Electronic Presentation Guide - 2004 HPS Topical Meeting

Black swans in a risk context

Terje Aven

University of Stavanger

JRC, ISPRA

21 June 2013

Talking about black swans

• Creates a lot of enthusiasm

• Hard negative words from some researchers

Aven (2013) On the meaning of a black swan in a risk context. Safety Science

Professor Dennis Lindley

Taleb talks nonsense

He lampoons Taleb’s distinction between the lands of Mediocristan and Extremistan, the former capturing the placid randomness as in tosses of a coin, and the latter covering the dramatic randomness that provides the black swans

No need to see beyond probability

• Mediocristan

(Normalistan)

• Extremistan (black swans)

Nassim N. Taleb

Lindley example

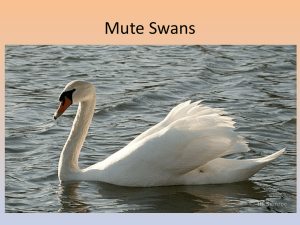

A sequence of independent trials with a constant unknown chance p of success (white swan)

Lindley shows that a black swan is almost certain to arise if you are to see a lot of swans, although the probability that the next swan observed is white, is nearly one.

1

Prior density for p: the chance of a white swan

1

1

What is the probability that p=1?

1

Prior density for p: the chance of a white swan

1

What is the probability that p=1?

It is zero!

1

Prior density for p: the chance of a white swan

1

There is a positive fraction of black swans out there !

1

Prior density for p: the chance of a white swan

The probability-based approach to treating the risk and uncertainties is based on a background knowledge that could hide critical assumptions and therefore provide a misleading risk description

0.8

0.2

x x

0.99

1

Prior density for p: the chance of a white swan

0.8

x x

0.2

the probability of a black swan occurring is

0.99

close to zero

1

Prior density for p: the chance of a white swan

Depending on the assumptions made, we get completely different conclusions about the probability of a black swan occurring

Lindley’s example also fails to reflect the essence of the black swan issue in another way

In real life the definition of a probability model and chances cannot always be justified

P(attack)

Main problems with the probability based approach

1

Assumptions can conceal important aspects of risk and uncertainties

2

Presume existence of probability models

3

The probabilities can be the same but the knowledge they are built on strong or weak

4

Surprises occur

15

Risk perspective

Probabilitybased

Historical data

+

Knowledge dimension +

Surprises

P(head) = 0.5

P(attack) = 0.5

Strong knowledge

Poor knowledge

John offers you a game: throwing a die

• ”1,2,3,4,5”:

• ”6”:

What is your risk?

6

-24

Risk

(C,P):

• 6 5/6

• -24 1/6

Is based on an important assumption – the die is fair

“Background knowledge”

Assumption 1: …

Assumption 2: …

Assumption 3: …

Assumption 4: …

…

Assumption 50: The platform jacket structure will withstand a ship collision energy of 14 MJ

Assumption 51: There will be no hot work on the platform

Assumption 52: The work permit system is adhered to

Assumption 53: The reliability of the blowdown system is p

Assumption 54: There will be N crane lifts per year

…

Assumption 100: …

…

Model: A very crude gas dispersion model is applied

Risk perspective

Probabilitybased

Historical data

+

Knowledge dimension +

Surprises

Black swan

(Taleb 2007)

• Firstly, it is an outlier, as it lies outside the realm of regular expectations, because nothing in the past can convincingly point to its possibility.

• Secondly, it carries an extreme impact.

• Thirdly, in spite of its outlier status, human nature makes us concoct explanations for its occurrence after the fact, making it explainable and predictable.

22

Aven (2013) questions whether a black swan is

1. A surprising extreme event relative to the expected occurrence rate

2. An extreme event with a very low probability.

3. A surprising, extreme event in situations with large uncertainties.

4. An unknown unknown.

Black swan (Aven 2013)

A surprising extreme event relative to the present knowledge/beliefs.

Hence the concept always has to be viewed in relation to whose knowledge/beliefs we are talking about, and at what time.

Unforeseen/surprising events:

A. Events that were completely unknown to the scientific environment (unknown unknowns)

B.

Events that were not on the list of known events from the perspective of those who carried out a risk analysis (or another stakeholder)

C.

Events on the list of known events in the risk analysis but found to represent a negligible risk

Government building Oslo 22 July 2011

Threats

Known unknowns

(A’, C’, Q, K)

Unknown unknowns, black swans

It is not about assigning correct probabilities

• But to provide

– a proper understanding of the total system

– means to identify many of these B and C events

– measures to me meet them, in particular resilient measures

– means to read signals and warnings to make adjustments

28

Statfjord A

Do we have black swans here?

How to confront black swans

• Improved Risk Assessments

• Robustness

• Resilience

• Antifragility

How to confront black swans

• Improved Risk Assessments

• Robustness

• Resilience

• Antifragility

Taleb: propose to stand our current approaches to prediction, prognostication, and risk management

PETROMAKS project:

Improved risk assessments

- to better reflect the knowledge dimension and surprises

Unforeseen/surprising events:

A. Events that were completely unknown to the scientific environment (unknown unknowns)

B.

Events that were not on the list of known events from the perspective of those who carried out a risk analysis (or another stakeholder)

C.

Events on the list of known events in the risk analysis but found to represent a negligible risk

• Not seeing what is coming, when we should have seen it

- Preoccupation with failure

Reluctance to simplify

Sensitivity to operations

Commitment to resilience

Deference to expertise

2

Mindfulness

(Collective)

New way of thinking about risk

1

Risk analysis and management

Aven and Krohn (2013) RESS.

2

Quality management

1

Concepts and principles

Analysis

Risk analysis

Describing uncertainties, …

Management

Management review and judgment

Decision

Risk-informed decision making

• Extra

Risk

(A,C,U) (C,U)

A: Event, C: Consequences

U: Uncertainty

Risk description

(A,C,U) (C,U)

Q: Measure of uncertainty (e.g. P)

K: Background knowledge

C’: Specific consequences

Q

K

C’

Subjective/knowledge-based probability

• P(A|K) =0.1

• The assessor compares his/her uncertainty (degree og belief) about the occurrence of the event A with drawing a specific ball from an urn that contains 10 balls

(Lindley, 2000. Kaplan and Garrick 1981).

K: background knowledge

Analysis

Risk analysis

Cost-benefit analysis,

Risk acceptance criteria

…

Management

Management review and judgment

Decision

Risk-informed decision making