MRC engages directly with industry

advertisement

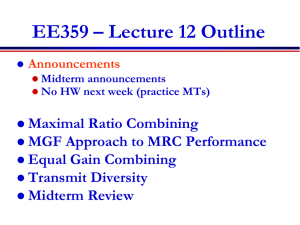

Prospective partnerships for industry and academia Emily Gale Medical Research Council 21 November 2013 MRC mission • Encourage and support high-quality research with the aim of improving human health. • Produce skilled researchers. • Advance and disseminate knowledge and technology to improve the quality of life and economic competitiveness in the UK and worldwide. • Promote dialogue with the public about medical research. Post-Comprehensive Spending Review • Encourage and support high-quality research with the aim of improving human health. • Produce skilled researchers. • Advance and disseminate knowledge and technology to improve the quality of life and economic competitiveness in the UK and worldwide. • Promote dialogue with the public about medical research. • Work with industry to drive economic development MRC discoveries and developments • • • • • • • • • Rickets caused by lack of vitamin D (1916) Discovery and development of penicillin (1940s) Pioneered randomised controlled trial design (1940s) Discovery of link between smoking and cancer (1950s) Clinical trials for radiotherapy for cancer (1960s) Clinical trials of chemotherapy for leukaemia (1970s) Invention of DNA fingerprinting (1980s) Gene for Huntington’s disease discovered (1990s) Humanised therapeutic antibodies in widespread use (2000s) MRC investment in research, 2012/13 MRC research expenditure - £766.9 million in 12/13 • £343.1m for more than 400 programmes in MRC research units and institutes. • £334.6m on 1,400 grants to researchers in universities, medical schools and research institutes. • £71.3m on training and career development. • £54.2m on individual grants with industry partners • £29.5m on industry/academic consortia MRC resources available to researchers from industry and academia • MRC research underpins R&D – Patient Research Cohorts Initiative – UK Biobank – UK Brain Bank Network – WT/MRC Stem Cell Centre – Developing animal models – FARR Institute – Clinical trials and methodology resources • MRC engagement directly with industry Current focuses of MRC activity Discovery and exploratory research Application and delivery research MRC lead Genetics/genomics Pharmacogenomics Structural biology Animal/human models Imaging Systems medicine Global health Ageing: life course Stem cells Regenerative medicine NIHR lead Programmes in Experimental medicine HTA Trials Applied research Methodology Global health Stratified medicine EME Trials (Late stage III) Research for Patient Benefit Invention for Innovation Infections Population science Public health Service Delivery and Organisation E-health CSO (Scotland) WORD (Wales) HSCNI (Northern Ireland) Where industry and MRC academics meet • 92 new products and interventions launched onto the market. • Creation or growth of 104 companies, 56 formed since 2006. • 578 patents granted or published since 2006, with around 30% licensed. • More than 100 new industry collaborations are reported every year outside of the MRC-mediated collaborations. • Cross-sector MRC funded partnerships Types of products and interventions generated by MRC-supported scientists MICA – a gateway to funding • Encouraging and supporting collaborative research projects between academic and industry researchers. • Key feature: Flexibility – Level and nature of industry contribution can vary – Companies of any size can participate – Applies to all MRC funding and fellowship schemes • Agreement between partners forms part of application. • >80 awards so far, including collaboration involving: – 38 different HEI – 50 different industry partners MICA: “More than just money” • MenBioVax: meningitis vaccine developed by ImmBio with TSB funding following a collaborative programme with Bristol Medical School • MRC DPFS funding to take MenBioVax through preclinical studies “There aren’t many other sources of funding for this type of project in the UK. It brings more than just money, of course. It’s important for potential investors to be able to see that bodies like the MRC have confidence in our technology and products.” Graham Clarke, ImmBio CEO MICA: “A very positive experience” • Evaluation of a potential biomarker for idiopathic pulmonary fibrosis. • Collaboration between scientists at University of Nottingham, GlaxoSmithKline and Queen Mary, University of London • “We all believe in the target but each of us has only one piece of the jigsaw.” “MICA is a tremendous initiative that will accelerate the development of new drugs to meet clinical needs.” Dr Andy Blanchard Director of External Discovery, GSK MICA numbers on the rise