80 79 78 77 76 75 74 73 72 71 70 69 68 67 66 65 64 63 62 61 60 59 58 57 56 55 54 53 52 51 50 49 48 47 46 45 44 43 42 41 40 39 38 37 36 35 34 33 32 31 30 29 28 27 26 25 24 23 22 21 20 19 18 17 16 15 14 13 12 11 10 9 8 7 6 5 2.0 4 3 2 1 309 308 307 306 305 304 303 302 301 300 299 298 297 296 295 294 293 292 291 290 289 288 287 286 285 284 283 282 281 280 279 278 277 276 275 274 273 272 271 270 269 268 267 266 265 264 263 262 261 260 259 258 257 256 255 254 253 252 251 250 249 248 247 246 245 244 243 242 241 240 239 238 237 236 235 234 233 232 231 230 229 228 227 226 225 224 223 222 221 220 219 218 217 216 215 214 213 212 211 210 209 208 208 208 208 208 208 208 208 208 208 208 208 178 178 178 177 176 175 174 173 172 171 170 169 168 167 166 165 164 163 162 161 160 159 158 157 156 155 154 153 152 151 150 149 148 147 146 145 144 143 142 141 140 139 138 137 136 135 134 133 132 131 130 129 128 127 126 125 124 123 122 121 120 119 118 117 116 115 114 113 112 111 110 109 108 107 106 105 104 103 102 101 100 99 98 97 96 95 94 93 92 91 90 89 88 87 86 85 84 83 82 81 80 79 78 77 76 75 74 73 72 71 70 69 68 67 66 65 64 63 62 61 60 59 58 57 56 55 54 53 52 51 50 49 48 47 46 45 44 43 42 41 40 39 38 37 36 35 34 33 32 31 30 29 28 27 26 25 24 23 22 21 20 19 18 17 16 15 14 13 12 11 10 9 8 7 6 5 4 3 2 1 Estimated Potash Developer Cost Curve (US$/tonne KCl) Royalties Freight Costs Operating Costs $96 Expected Capacity (Mtpa) 2.0 $112 2.7 $133 2.8 $163 8.0 $170 2.8 309 309 ## 308 308 307 307 306 306 305 305 304 304 ### 303 303 302 302 301 301 300 300 299 299 298 298 ### 297 297 296 296 295 295 294 294 293 293 292 292 ### 291 291 290 290 289 289 288 288 287 287 286 286 ### 285 285 284 284 283 283 282 282 281 281 280 280 ### 279 279 278 278 277 277 276 276 275 275 274 274 ## 273 273 272 272 271 271 270 270 269 269 ### 268 268 267 267 266 266 265 265 264 264 263 263 ### 262 262 261 261 260 260 259 259 258 258 257 257 ### 256 256 255 255 254 254 253 253 252 252 251 251 ### 250 250 249 249 248 248 247 247 246 246 245 245 ### 244 244 243 243 242 242 241 241 240 240 239 239 ### 238 238 237 237 236 236 235 235 234 234 233 233 ## 232 232 231 231 230 230 229 229 228 228 ### 227 227 226 226 225 225 224 224 223 223 222 222 ### 221 221 220 220 219 219 218 218 217 217 216 216 ### 215 215 214 214 213 213 212 212 211 211 210 210 ### 209 209 208 208 207 207 206 206 205 205 204 204 ### 203 203 202 202 201 201 200 200 199 199 198 198 ### 197 197 196 196 195 195 194 194 193 193 # $191 192 192 191 191 190 190 189 189 188 188 187 187 #### 186 186 185 185 184 184 183 183 182 182 $179 181 181 ## 180 180 179 179 178 178 177 177 176 176 175 175 ### 174 174 173 173 172 172 171 171 170 170 169 169 ### 168 168 167 167 166 166 165 165 164 164 163 163 ### 162 162 161 161 160 160 159 159 158 158 157 157 ### 156 156 155 155 154 154 153 153 152 152 151 151 ## 150 150 149 149 148 148 147 147 146 146 ### 145 145 144 144 143 143 142 142 141 141 140 140 ### 139 139 138 138 137 137 136 136 135 135 134 134 ### 133 133 132 132 131 131 130 130 129 129 128 128 ### 127 127 126 126 125 125 124 124 123 123 122 122 ### 121 121 120 120 119 119 118 118 117 117 116 116 ### 115 115 114 114 113 113 112 112 111 111 110 110 ## 109 109 108 108 107 107 106 106 105 105 ### 104 104 103 103 102 102 101 101 100 100 99 99 ### 98 98 97 97 96 96 95 95 94 94 93 93 ### 92 92 91 91 90 90 89 89 88 88 87 87 ### 86 86 85 85 84 84 83 83 82 82 81 81 ### 80 80 79 79 78 78 77 77 76 76 75 75 ### 74 74 73 73 72 72 71 71 70 70 69 69 ## 68 68 67 67 66 66 65 65 64 64 ### 63 63 62 62 61 61 60 60 59 59 58 58 ### 57 57 56 56 55 55 54 54 53 53 52 52 ### 51 51 50 50 49 49 48 48 47 47 46 46 ### 45 45 44 44 43 43 42 42 41 41 40 40 ### 39 39 38 38 37 37 36 36 35 35 34 34 ### 33 33 32 32 31 31 30 30 29 29 28 28 ### 27 27 26 26 25 25 24 24 23 23 22 22 ## 21 21 20 20 19 19 18 18 17 17 ### 16 16 15 15 14 14 13 13 12 12 11 11 10 10 9 9 ##6 9 8 8 8 7 7 7 6 5 0.9 6 5 5 4 40.3 4 3 3 3 2 2 2 1 1 1 309 308 307 306 305 304 303 302 301 