*Understanding Real Business Cycles* by Charles I. Plosser

advertisement

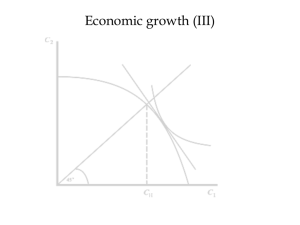

“Understanding Real Business Cycles” by Charles I. Plosser Presented by: Lizzie Dies Wade Letter Adam Vande Zande Key Questions Addressed • Can current shocks have implications for future decisions and/or outcomes? • What different factors does RBC look at compared to other methods? • How close does the model get to actual data? Main Points • Focuses of Neoclassical vs. ISLM vs. Real Business Cycle • Model can be accurate with some variables but off with others • Difference – Real Business Cycles look at productivity shocks and other variables • Neoclassical precursor for RBC Outline of the Presentation • • • • • • • • • Background Information Neoclassical Model Robinson Crusoe Productivity Disturbances Economic Growth & Business Cycles Real Business Cycles 1954-1985 Model Data Productivity Shift Graphs Real Business Cycle Research Background Information • • • • 1960s & 1970s Keynesian model vs. Business Cycles “Idealized state of dynamic equilibrium” Transform into more neoclassical Neoclassical Model • Most basic model of economic dynamics • Benchmark model • Simple economic environment to consider • Households live forever • Utility of each agent is function of consumption & leisure • Maximize utility F(C,L) • Labeled a “real business cycle model” Robinson Crusoe • Crusoe’s choice problem is to maximize his lifetime utility • If there were no productivity disturbances… • Model imposes resource constraints • C+I≤Y • L+N≤1 • C, L, N, K, I are all positive Robinson Crusoe (cont.) • First Order Conditions • Linearize (approximations) • Constant Parameters α = .58; ᵦ = .95; ᵹ = .10 Productivity Disturbances • Observes a temporarily high value of productivity… • Consume more output in current period • Also value future consumption and leisure • Temporary vs. Permanent • Temporary - substitution current for future work, and current consumption for leisure, wealth higher, higher output, consumption and leisure in the future • Permanent - raise wealth, less incentive to increase investment, more incentive for current consumption, less incentive to work harder today • Output and consumption are likely to be correlated • Government actions? Economic Growth & Business Cycles • Neoclassical model of capital accumulation predicts that per capita values of output, capital and consumption will converge to constants. • Solow – major factors • Nelson and Plosser argue that real per capita output behaves as if they have random walk components. They also argue that Solow’s technology series behaves like a random walk. • The fact that productivity grows over time raises additional complications Productivity Shifts • Need to obtain some measure of the productivity shocks. • Figure 1 is the annual percentage rate of change in technology. Real Business Cycles 1954-1985 • Simple neoclassical model described earlier is clearly an incomplete model of the U.S. Economy. • Table 1 highlights some of the statistical properties of postwar business fluctuations. Real Business Cycle Research • Multi-Sector Extension • Labor Markets • Endogenous Growth • Money • Strategies Conclusions • Basic framework of RBC is the neoclassical model • The model is accurate for some variables but not others • Real technology shocks have occupied the central focus, but other shocks are being studied • Real business cycle theory is still in its infancy • Much work remains before economists have a full understanding of RBC