MRC working with industry • MRC engages directly with industry – DSTT – MRC/ABPI Inflammation and Immunology Initiative – Stratified Medicines Innovation Platform • MRC promotes partnerships and translational science – MRC/AZ Mechanisms of disease – Confidence in Concept – DPFS/DCS – BMC – Biomedical Catalyst – Bioinformatics call – Experimental Medicine Challenge Grants • PPP in Europe Inflammation and Immunology Initiative A new way of funding from the MRC • Collaboration with ABPI: Disease-focused workshops • COPD • Rheumatoid arthritis Brought together experts from academia and industry Identified research priorities Ear-marked funds for research consortiums to address barriers and exploit opportunities MRC invested £9.5m over four years Stratified Medicine Consortia Disease-focused cross-sector consortia • Pitzalis • Gaucher’s disease • Hepatitis C • Psoriasis • Schizophrenia • Primary Biliary Cirrosis MRC invested £50m over four years Exploiting existing expertise and clinical research infrastructure Aim to provide a dynamic platform for disease focused research RA Partners MRC working with industry • MRC engages directly with industry – DSTT – MRC/ABPI Inflammation and Immunology Initiative – Stratified Medicines Innovation Platform • MRC promotes partnerships and translational science – MRC/AZ Mechanisms of disease – Confidence in Concept – DPFS/DCS – BMC – Biomedical Catalyst – Experimental Medicine Challenge Grants • PPP in Europe Products and interventions by pipeline stage Initial development Refinement, Non-clinical Refinement, Clinical Early clinical assessment Late clinical evaluation Market authorisation Small-scale adoption Wide-scale adoption “Investable opportunities” • Over 600 projects developing new products or interventions - at all stages of development have been reported • 110 have reached the market since 2006 • For the first time we can track all of these, noting which are active, closed, seeking support, and which are progressing • 75% of projects are prior to the “valley of death”, 25% after • Around 80 would benefit from further investment – so could be “investable opportunities” • The first year in which we published this data (2011) the three hundred development projects were used by the science minister as an example of the untapped potential that the biomedical catalyst could unlock “Valley of death” General Objectives of IMI 2 To provide European citizens with timely access to new and effective diagnostics and treatments that improve their health and wellbeing Helping safeguard the future international competitiveness of the European biopharmaceutical industry and secure growth and jobs. Innovative Medicines Initiative: Joining forces in the healthcare sector The European Union and the pharmaceutical industry have joined forces to make drug R&D processes in Europe more innovative and efficient, enhance Europe’s competitiveness & address key societal challenges by forming the biggest PPP in Life Science •22 COMBACTE CLIN-Network 280 members and Candidate members 22 million euros awarded to UK SMEs 1 in 4 UK SME applicants are successful in IMI total SME participants per country United Kingdom Germany France Belgium Netherlands Iceland Spain Denmark Finland Hungary Sweden Italy Austria Ireland Israel Greece Thinking about cross-sector collaboration Bioinformatics • Computer science • Data management Diagnostics • Engineering • Microscopy/scanning • Clinical biology Thank you for your attention Emily Gale emily.gale@headoffice.mrc.ac.uk Translation • What is it? Turning discoveries into clinical benefits, while maintaining the basic research that drives it. Basic medical research Prototype discovery and design Pre-clinical development Early clinical trials Late clinical trials • The MRC’s translational strategy: – builds on the MRC’s existing role in pushing forward basic knowledge to improve people’s health and wealth – strengthens the support and oversight of the translational processes Translation of basic research takes time 1973 Mouse antibodies isolated by César Milstein and George Köhler (MRC Laboratory of Molecular Biology) 1986 Michael Neuberger and Sir Greg Winter ‘humanise’ mouse antibodies Sir Greg develops and patents technology for producing antibodies in vitro 2003 MRC-developed Humira® licensed to treat UK arthritis patients 2008 21 monoclonal antibody drugs on market for treating breast cancer, leukaemia, asthma, arthritis, psoriasis and transplant rejection 2011 Antibodies make up 1/3 of new drugs for cancer, arthritis and asthma; global antibody market estimated to be worth $40bn MRC spend by research activity, 2010/11 MRC spend by health category, 2010/11