The pork cycle revisited with ABM - applied to a

advertisement

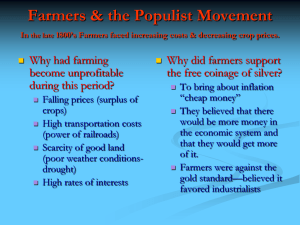

The pork cycle revisited with ABM - applied to a case of Chinese pig farmers Sjoukje A. OSINGA Mark R. KRAMER Gert Jan HOFSTEDE Adrie J.M. BEULENS Wageningen University Logistics, Decision and Information Sciences sjoukje.osinga@wur.nl Pork cycle: it’s still there – China example Increased corn prices have likely exaggerated the shifts in supply associated with the natural market cycle for pork. Pork prices dropped sharply in the first half of 2006 while corn prices remained high. Consequently, hog profitability plummeted and many farmers reduced numbers of hogs being reared. This led to a marked reduction in the supply of 2007, despite the fact that it only takes 4-6 months for commercially produced hogs to reach market weight. Figure 6 illustrates the cyclical nature for both pork and poultry over a six-year period as well as the general upward trend for both prices. To smoothen: government interferes; buy / sell surpluses (indicator: hog / grain price ratio) Source: China National Development and Reform Commission, Price Information Center, chinaprice.gov.cn Sjoukje Osinga - AE2011 - 2 Two models of the pork cycle Basic model without individuals (averages) Model with individual behaviour Sjoukje Osinga - AE2011 - 3 From literature: Cobweb model (1) Basic demand and supply system (𝑄𝑑 =𝑄𝑠 ): 𝑄𝐷 = 𝐷0 − ℎ𝐷 ∗ 𝑃 𝑄𝑆 = 𝑆0 + ℎ𝑆 ∗ 𝑃 𝑃 𝑠𝑢𝑝𝑝𝑙𝑦 ℎ𝐷 𝑃2 ℎ𝑆 < ℎ𝐷 divergent cobweb 𝑃1 ℎ𝑆 𝑑𝑒𝑚𝑎𝑛𝑑 𝑄1 𝑄2 𝑄 Sjoukje Osinga - AE2011 - 4 From literature: Cobweb model (2) 𝑃 Basic demand and supply system (𝑄𝑑 =𝑄𝑠 ): 𝑄𝐷 = 𝐷0 − ℎ𝐷 ∗ 𝑃 𝑄𝑆 = 𝑆0 + ℎ𝑆 ∗ 𝑃 𝑠𝑢𝑝𝑝𝑙𝑦 ℎ𝐷 ℎ𝑠 > ℎ𝐷 convergent cobweb ℎ𝑠 = ℎ𝐷 stable ℎ𝑆 𝑑𝑒𝑚𝑎𝑛𝑑 𝑄 Sjoukje Osinga - AE2011 - 5 Typical for over- / under supply problem: Problem arises due to production delay Pigs need 6 months to mature Inaccurate price expectations Naive expectations: assume price will be same as current price Adaptive / rational expectiations: estimate price based on available information Sjoukje Osinga - AE2011 - 6 Why model this by means of ABM? 1. Pork cycle “still happens”: 2. Cyclical nature of over/under supply is emergent 3. Farmers demonstrate bounded rationality It’s the result of many individual farmers’ decisions Revisiting some assumptions of classical model How valid / useful are they in an AMB? Sjoukje Osinga - AE2011 - 7 Research questions 1. 2. 3. Grow it to show it: can we generate “the pork cycle” with an individual-based ABM? Can we dampen the pork cycle through improved information provision? What can we learn regarding model assumptions? Sjoukje Osinga - AE2011 - 8 Agent-based information management model stock pig age info-items estimated-price α𝑖 = 𝑖𝑛𝑓𝑜−𝑖𝑡𝑒𝑚𝑠𝑖 𝑖 𝑖𝑛𝑓𝑜−𝑖𝑡𝑒𝑚𝑠 𝐸𝑃𝑖 = α𝑖 ∗ 𝑃𝑒𝑞 + 1 − α𝑖 ∗ 𝑃𝑡 depends on the proportional accuracy α of equilibrium price 𝑃𝑒𝑞 Sjoukje Osinga - AE2011 - 9 Research models 𝐸𝑃 = α ∗ 𝑃𝑒𝑞 + 1 − α ∗ 𝑃𝑡 Test 3 models (actually 1 model with 3 values for α ): current-price-model (α = 0): 𝐸𝑃 = 𝑃𝑡 perfect-price-model (α = 1): 𝐸𝑃 = 𝑃𝑒𝑞 estimated-price-model (0 < α < 1): 𝐸𝑃 = α ∗ 𝑃𝑒𝑞 + 1 − α ∗ 𝑃𝑡 Sjoukje Osinga - AE2011 - 10 Simulation process α𝑖 𝐸𝑃 𝑃𝑡 ? 