Chapter7 power point

advertisement

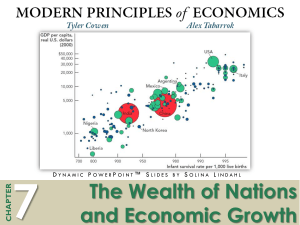

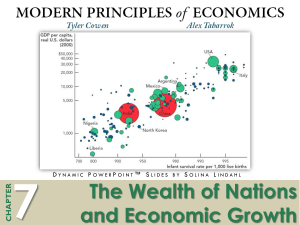

Modern Principles: Macroeconomics Tyler Cowen and Alex Tabarrok Chapter 6 The Wealth of Nations and Economic Growth Copyright © 2010 Worth Publishers • Modern Principles: Macroeconomics • Cowen/Tabarrok Introduction • Every year 1.8 million children die from • • diarrhea. Preventing these deaths requires only one thing: economic growth. Health and wealth go together. The next figure shows that the higher the GDP per capita the greater is the survival rate of newborns. Slide 2 of 37 Introduction Slide 3 of 37 Introduction • Wealth is clearly important. This leads us to ask three questions: Why are some nations wealthy while others are poor? Why are some nations getting wealthier faster than others? Can anything be done to help poor nations become wealthy? • In this chapter and the next, we will try to answer some of these questions. Slide 4 of 37 Wealth of Nations and Economic Growth • Three Key Facts 1. GDP per Capita Today Varies Enormously among Nations 2. Everyone Used to Be Poor 3. There are Growth Miracles and Growth Disasters • Let’s look at each of these in turn. Slide 5 of 37 Wealth of Nations and Economic Growth 1. GDP per Capita Today Varies Enormously Among Nations Slide 6 of 37 Wealth of Nations and Economic Growth 2. Everyone Used to Be Poor Slide 7 of 37 Wealth of Nations and Economic Growth • A Primer on Growth Rates How is economic growth measured? y t y t 1 gt 100 y t 1 Example: Year 2008 2009 real GDP per capita $15,000 $15,500 15,50015,000 g 2009 100 3.33% 15,000 Slide 8 of 37 Wealth of Nations and Economic Growth • The rule of 70: 70 Doubling time growth rate in % Example: If real GDP per capita is growing at an annual growth rate of 3.5%, it will double in: 70 20 years. 3.5 If the interest rate is expressed in years, the doubling time will also be in years. Slide 9 of 37 Wealth of Nations and Economic Growth • As the table shows, small changes in the growth rate → large changes over time. Slide 10 of 37 Wealth of Nations and Economic Growth 3. Growth Miracles and Growth Disasters The U.S. is one of the wealthiest countries due to long-run steady growth. Real growth of other countries can be evaluated by comparing theirs to the U.S. Slide 11 of 37 Wealth of Nations and Economic Growth • Two Growth Miracles Japan: • annual rate of real growth1950-70 = 8.5% South Korea: • annual rate of real growth1950-70 = 7.2% • Two Growth Disasters Argentina • 1900: one of the richest countries in the world • Now: per capita real GDP is 1/3 that of the U.S. Nigeria • Has barely grown since 1950 • Poorer now than it was in 1974 Slide 12 of 37 Wealth of Nations and Economic Growth Slide 13 of 37 CHECK YOURSELF According to Figure 6.2,approximately what percentage of the world’s f population lived in China in 2000? If you make 5 percent on your savings in a bank account, how many years will it take for your savings to double? How about if you make 8 percent? In Figure 6.4, approximately when did Japan’s real GDP per capita cross the $10,000 barrier? The $20,000 barrier? What was Japan’s growth rate in that time span? Slide 14 of 37 Understanding the Wealth of Nations • The Factors of Production Physical capital: the stock of tools, structures, and equipment. Human capital: is the productive knowledge and skills that workers acquire through education, training and experience. Technological knowledge: knowledge about how the world works that is used to produce goods and services. Slide 15 of 37 CHECK YOURSELF Which country has more physical capital: the United States or China? China or Nigeria? What are the three primary factors of production? Slide 16 of 37 Incentives and Institutions • The amount of available resources only tells part of the story. Why do some countries have more physical and human capital and use more advanced technology? Why do some countries obtain greater output from the resources they have than others? The answers lie in the institutions and incentives that countries adopt. Slide 17 of 37 Incentives and Institutions • • A natural experiment - North and South Korea Before division after WWII • Shared the same people and culture. • Had similar levels of physical capital. • Had access to the same technology. North Korea became a communist state with a centrally planned economy. South Korea adopted the capitalist free market model. The result 50 years later is dramatic as seen in the following photo from outer space. Slide 18 of 37 Incentives and Institutions North and South Korea at Night Slide 19 of 37 Incentives and Institutions • Institutions are the “rules of the game” • that structure economic incentives. Institutions of Economic Growth 1. Property rights 2. Honest government 3. Political stability 4. A dependable legal system 5. Competitive and open markets Slide 20 of 37 Incentives and Institutions • Institutions of Economic Growth (cont.) 1. Property rights: the right to benefit from one’s effort. • Provide