300 299 298 297 296 295 294 293 292 291 290 289 288 287 286 285 284 283 282 281 280 279 278 277 276 275 274 273 272 271 270 269 268 267 266 265 264 263 262 261 260 259 258 257 256 255 254 253 252 251 250 249 248 247 246 245 244 243 242 241 240 239 238 237 236 235 234 233 232 231 230 229 228 227 226 225 224 223 222 221 220 219 218 217 216 215 214 213 212 211 210 209 208 207 206 204 $200 205 203 202 201 200 199 198 197 196 195 194 193 192 191 190 189 188 187 186 185 184 183 182 181 180 179 178 177 176 175 174 173 172 171 170 169 168 167 166 165 164 163 162 161 160 159 158 157 156 155 154 153 152 151 150 149 148 147 146 145 144 143 142 141 140 139 138 137 136 135 134 133 132 131 130 129 128 127 126 125 124 123 122 121 120 119 118 117 116 115 114 113 112 111 110 109 108 107 106 105 104 103 102 101 100 99 98 97 96 95 94 93 92 91 90 89 88 87 86 85 84 83 82 81 80 79 78 77 76 75 74 73 72 71 70 69 68 67 66 65 64 63 62 61 60 59 58 57 56 55 54 53 52 51 50 49 48 47 46 45 44 43 42 41 40 39 38 37 36 35 34 33 32 31 30 29 28 27 26 25 24 23 22 21 20 19 18 17 16 15 14 13 12 11 10 9 8 7 6 5 2.1 4 3 2 1 309 308 307 306 305 304 303 302 301 300 299 298 297 296 295 294 293 292 291 290 289 288 287 286 285 284 283 282 281 280 279 278 277 276 275 274 273 272 271 270 269 268 267 266 265 264 263 262 261 260 259 258 257 256 255 254 253 252 251 250 249 248 247 246 245 244 243 242 241 240 239 238 237 236 235 234 233 232 231 230 229 228 227 226 225 224 223 222 221 220 219 218 217 216 215 214 213 212 211 210 209 208 207 206 205 204 203 202 201 200 199 198 197 196 195 194 193 192 191 190 189 188 187 186 185 184 183 182 181 180 179 178 177 176 175 174 173 172 171 170 169 168 167 166 165 164 163 162 161 160 159 158 157 156 155 154 153 152 151 150 149 148 147 146 145 144 143 142 141 140 139 138 137 136 135 134 133 132 131 130 129 128 127 126 125 124 123 122 121 120 119 118 117 116 115 114 113 112 111 110 109 108 107 106 105 104 103 102 101 100 99 98 97 96 95 94 93 92 91 90 89 88 87 86 85 84 83 82 81 80 79 78 77 76 75 74 73 72 71 70 69 68 67 66 65 64 63 62 61 60 59 58 57 56 55 54 53 52 51 50 49 48 47 46 45 44 43 42 41 40 39 38 37 36 35 34 33 32 31 30 29 28 27 26 25 24 23 22 21 20 19 18 17 16 15 14 13 12 11 10 9 8 7 6 5 4 3 2 1 $286 3.0 (US$/tonne) Project Operating Costs Freight Costs Royalties (1) Sintoukola Potash (1) $81 (2) Legacy Burr Danakhil Project Milestone Mengo Holbrook Basin Jansen Muskowekwan Property Ochoa Sevier Lake Project Wynyard Cerrado Verde $63 $59 $69 $63 $124 $98 $163 $54 $158 $155 $131 $285 -- $49 $59 $30 $60 -- $44 -- $51 $4 -- $45 -- $14 -- -- $24 $10 $16 $20 -- $65 $17 $36 $25 (3) $1 Sintoukola’s opex per tonne is the lowest when benchmarked against its peers Source: Company Reports, Equity Research, NI 43-101 Technical Report, Sintoukola Potash Project, Sep. 17, 2012; available at www.sedar.com Note: Freight and royalties included where available, excludes Saskatchewan Potash Production Taxes 1. Figures based on weighted average cost over LOM production 2. Includes sales and marketing costs; using Q2 2013 figures 3. Includes 2.5% crown royalty and 3.0% Saskatchewan resource surcharge based on US$450/tonne KCl price 18 Summary & Conclusions ● The growing world population underpins strong fundamentals for the potash market ● Price levels are likely to remain high due to the controlled concentration of production and the high barriers to entry ● The Sintoukola Potash Project hosts a significant high grade resource ● Strong cost advantages result in excellent project economics: NPV = $2.97bn, IRR = 29%. ● Proven conventional mining, processing and shallow depth ● Excellent location to serve the Brazilian market 19 Questions? 