𝑆𝑡 sell mature pigs (inrestock: batches): theon actual supply 𝑆𝑡 𝑃𝑡 Farmers decide whether to calculate estimated price based info-items and Current market price is calculated actual supply: 𝑆 −𝑆𝑡1 − α ∗ 𝑃 0+ 𝐸𝑃 = α𝑃∗𝑡 𝑃 𝑅𝑒𝑠𝑡𝑜𝑐𝑘 < =𝑒𝑞𝐷𝑟𝑎𝑛𝑑𝑜𝑚 𝑡 𝑚𝑎𝑥𝑆 ℎ 𝐷 𝑆 : total supply farmers expect using their estimated price Actual supply changes at every time step, influencing the 𝑚𝑎𝑥𝑆 : maximum supply farmers could possibly restock price, influencing the decision to restock, etc. Sjoukje Osinga - AE2011 - 11 Assumptions to this model: Equal slopes ℎ𝐷 = ℎ𝑆 (stable model) Farmers (fully) restock or not: discrete choice This is what happens in reality Farmers know the total available capacity But they do not know individual decisions of other farmers Sjoukje Osinga - AE2011 - 12 Results: current price model Current price: naive expectations Result: periodical pattern, pork cycle Sjoukje Osinga - AE2011 - 13 Results: perfect price model Perfect price: equilibrium price Only the decision whether to restock was randomized Result: random behaviour ? Sjoukje Osinga - AE2011 - 14 Results: estimated price model Using parameter α for information accuracy (many α‘s) This figure: α = 0.5 (varying α is consistent with expectation) Result... periodicity or random behaviour ? Sjoukje Osinga - AE2011 - 15 Determine periodicity –Fourier transformation Fourier graph shows clearly periodical frequencies Sjoukje Osinga - AE2011 - 16 Perfect price model results: periodical? Fourier graph shows that there is no periodicity Sjoukje Osinga - AE2011 - 17 Results: estimated price model Fourier graph shows periodicity left in frequencies Sjoukje Osinga - AE2011 - 18 Conclusions 1. Grow it to show it: can we generate the pork cycle with our individual-based ABM? 2. Can we dampen the pork cycle through improved information provision? 3. Answer: yes, we can (when farmers have naive expectations). Answer: yes, more information leads to less periodicity What can we learn regarding model assumptions? See next slide Sjoukje Osinga - AE2011 - 19 Conclusions (continued) / discussion Mapping of economic supply-demand system to an ABM is not straightforward The theory works with total supply quantities In practice, farmers will restock or find alternative income → 40% restock (i.e. all stables 40% full) ≠ 40% of the farmers (fully) restock their stables ! Sjoukje Osinga - AE2011 - 20 Conclusions (continued) / discussion Transition point: only periodicity when overcapacity When farmers produce less than demand → problem does not appear no periodicity In conventional approach, 2 models: model a for overcapacity, model b for undercapacity in an ABM: the same model shows behaviour a or b (emergent) Sjoukje Osinga - AE2011 - 21 Conclusions (continued) / discussion Nr of farmers involved in restocking may be limited (depends on ratio max farmers’ supply / total demand) Socio-economic consequences are not visible in a conventional model Majority of farmers may be out of business → not an issue in models without individual farmers Sjoukje Osinga - AE2011 - 22 Future improvements Experiment with alternative information diffusion processes, or: ‘whom does it come from’ Network structures → information exchange Nature of info-items Include interaction mechanisms between farmers Peer influence / imitative behaviour (e.g. restock when your neighbour does) Implicit interaction is already present because it is assumed that farmers know the maximum possible supply Sjoukje Osinga - AE2011 - 23 Future improvements (continued) Include more heterogeneity Personality and cultural population attributes Include external shocks Model government intervention based on grain price Fall/rise of grain price → costs of pig raising change Sjoukje Osinga - AE2011 - 24 Thank you © Wageningen UR