Marketing to Adults Affluent Consumers

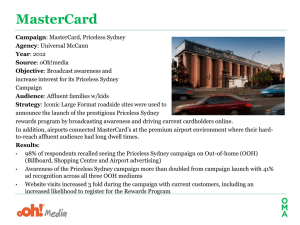

advertisement

Marketing to Affluent Consumers 1 Marketing to Affluent Consumers Definition of Affluent Consumer Income Segments Total Net Worth Segments Discretionary Spending Segments Affluent Households’ Vehicles Expenditure Plans Cultural & Leisure Activities Shopping Attitudes Psychographic Segments Slide Slide Slide Slide Slide Slide Slide Slide Slide 3 4 5 6 7 8 9 10 11 2 Definition of Affluent Market According to the Mendelsohn Affluent Survey, the definition is: Households with $100,000 or more in total income: 23,900,000 households, or 20% of total households. Heads of House with $100,000 or more in total income – 43,100,000, or 19% of total adults. Source: Mendelsohn Affluent Survey, 2009 Annual Report 3 Income Segments in the Affluent Marketplace Household Income Segment Percent of Total HHs Percent of Affluent HHs Estimated Total HH Income $100,000-$149,000 12% 59% $1.7 trillion $150,000-$249,000 6% 31% $1.4 trillion $250,000 or more 2% 10% $1.5 trillion Source: Mendelsohn Affluent Survey, 2009 Annual Report 4 Number of Affluent Households by Total Net Worth* Under $250,000 4.7 million $2,000,000 or more 2.8 million $250,000 - $499,999 5.1 million $500,000 - $999,99 6.9 million $1,000,000 - $1,999,999 4.3 million *Definition of Net Worth = all household assets owned by all household members, less all debts the household may owe. Source: Mendelsohn Affluent Survey, 2009 Annual Report 5 Discretionary Spending Segments Ipsos Mendelsohn estimates that the affluent market spent $1.2 trillion across all the expenditures measured, which are aggregated into the following 12 summary categories. Home-related Personal Insurance Travel Apparel Charitable Donations Entertainment & Dining Computers, electronics Personal Care, Wellness Watches, Jewelry Alcoholic Beverages Weddings Other Source: Mendelsohn Affluent Survey, 2009 Annual Report 19% 18% 16% 10% 8% 7% 5% 3% 3% 2% 2% 7% 6 Affluent Households’ Vehicles Total Vehicle Units (in millions) 10.0% Sport utility vehicle 7.2% Pickup truck 7.1% Midsize car Crossover vehicle (total) 6.1% 5.9% Luxury car 5.2% Compact car 3.7% Van Sporty Car Fullsize Car 2.7% 2.2% Source: Mendelsohn Affluent Survey, 2009 Annual Report 7 Plans for the Next 12 Months Ipsos Mendelsohn has been asking respondents about significant life event or expenditures they or someone else in their household plan to experience in the next 12 months. Respondent plans to do in next 12 months (millions) Invest in stocks/ mutual funds Take a trip/ vacation outside the U.S. Redecorate home Remodel or renovate other room(s) Buy or lease a new car, SUV, or truck Remodel or renovate bathroom Take a cruise Remodel or renovate kitchen Change careers or jobs Move or relocate Have a baby Buy a new home Start a new business Retire Source: Mendelsohn Affluent Survey, 2009 Annual Report 13.9 12.2 7.3 7.0 6.3 6.2 6.0 4.8 3.6 2.3 1.9 1.8 1.7 1.3 8 Cultural and Leisure Activities Visited/Attended in the Past Year (in millions) 34.4 Movie Theatres 26.4 Sports Events 22.1 Music Concerts Museums 20.9 Live Theatre Performances 20.8 12.1 Art Auctions/Gallery Exhibits 6.7 Auto Shows Antique Shows 5.4 Dance/Ballet Performances 5.4 Boat Shows 3.8 Source: Mendelsohn Affluent Survey, 2009 Annual Report 9 Shopping Attitudes Ipsos Mendelsohn’s new psychographic section highlighted the following information about shopping. Affluent who agree with statement (millions) When I discover a brand I really like, I keep buying it When it comes to quality, you get what you pay for Good value for the money is more important than price Sometimes I treat myself to something, even though I don’t need it Owning good quality things brings me enjoyment I look for superior service when I shop I prefer to buy American-made products I buy the brands I grew up with I don’t tend to seek the advice of others when I am making a purchase I am willing to spend more money for gourmet food I am willing to pay more for luxury toiletries and cosmetics I derive enjoyment from any kind of shopping Source: Mendelsohn Affluent Survey, 2009 Annual Report 37.5 34.5 32.8 28.4 25.1 24.5 24.4 16.6 16.0 14.1 12.6 11.4 10 Affluent Psychographic Segments Ipsos Mendelsohn determined that the affluent marketplace divides itself into the following four psychographic segments, based on answers to 100+ statements. Affluent StyleSetters – 11.8 million (27%) Enjoy keeping up with the latest fashions; get enjoyment from shopping for clothes; have an excellent sense of style; people often ask my advice on fashion and what they should wear; prefer to buy designer or luxury brands. Affluent Traditionalists – 11.6 million (27%) Buy the brands I grew up with; stock market is too risky for me; tend to buy based on price, not quality; like to take vacations in the U.S. rather than abroad; not very interested in current affairs and politics. Affluent Individualists – 10.0 million (23%) Tend to take the lead in decision-making; environmental issues are overblown; try to keep up with technological developments; keep up with financial news; am a risk taker. Affluent Globalists – 7.6 million (18%) Would be willing to pay more for environmentally friendly products; minimizing my impact on the environment is an important part of my life; traveling internationally helps me learn about other cultures; enjoy eating foreign cuisines; believe in protecting the environment. Source: Mendelsohn Affluent Survey, 2009 Annual Report 11 Thank You! 12