20 Appendix 21 PFS Mineral Reserves & Resource Estimate Mineral Reserve for sylvinite mineralization only at a 10% K2O cut-off grade Proven Tonnes(Mt) 87.9 Probable %K2O 20.0 %KCl 31.7 Tonnes(Mt) 63.8 Total %K2O 20.0 %KCl 31.7 Tonnes(Mt) 151.7 %K2O 20.0 Mineral Resource estimate for sylvinite mineralization only at a 10% K2O cut-off grade Measured Tonnes(Mt) HWS Indicated %K2O %KCl Tonnes(Mt) %KCl 31.7 (1) Inferred %K2O %KCl Tonnes(Mt) %K2O %KCl - - - - - - 47 34.8 55.0 Upper Seam 171 22.5 35.5 159 22.0 34.89 96 21.8 34.5 Lower Seam 93 19.2 30.4 150 19.1 30.17 107 19.1 30.3 225 17.6 27.9 475 20.4 32.3 Footwall Seam Total 264 21.3 33.7 309 20.6 32.61 Mineral Resource estimate for sylvinite and carnallitite mineralization at a 10% K2O cut-off grade Measured Tonnes(Mt) Indicated %K2O %KCl Tonnes(Mt) Inferred %K2O %KCl HWS Tonnes(Mt) %K2O %KCl 47 34.8 55.0 Upper Seam 245 19.5 30.9 310 17.8 28.1 278 16.3 25.8 Lower Seam 313 13.3 21.0 448 13.7 21.8 398 13.1 20.8 225 17.6 27.9 948 16.2 25.6 Footwall Seam Total 559 16.0 25.4 758 (1) 15.4 24.4 Source: NI 43-101 Technical Report, Sintoukola Potash Project, Sep. 17, 2012; available at www.sedar.com 1. Includes resources upgraded to P&P reserves Strategic World Class Potash Project 22 Disclaimer This Presentation contains "forward-looking statements" ‘‘forward-looking information’’ within the meaning of applicable Canadian securities legislation. Wherever possible, words such as ‘‘plans’’, ‘‘expects’’, or ‘‘does not expect’’, ‘‘budget’’, ‘‘scheduled’’, ‘‘estimates’’, ‘‘forecasts’’, ‘‘anticipate’’ or ‘‘does not anticipate’’, ‘‘believe’’, ‘‘intend’’ and similar expressions or statements that certain actions, events or results ‘‘may’’, ‘‘could’’, ‘‘would’’, ‘‘might’’ or ‘‘will’’ be taken, occur or be achieved, have been used to identify forwardlooking information. Forward-looking statements in this Presentation may include, but are not limited to, statements regarding: future extraction, methodologies and the exploitation of mineral deposits; capital expenditure requirements; IRR and NPV of the Sintoukola Potash Project; expected production capacity; certain mining assumptions; cost estimates; product market assumptions; market price assumptions; transportation and marketing costs; life of mine production parameters; arable land per capita projections; estimation of Mineral Resources; the Company spending the funds available to it as stated in this Presentation; expectations regarding the Company’s ability to subsequently raise capital; expenditures to be made by the Company to meet certain work commitments; work plans to be conducted by the Company; reclamation and rehabilitation obligation and liabilities; treatment under governmental regulatory regimes with respect to environmental matters; treatment under governmental taxation regimes; government regulation of mining operations; dependence on personnel and competitive conditions. Forward-looking statements are based on the reasonable assumptions, estimates, analysis and opinions of management made in light of its experience and its perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances at the date that such statements are made, but which may prove to be incorrect. Management believes that the assumptions and expectations reflected in such forward-looking statements are reasonable. Assumptions have been made regarding, among other things: the Company executing its project development plans in accordance with its budgets and planning; feasibility and other studies supporting the Company’s development plans; the Company being able to obtain sufficient financing when required and on reasonable terms; the Company being able to convert existing Mineral Resources into Proven or Probable Mineral Reserves; the Company obtaining required licenses and approvals in a timely manner; applicable environmental and other laws and other regulations not being amended; key management continuing to serve in their respective roles with the Company; title to the Sintoukola Potash Project not being challenged; and no changes occurring to the price of potash that might adversely affect the prospects for developing and operating the Sintoukola Potash Project or which might make it uneconomic to proceed with development. Forward-looking