Recommended Budget Practices

advertisement

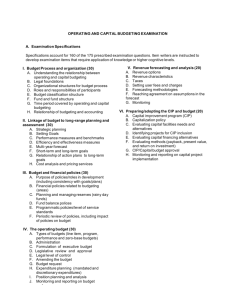

Recommended Budget Practices: A Framework for Improved State and Local Budgeting Government Finance Officers Association of Arizona Thursday, October 25, 2012 Eric R. Johnson Hillsborough County, (Tampa) FL Issues with the Distinguished Budget Presentation Awards Program Focus on a document, not a process Form over content? How to move forward? GFOA Strategy Bring together interested participants Develop a “white paper” 1994 National Symposium What are the principles of good budgeting? What are the barriers to good budgeting? How to encourage best practices? White Paper Establish a national council on budgeting Systematically identify best practices Provide a mechanism to share the best practices National Advisory Council on State and Local Budgeting Invite all major players to participate 3 Year sunset to the Council National Advisory Council on State and Local Budgeting Association of School Business Officials International Council of State Governments GFOA ICMA National Association of Counties National Conference of State Legislators National League of Cities U.S. Conference of Mayors Industry, Labor & Academia Results of the NACSLB Publish framework, practice statements and examples Develop research and sharing tools Encourage member institutions to further roll out the results through training, tools, and techniques. Focus on Best Practices Intended to educate Intended as “benchmarks” Intended to improve capacity Intended to promote further enhancements Final Report issued December 15, 1997 Council work completed Plan for dissemination Tremendous resource Baton passed to the major organizations GFOA has used the results most extensively What are the Recommended Budget Practices? A comprehensive set of processes & procedures that define an accepted budget process A goal-driven approach that spans the planning, development, adoption and execution phases of budgeting Benefits of Recommended Practices Helpful tool for governments seeking to improve budget process Educate on potential of budget process Help assess existing budgetary processes Guidance on improving budget practices Promote education, training, and research on effective techniques Recommended, not Required Blueprint for governments wanting to improve budget practices Implementation likely take place over number of years Apply to variety of management and political styles Account for governmental differences: State/local laws, political aspects, management needs Definition of the Budget Process Activities that encompass the development, implementation and evaluation of a plan for the provision of services and capital assets. Essential Features of a Good Budget Process Incorporates long-term perspective Establishes linkages to broad organizational goals Focuses budget decisions on results & outcomes Involves and promotes effective communication with stakeholders Provides incentives to government management & employees Mission of the Budget Process Help decision makers make informed choices about the provision of services and capital assets, and Promote stakeholder participation in the process Stakeholder Involvement Vital Involve all stakeholders: Elected officials, administrators, employees, citizen groups, business leaders Identify stakeholder issues & concerns Obtain stakeholder support for overall process Achieve stakeholder acceptance of decisions regarding goals, services and resource utilization Report to stakeholders on services and resource utilization Four Principles of the Budget Process 1. Establish broad goals to guide government decision making 2. Develop approaches to achieve goals 3. Develop a budget consistent with goals, policies, plans, etc. 4. Evaluate performance and make adjustments Twelve Elements of the Budget Process Principle 1: Establish Broad Goals to Guide Government Decision Making 1. Assess community needs, priorities, challenges and opportunities 2. Identify opportunities and challenges for government services, capital assets & management 3. Develop and disseminate broad goals Twelve Elements, cont’d Principle 2: Develop Approaches to Achieve Goals 4. Adopt financial policies 5. Develop programmatic, operating and capital policies and plans 6. Develop programs and services that are consistent with policies and plans 7. Develop management strategies Twelve Elements, cont’d Principle 3: Develop a Budget Consistent with Approaches to Achieve Goals 8. Develop a process for preparing and adopting a budget 9. Develop and evaluate financial options 10. Make choices necessary to adopt a budget Twelve Elements, cont’d Principle 4:Evaluate Performance and Make Adjustments 11. Monitor, measure and evaluate performance 12. Make adjustments as needed 59 Recommended Budget Practices Procedures that assist in accomplishing principles and elements of budget process Multiple practices usually associated with each budget element Appropriate for all governments, all circumstances and situations The next slide provides a sample practice. Develop Policy on Use of One-time Revenues Practice: A government should adopt a policy limiting the use of one-time revenues for ongoing expenditures. Rationale: By definition, one-time revenues cannot be relied on in future budget periods. A policy on the use of one-time revenues provides guidance to minimize disruptive effects on services due to non-recurrence of these sources. Outputs: One-time revenues and allowable uses for those revenues should be explicitly defined. The policy should be publicly discussed before adoption and should be readily available to stakeholders during the budget process. The policy, and compliance with it, should be reviewed periodically. For detail on the 59 practices, go to www.gfoa.org and select the link for “Budget Practices”