Pcard Overview Presentation - University of Rochester Medical Center

advertisement

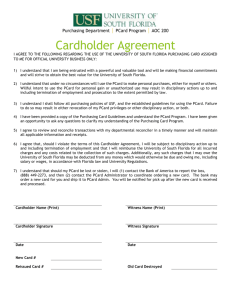

University of Rochester Purchasing Card Program Summary CONFIDENTIAL AND PROPRIETARY INFORMATION The contents of this material are confidential and proprietary, and may not be reproduced, disclosed, distributed or used without the express permission of an authorized representative. Any other use is expressly prohibited Pcard Program Overview Only existing cardholders and managers will be transitioned to US Bank program Program expansion will not be initiated until after the initial cardholders and managers are transitioned and the program has been stabilized. Pcard Holders and Managers are expected to complete all training (Pcard Program Overview and US Bank application). JP Morgan cards are effective until you have been issued and have activated your US Bank Pcard. It is anticipated that US Bank Pcards will not be issued prior to December 2nd 2 Pcard Program HOW IT WORKS Cardholder makes an authorized business-related purchase by charging it on their US Bank Visa Card. Cardholder must upload the receipt(s) along with any additional supporting documentation in the Access Online Internet application. Cardholder reviews P Card transactions daily/weekly in the Access Online Internet application. Cardholder reconciles receipts to the Transaction Detail Report and to the Commercial Card Statement, both from Access Online. The P Card Manager reviews and approves the Cardholders’ transactions in the Access Online internet application. P Card Manager reviews all charges within the current billing cycle for distribution to the appropriate general ledger account, valid business purpose and adequate supporting documentation. The P Card Manager signs and dates the Commercial Card Statement from US Bank on a monthly basis. Cardholders need to keep original receipts and supporting documentation, transaction detail reports, and bank statements, within the department for ledger reconciliation and audit requirements The bank pays the merchant when merchant submits the transaction. University of Rochester pays the bank each billing cycle. (25th of each month) 3 Pcard Program Support US Bank Pcard Technical Support Access Online Help Desk – (877) 887-9260 - General Website Navigation Inquiry - Resetting Passwords - General Account Inquiry 24-Hour Customer Service- (800) 344-5696 - Balance Inquiry - Statement Inquiry - Disputed Items - Declined Purchases - Card Activation - Lost, Stolen or Compromised Card University of Rochester Pcard Policy Support Pat Smith Pcard Administrator, 585-275-8900 Pat_Smith@urmc.rochester.edu Mary Margaret Scanlan Purchasing Assistant/Pcard Program, 585-273-3512 Marymargaret_scanlan@urmc.rochester.edu 4 Pcard Program Resources Pcard Resources – Purchasing Website Pcard Policy: http://www.urmc.rochester.edu/purchasing/how-to-purchase/purchasing-card.cfm Quick Reference Guides and User Guides: http://www.urmc.rochester.edu/purchasing/how-to-purchase/PcardLearningResources.cfm 5 Cardholder Roles and Responsibilities Upon accepting the P Card, cardholder becomes an authorized purchaser for the University with specific responsibilities for expending University funds as follows: Limit purchases to $1,500 or less. Keep original receipts, scan and upload into Access Online Utilize lowest price. Protect the security of his/her P Card and P Card number. Do not make P Card purchases from friends or relatives where he/she has a financial interest. Do not accept any gift or gratuity from any supplier. Ensure that items prohibited from purchase with P Card are not procured. (Refer to the exclusion list in your handouts). Ensure that purchases are not made from any vendors on the Office of the Inspector General (OIG) Vendor Exclusion list (Click on link to https://www.sam.gov/portal/public/SAM/ to determine whether vendor has been debarred. 6 Cardholder Roles and Responsibilities Follow the guidelines related to special requirements for Sponsored Projects. Upload transaction receipts into Access Online Give supplier detailed shipping instructions. Following is the preferred format for shipping instructions: University of Rochester Requesters Name/Department Name & Room # Street Address and Box # City, State and Zip Purchases for the Medical Center should always be shipped to Receiving at 575 Elmwood Avenue, Rochester, NY 14642. 