statements involve significant risks and uncertainties, should not be read as guarantees of future performance or results, and will not necessarily be accurate indications of whether or not such results will be achieved. A number of factors could cause actual results to differ materially from the results discussed in the forward-looking statements, including risks related to: no history of mineral production; lack of revenue from operations; dependence on the Sintoukola Potash Project; uncertainty of estimates of Mineral Resources; lack of Proven or Probable Mineral Reserves; projections being materially different than results; challenge of title to the Project; failure to obtain approvals and licenses; adverse regulatory requirements; litigation; mining complexities; construction delays; potential for water ingress; potential for ground water access to Mineral Resources; adverse climate conditions; failure to secure suitable waste disposal permits; inadequate infrastructure; delays in gaining access to land; existence of cultural heritage on lands for which access is required; inability to recruit and retain key employees; unknown environmental risks; uninsurable risks; potential officer and director conflict of interest; inability to secure additional capital; global financial conditions; competition in the mining industry; cyclical demand for potash; weather patterns and natural disasters; volatility in potash prices; political and economic risks in the ROC; entitlement of the Congolese government to a stake in the Sintoukola Potash Project; enforcement of contractual rights in the ROC; exchange rate fluctuations; repatriation of funds; failure to declare funds prior to bringing them into the ROC; opposition from non-governmental organizations; lack of dividends; volatility and lack of liquidity of ordinary shares of the Company. Although the forward-looking statements contained in this Presentation are based upon what management of the Company believes are reasonable assumptions, the Company cannot assure investors that future performance and actual results will be consistent with these forward-looking statements. The Company, its directors, officers, agents, employees or advisors, do not represent, warrant or guarantee, expressly or impliedly, that the information in this Presentation is complete or accurate. To the maximum extent permitted by law, the Company disclaims any responsibility to inform any recipient of this Presentation or any matter that subsequently comes to its notice which may affect any of the information contained in this Presentation. These forward-looking statements are made as of the date of this Presentation and are expressly qualified in their entirety by this cautionary statement. Subject to applicable securities laws, the Company does not assume any obligation to update or revise them to reflect new events or circumstances. 23 Disclaimer cont’d This Presentation does not constitute or form part of any offer for sale or solicitation of any offer to buy or subscribe for any securities nor shall it or any part of it form the basis of or be relied on in connection with, or act as any inducement to enter into, any contract or commitment whatsoever in any jurisdiction. Recipients of this Presentation who are considering acquiring securities of the Company are reminded that any such purchase or subscription must not be made on the basis of the information contained in this Presentation but are referred to the entire body of publicly disclosed information regarding the Company. The information contained in this Presentation is derived solely from otherwise publicly available information concerning the Company and does not purport to be allinclusive or to contain all the information that an investor may desire to have in evaluating whether or not to make an investment in the Company. The information is qualified entirely by reference to the Company’s publicly disclosed information. This Presentation