Doing Business in Indonesia - Asia New Zealand Foundation

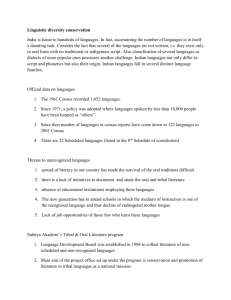

advertisement

• Population: 241 million • Land area: 1.9 million square kilometers (the size of Mexico, almost 2/3 of India) • 17,500 islands • 300 ethnic groups 2 Population: 140 million, thereof approx. 90 million ethnic Javanese (largest ethnic group in Southeast Asia). Size: 126.700 km2 (almost 1/2 the size of New Zealand). 1000-km northern route (great post road/groote postweg) constructed by Governor General Herman Daendels in 1808 – 1810 in the service of France the island’s main artery to date. Center of power and economy since colonial times. Javanese culture dominant, and pre-eminently dominant during President Soeharto’s 32-year reign. 3 4 5 “Ask anyone in Indonesia about the country’s future and most likely you will get an optimistic answer. This is no surprise. The third largest democracy and fourth most populous country in the world has transformed itself from a lowincome country in the 1960s into a fastgrowing emerging market.” “Doing Business in Indonesia 2010” – The World Bank and IMF 6 POLITICAL WILL Governments Political Attitude GOAL: GOOD OF COMMUNITY (“Negotiating Mining Agreements: Past, Present and Future Trends,” Danièle Barberis, 1998) Policies and Strategies 7 Year Era Economy 1945-1950 Revolution (War against the Dutch) Non-existent 1950-1957 Proto-democracy In shambles 1957-1966 Guided Democracy (Revolution Ch. 2) 1966-1998 New Order In ruins – inflation 650% Excellent: 7- 8% growth 1998-2005 Reformation – seeds In the Doldrums of democracy 2005- now Nascent Democracy Respectable: 6% + growth 8 1. The economy shall be organized as a common endeavor based upon the principles of the family system 2. Sectors of production that are important for the country and affect the life of the People shall be controlled by the State 3. The land, the waters and the natural riches contained therein shall be controlled by the State and exploited to the greatest benefit of the people 9 7 BANKING INSURANCE FMCG ANZ, HSBC, CIMB, Commonwealth CIGNA, Prudential, Manulife, Allianz Unilever, Arnott’s, Phillip Morris, BAT LOGISTICS TECHNOLOGY TRAVEL Schenker, DHL, Maersk Axiata, RIM, Siemens, GE Air Asia, Accor Group AUTOMOTIVE Toyota (market share > 50%), Honda, Mercedes It definitely is, but you can do (good) business in Indonesia without promoting and resorting to bribery or being otherwise involved in corruption. 12 Middle class group: 50 million + 27th biggest exporter in 2010 Inflation 5.4% (2011) Economic growth in 2011 6.5% - 2012 revised downward to 6.3% Size of economy : US$ 846 billion in 2011, projected to be a trillion dollar economy in 2014 16th largest economy in the world 13 National flag carrier Garuda flew 4.6 million passengers in Q1/2012 (up 25% YOY) Growth of air travel in 2011 22% 1200 air traffic controllers needed New car sales in 2012 projected at 1 million units 800 new pilots needed annually US$ 2 billion commuter line from airport – Jakarta operational 2014 Mobile telephone subscriptions in Q1/2012 255 million numbers Jakarta Airport served 52.4 million passengers in 2011 Accor to double number of hotels to 100 by end 2015 Aston Hotels to add 73 new hotels (20 thereof this year) to existing 45 14 Indonesians don’t know much about New Zealand Kiwis don’t know much about Indonesia Ergo – stereotypes prevail 15 16 Cooperation exists in all sectors and areas: economy, security, education, counter-terrorism Negotiations on Indonesia – Australia Comprehensive Economic Partnership Agreement (IA-CEPA) commenced in September 2012 May be turned into an advantage if linked to Australia – New Zealand Closer Economic Relations (CER) 17 18 • 16th-largest economy in the world • 45 million members of the consuming class • 53% of the population in cities producing 74% of GDP • 55 million skilled workers in the Indonesian Economy • $0.5 trillion market opportunity in consumer services, agriculture and fisheries, resources, and education • 7th-largest economy in the world • 135 million members of the consuming class • 71% of the population in cities producing 86% of GDP • 113 million skilled workers needed • $1.8 trillion market opportunity in consumer services, agriculture and fisheries, resources, and education (“The archipelago economy: Unleashing Indonesia’s Potential – Executive Summary” – McKinsey Global Institute, September 2012) 19 The Indonesian economy has performed strongly over the past decade and is more diverse and stable than many realize. Indonesia had the lowest volatility in economic growth compared to OECD and BRIC countries. Another misperception is that Indonesia’s economic growth centers on Jakarta. The fastest growing urban centers are large and mid-sized cities with more than 2 million people, incl. Medan, Bandung, Bogor and Surabaya. Indonesia is not an Asian manufacturing exporter driven by its growing workforce or a commodity exporter driven by its natural resources. The main drivers of growth are domestic consumption and services. The majority of Indonesia’s productivity gain has come not from a shift of workers from lowerproductivity agriculture into more productive sectors, but from productivity improvement within sectors and not at the expense of employment. (“The archipelago economy: Unleashing Indonesia’s Potential – Executive Summary” – McKinsey Global Institute, September 2012) 20 21 22 23 Menara Karya, 10th Floor Suite H Jl. HR Rasuna Said Blok X-5 Kav. 1-2 Jakarta 12950 – INDONESIA T: +6221 5794 4694 F: +6221 5794 4696 info@kiroyan-partners.com www.kiroyan-partners.com