7 Cardholder Roles and Responsibilities Every Week (at minimum): Log into Access Online (https://access.usbank.com/cpsApp1/index.jsp) Review Transactions Ensure that all purchases have been coded appropriately Reconcile all original receipts and/or packing slips with pricing information in Access Online Upload receipts into Access Online prior to the 25th of each month If necessary, reject/dispute goods and services and work with supplier(s) to resolve issues Immediately inform Department P Card Manager of the potential dispute It is your responsibility to ensure appropriate resolution of all disputes All receipts and statements supporting P Card transactions for the current and past fiscal years must be kept at the department level (in accordance with official records retention policy) The University’s policy on record retention may be found at http://www.rochester.edu/adminfinance/records.html 8 Department P Card Managers Roles and Responsibilities P Card Managers: Provide general oversight and accountability within departments Perform the only detailed review done for Purchasing Card purchases Serve as cardholder’s first point of contact for Access Online and program related clarification/questions Ensure that purchases are not made from any vendors that are identified as debarred (https://www.sam.gov/portal/public/SAM/) Every Week (at minimum): Log into Access Online (https://access.usbank.com/cpsApp1/index.jsp) Reconcile department-wide transactions against receipts Ensure receipts are uploaded for all transactions Ensure purchases are within program guidelines Investigate unusual items or spending patterns immediately Review transaction coding, re-classify or split if necessary Dispute transactions if necessary 9 P Card Program Administrator Roles and Responsibilities Purchasing Card Administrator will: Provide help desk support to Finance and P Card Managers Ultimately be responsible for maintaining the Purchasing Card infrastructure within Access Online Monitor UR Purchasing Card program success Audit card use as necessary and report irregular/suspicious activity to UR Audit for follow-up Coordinate with US Bank Customer Relations Team 10 Accounts Payable Roles & Responsibilities END OF BILLING CYCLE: Accounts Payable pulls the Access Online statement on the 25th day of the month. Cardholders need to assure all transactions have been reviewed, approved and receipts uploaded prior to the 25th. Transactions posted after the 25th of the month will appear in the next billing cycle. (i.e. transaction posts on 11/27, you will have until 12/25 to adjust the account to be charged and upload receipts) Once the statement is downloaded, transactions not reconciled will be coded to the default GL Account Codes and cannot be approved, rejected, disputed or reallocated. Accounts Payable will process US Bank’s invoice for payment. 11 Program Guidelines & Activity Review Control All cardholders are responsible for the security of the Purchasing Card issued to them. Any purchases made on the card are assumed to have been made by the cardholder. The Purchasing Card should be used for pre-approved commodities only. In general, do not use your U of R Purchasing Card for commodities identified as exclusions in the Purchasing Card Policy. Card usage will be audited. Compliance with Purchasing Card Program policies is monitored by Purchasing and UR Audit. Purchasing staff review transactions frequently and may require a copy of documentation at any time for transactions which are questionable or may be deemed inappropriate. Poorly documented transactions will be referred to University Audit for follow up. 12 Pcard Policy Card Restrictions Red Flag Items: The following items should only be purchased with a P Card when a valid business reason can be documented. Questionable transactions should be discussed with divisional or University Finance prior to purchasing these products or services. Dues and Memberships Entertainment Tickets (i.e., concerts, baseball, hockey, bowling, football, movie, etc.) Flowers Food, Beverages & Meals Home Internet Service Cell Phone Pagers Gifts and Employee Awards Gift Cards 13 Pcard Policy Card Restrictions Excluded Items: The following may not be purchased with the P Card. (This list may not be allinclusive. When in doubt, contact the P Card Administrator.) Alcoholic Beverages Items ,Food, Beverage for personal use or consumption Animals Lease, Rental or Demonstration of Equipment Business Cards Medical Supplies Capital Equipment (i.e., with a 2+ year useful life and unit cost greater than $300 (SMH purchases), and greater than $1,000 (University purchases) Purchases from individuals Cash Advances Radioactive Isotopes Contracting (i.e., Consultants/Independent Contractors, Maintenance Agreements) Releases on standing orders, blanket orders or multiple shipments E-bay Purchases Sales Tax (University is tax exempt) Equipment involving a trade-in or exchange Services (i.e. laundry, dry cleaning, phone, television, utilities, moving, storage, rigging, transportation, employment and other professional services ). Forms Furniture Split orders to remain within the transaction limit Travel and travel related purchases or services (i.e. airline tickets, car rentals, travel agencies, gasoline, fuel - Use T&C) Hazardous Substances/Materials (i.e., Gasoline, fuel, explosives, etc.) Textbooks (Due to Contract Agreement) Hotel/Motel (sleeping accommodations) 14 Point-of-Sale Controls Purchases may be declined due to Point-of-Sale controls established for each cardholder, including the following: Point-of -Sale controls include transaction volume and spend limitations as well as Merchants Category Code restrictions. Transaction Spending restriction $1,500. Other limits can be established by the department head. There is enough flexibility in the card to set pre-determined limits for each cardholder, including: Daily transaction volume (i.e. 10 transactions per day) Transaction spend (i.e. $10,000 per day per account) Monthly spend (i.e. $10,000 per month per account) Cardholder should contact his/her P Card Manager about temporary or permanent limit increases. P Card Managers will then communicate limit increase requests, in writing, to the Department Head. The Department Head will need to request limit increases in writing to the P Card Administrator. 15 Pcard Control and Program Compliance Consistent adherence to the P Card Program controls and rules is required of all Cardholders and Card Managers to assure continued eligibility to participate in the program. Failure to properly adhere to these controls and rules will result in the following actions: Corrective Action Event or Cause Suspension or removal of Cardholder privileges. • Using the card to purchase restricted products or services. • Failure to properly review transactions. • Failure to properly upload documentation to Access Online (i.e. receipts, order confirmations, packing slips, etc.) • Failure to properly document transaction • business purpose. • Failure to properly prepare, review and file • monthly statements. Suspension or removal of Card Manager privileges. Referral for possible Performance Management Process up to and including discharge and/or possible criminal prosecution. • • • • • • • • • • • Failure to properly review and approve Cardholder monthly transactions. Failure to properly review and approve monthly statements. Failure to properly report transactions with employee tax reporting liability. Failure to properly retain transaction documentation (invoice copies, documentation, statements) of all employees including terminated. Using the card for personal use. Fraudulent use of card. Receiving cash or check issued to Cardholder to resolve a credit or return 16 Pcard Control and Program Compliance Consistent adherence to the P Card Program controls and rules is required of all Cardholders and Card Managers to assure continued eligibility to participate in the program. Failure to properly adhere to these controls and rules will result in the following actions: Corrective Action Removal of Cardholder or Card Manager privileges. Suspension or removal of Cardholder privileges. Referral for possible Performance Management Process up to and including discharge and/or possible criminal prosecution. Event or Cause • Failure to successfully pass a re-audit resulting from a previous unsatisfactory audit. Using the card for personal use. Fraudulent use of card. Receiving cash or check issued to Cardholder to resolve a credit or return. 17 Pcard Program Transition and Next Steps Congratulations! You have completed the Pcard Overview WebEx Training. If you have not submitted your Pcard Authorization Form, please send it to Pcardadministrator@urmc.rochester.edu Following are the next steps to complete the transition process to the US Bank Pcard Program. (1) Complete US Bank Web Based Training, Complete Certification Exam and submit Training Certificate https://wbt.access.usbank.com/ Specific instructions on how to access the training and certification exam will be sent to you in a separate email. (2) Sign and submit a Pcard Program Cardholder or Pcard Program Manager Agreement Form to Pcard Administrator Pcardadministrator@urmc.rochester.edu The forms are located on the Purchasing Website under the Forms Bank Upon completion of the US Bank Web Based Training and submission of your training certificate as well as the above-mentioned agreement forms, you will be notified via email on next steps to obtain your US Bank Pcard. You will not be able to receive your US Bank Pcard until all training has been completed and documentation received. Attention: Due to an unexpected delay in the testing of transaction downloads from US Bank to the University of Rochester, US Bank Pcards will not be issued until the first week of December. Your JP Morgan Pcard will continue to be effective until you are issued your US Bank Pcard. 18 Questions Thank you for participating in the Pcard Overview Training Session. If there were other participants in your department, other than the person who registered for the training session, please send an email to Pcardadministrator@urmc.rochester.edu with a list of those participants to ensure everyone receives credit for completing Step 2 of the implementation process. 19