is being supplied to you solely for your information and may not be reproduced, further distributed or published in whole or in part by any other person. Neither this Presentation nor any copy of it may be taken or transmitted into or distributed in Canada, the United States or any other jurisdiction which prohibits the same except in compliance with applicable securities laws. Any failure to comply with this restriction may constitute a violation of applicable securities laws. No representation, warranty or guarantee express or implied, is made or given by or on behalf of the Company or any of their subsidiary undertakings or any of the directors, officers, employees or advisors of any such entities as to the accuracy, completeness or fairness of the information or opinions contained in this Presentation (or of any other written or oral information made or to be made available to any interested party or its advisors) and, to the fullest extent permitted by law, no responsibility or liability, howsoever arising, is accepted by any person for such information or opinions. In furnishing this Presentation, the Company does not undertake or agree to any obligation to provide the attendees with access to any additional information or to update this Presentation or to correct any inaccuracies in, or omissions from, this Presentation that may become apparent. The information and opinions contained in this Presentation are provided as at the date of this Presentation. The contents of this Presentation are not to be construed as legal, financial or tax advice. Each prospective investor should contact his, her or its own legal adviser, independent financial adviser or tax adviser for legal, financial or tax advice. In particular, any estimates or projections or opinions contained in this Presentation necessarily involve significant elements of subjective judgment, analysis and assumptions and each recipient should satisfy itself in relation to such matters. Competent Person / Qualified Person Statement: All scientific or technical information, including information that relates to exploration results and minerals resources (“Information”) in this press presentation is based on information prepared and/or approved by Andrew Scogings, MSc, MAusIMM, MAIG, PhD (CSA), Jean Hector, Senior Geologist (EGIS), Jane Joughin, Pr.Sci.Nat., MSc (SRK), Johan Boshoff, MEng, P.Eng. (SRK), Neal Rigby, CEng MIMMM, PhD (SRK), Paul O’Hara, P.Eng. (AMEC) and Simon Dorling, MSc, MAIG, PhD (CSA) (collectively, the “Qualified Persons”), each of whom are independent of the Company and have sufficient experience which is relevant to the style of mineralization and type of deposit under consideration and to the activity they are undertaking to qualify as a Competent Person as defined in the 2004 Edition of the “Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves” (the JORC Code) and as a Qualified Person for the purposes of Canadian National Instrument 43-101. Each of the Qualified Person consents to the inclusion in this press presentation of the Information, in the form and context in which it appears. Further information respecting Elemental’s Sintoukola Potash Project and the PFS is contained in a technical report entitled ‘‘NI 43-101 Technical Report, Sintoukola Potash Project, Republic of Congo’’ dated September 17, 2012 with an effective date of September 17, 2012 (the “Technical Report”). The Technical Report can be accessed on the Company’s profile on SEDAR. 