What is RCM?

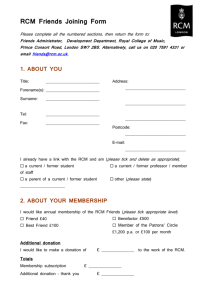

advertisement

Financial Review Models for Interdisciplinary Programs Are they mutually compatible? --------------------------------------------Isabelle Cherney, Ph.D. 1 What is RCM? • A budget and reporting framework. • It enables schools and auxiliary units that generate revenues to share in the results of their net contribution margin after covering a portion of the costs associated with other functions that serve the overall good of the institution. • RCM has also been referred to as: – RCB (Revenue Center Budgeting ) – Incentive Budgeting – ETOB (Every tub has its own bottom) • The RCM concept has been adopted by several universities since 1980. • A sample of Universities that have implemented a form of RCM: – Harvard, USC, Loyola- Chicago, University of Pennsylvania, Georgetown, Columbia, Cornell 2 Historical Perspective Centralized Model Expenses School A Expenses School D Revenues & Expenses (Central) Expenses School B Expenses School C Source: adapted from a USC presentation by Michael A. Diamond and Robert A. Cooper 3 Historical Perspective – Decentralized Model Revenues & Expenses School A Revenues & Expenses School D Administrative Revenues and Expenses (Central) Revenues & Expenses School B Revenues & Expenses School C Source: adapted from USC presentation by Michael A. Diamond and Robert A. Cooper 4 RCM Framework & Philosophy • RCM Units are defined at a rollup level that are made up of sub units at the program (dept/major) level. The net contribution for each program will be defined and measured. • Direct revenues such as tuition, fees and room & board are placed directly in the RCM units. • Direct expenses such as instructional costs are placed directly in the RCM units. • A share of the indirect revenues (gift income, interest) and indirect expenses (facilities, HR, finance) are allocated to the RCM unit. • A portion of the net contribution earned by each RCM unit is returned based upon a predetermined formula. • Negative net contribution RCM units are incented to reevaluate their individual programs. 5 Noteworthy Points • RCM is a decentralized budget framework. • Each University defines how to deploy RCM to work to meet their individual strategic goals. • Once implemented, RCM processes will evolve over time to better align with the changing needs of the University. 6 The Opportunities of RCM • Integrates strategic planning – Overall University priorities are defined and integrated into the budget process through the allocation of indirect activities. • Facilitates responsible management of entrepreneurial activities. – Establishes incentives for organizations that perform above expectations and disincentives for areas that perform below expectations. • Aids cost/benefit analyses and trade-off studies of programs. – RCM forces the University to determine their most valuable programs on both a qualitative and financial bottom line basis. If programs are low in quality and high in subsidy, the opportunity costs of protecting a weak academic unit are clear. • Encourages efficient, competitive administrative services. – The resulting cost of administrative services can be compared to alternative providers. • Allows for consistent net contribution measurement for programs (dept/majors) across schools. 7 The Risks of RCM • Cross-unit investments lack incentive and collaboration between responsibility centers diminishes. • Overlap of administrative functions increases. • Responsibility centers may begin to compete with each other for revenues. • Pursuit of responsibility center goals that are contrary to the University’s strategic goals may occur. • The University may arrive at insufficient funds to promote institution-wide initiatives. • Cost allocations for support functions are not widely understood causing a lack of support for the process. 8 Financial Review Model What strategies should Graduate Deans take? How do you create financial incentives for Interdisciplinary programs? What types of structures should be in place? 9