incentives to work hard. • Encourage investment in physical and human capital. • Are important for encouraging technological innovation. • Without property rights: Effort is divorced from payment → ↓incentive to work Free riders become a problem Slide 21 of 37 Incentives and Institutions • Institutions of Economic Growth (cont.) 2. Honest Government • Property rights are meaningless unless government guarantees property rights. • Corruption bleeds resources away from productive entrepreneurs. • Corruption takes resources away from more productive government activity. • Next is a list of the 10 most and the 10 least corrupt countries. Are you surprised to see who is or who isn’t on these lists? Slide 22 of 37 Honest Government: The Good and the Bad Slide 23 of 37 Honest Government: The Good and the Bad Slide 24 of 37 Incentives and Institutions • Institutions of Economic Growth (cont.) 3. Political Stability • Changing governments without the rule of law results in uncertainty which leads to less investment in physical and human capital. • In many nations civil war, military dictatorship, and anarchy have destroyed the institutions necessary for economic growth. Slide 25 of 37 Incentives and Institutions • Institutions of Economic Growth (cont.) 4. Dependable Legal System • A good legal system facilitates contracts and protects property from others including government. • Poorly protected property rights can result from too much government or too little government. The legal system in some governments is so poor that no one knows who owns what. Example: In India, residents who purchase land have to do so more than once because of lack of proper record keeping. Slide 26 of 37 Incentives and Institutions • Institutions of Economic Growth (cont.) 5. Competitive and Open Markets • Encourage the efficient organization of resources. • About half the differences in per capita income across countries is explained by a failure to use capital efficiently. • Example: One study found that if India used its physical and human capital as efficiently as the U.S., India would be four times richer than it is today. Slide 27 of 37 Incentives and Institutions • Institutions of Economic Growth (cont.) Why do poor countries use their capital inefficiently? • Inefficient and unnecessary regulations Create monopolies Impede markets • Example: until recently in India, it was illegal to produce shirts using largescale production • Expensive red tape increases time and cost Slide 28 of 37 Incentives and Institutions • Institutions and Growth Revisited Economic growth would become more common if more countries changed their institutions. Where do institutions come from? • Culture? • History? • Geography? • Luck? Key research question in economics: Understanding institutions, where they come from and how they can be changed. Slide 29 of 37 CHECK YOURSELF List five institutions that promote economic growth. In England during the Wars of the Roses (late 1400s), two parties fought for the crown. Contrast the prospects for economic growth during this period and after this period when Henry VII became the unquestioned head of the country. When the Pilgrims landed at Plymouth Rock, they established a system of collective farming in which all corn production was shared. Given your understanding of incentives, what do you think happened to the Pilgrims? Slide 30 of 37 Takeaway • Economic growth has resulted in GDP • • • per capita today being 50 times higher in the rich countries than in the poorest. Economic growth has lifted billions out of near-starvation poverty but billions still remain in dire poverty. Poor countries can catch up to the rich countries in a surprisingly short period of time. Accumulation of human and physical capital is key but not sufficient. Slide 31 of 37 Takeaway • Countries with institutions that encourage the efficient use of human and physical capital will succeed. These institutions are: • Property rights • Honest Government • Political stability • Dependable legal system • Competitive and open markets. Slide 32 of 37 Modern Principles: Macroeconomics Tyler Cowen and Alex Tabarrok Chapter 6 Appendix: The Magic of Compound Growth Using a Spreadsheet Copyright © 2010 Worth Publishers • Modern Principles: Macroeconomics • Cowen/Tabarrok Appendix • • The rule of 70 is handy, but using a Microsoft Excel spreadsheet can help answer more difficult questions. Compound Growth: The Long Method Slide 34 of 37 Appendix • Compound Growth: The Shortcut If the growth rate is r percent and we grow for n years then: n r Ending Value Starting Value 1 100 Slide 35 of 37 Appendix • Use Excel’s Goal Seek to work backward to find, for example: number of years to reach a certain level of GDP. The ending value in cell B6 is fixed at 1,000,000. Excel then calculates the value of the variable in B2, that will give this result. Slide 36 of 37 Appendix • The problem is solved Starting with $46,000 and growing at a rate of 2%, it will take a little over 150 years to reach $1,000,000. Slide 37 of 37