24 Disclaimer cont’d Canada This document may only be provided, and offers and sales may only be concluded in Canada, with or to, persons that are “accredited investors” as defined in National Instrument 45-106 – Prospectus and Registration Exemptions. This document is not, and under no circumstances is it to be construed as, an offer to sell the securities described herein or a solicitation of an offer to buy the securities described herein in any jurisdiction in Canada where the offer or sale of these securities is prohibited. This document is not, and under no circumstances is it to be construed as, an advertisement or a public offering in Canada of the securities referred to in this document. No securities commission or similar regulatory authority in Canada has reviewed or in any way passed upon this document or the merits of the securities described herein and any representation to the contrary is an offence. United Kingdom Neither the information in this document nor any other document relating to the offering described herein has been delivered for approval to the Financial Services Authority in the United Kingdom and no prospectus (within the meaning of section 85 of the Financial Services and Markets Act 2000, as amended ("FSMA")) has been published or is intended to be published in respect of the securities described herein. This document is issued on a confidential basis to "qualified investors" (within the meaning of section 86(7) of FSMA) in the United Kingdom, and the securities referenced herein may not be offered or sold in the United Kingdom by means of this document, any accompanying letter or any other document, except in circumstances which do not require the publication of a prospectus pursuant to section 86(1) FSMA. This document should not be distributed, published or reproduced, in whole or in part, nor may its contents be disclosed by recipients to any other person in the United Kingdom. Any invitation or inducement to engage in investment activity (within the meaning of section 21 of FSMA) received in connection with the issue or sale of the securities described herein has only been communicated or caused to be communicated and will only be communicated or caused to be communicated in the United Kingdom in circumstances in which section 21(1) of FSMA does not apply to the Company. In the United Kingdom, this document is being distributed only to, and is directed at, persons (i) who have professional experience in matters relating to investments falling within Article 19(5) (investment professionals) of the Financial Services and Markets Act 2000 (Financial Promotions) Order 2005 ("FPO"), (ii) who fall within the categories of persons referred to in Article 49(2)(a) to (d) (high net worth companies, unincorporated associations, etc.) of the FPO or (iii) to whom it may otherwise be lawfully communicated (together "relevant persons"). The investments to which this document relates are available only to, and any invitation, offer or agreement to purchase will be engaged in only with, relevant persons. Any person who is not a relevant person should not act or rely on this document or any of its contents. United States This document may not be released or distributed in the United States or to U.S. persons (as defined under the U.S. Securities Act of 1933, as amended (the “U.S. Securities Act”)) (“U.S. Persons”) or to persons acting for the account or benefit of U.S. Persons, except to persons that satisfy the requirements set forth in Rule 501(a)(1), (2), (3) or (7) of Regulation D. This document does not constitute an offer to sell, or a solicitation of an offer to buy, any securities in the United States or to, or for the account or benefit of, any U.S. Persons except to persons that satisfy the requirements set forth in Rule 501(a)(1), (2), (3) or (7) of Regulation D. The securities described herein have not been, and will not be, registered under the U.S. Securities Act or the securities laws of any state or other jurisdiction of the United States. Accordingly, the securities described herein may not be offered or sold, directly or indirectly, in the United States or to, or for the account or benefit of U.S. Persons , unless they have been registered under the U.S. Securities Act, or are offered and sold in a transaction exempt from, or not subject to, the registration requirements of the U.S. Securities Act and any other applicable state securities laws. 25