Presentation Materials

advertisement

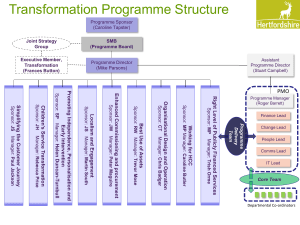

New Market Tax Credits Presentation Tax Exempt Sponsors Seminar – September 14, 2010 Panelists: Steven Paul, Partner, Tax Nicholas Romanos, Partner Tax Moderator: Andrew Grumet – Tax-Exempt Organizations New Market Tax Credits Summary of Benefits NMTC’s can account for more than 20% of project costs. This presentation will focus on a project with a cost of $9.5m of which $2.2m is derived from the sale of NMTC. NMTC investors typically derive their return solely from the NMTC effectively making their investments like grants which the sponsor need not repay. Principal Constraints Project must be in a qualified census tract The Non-Profit Sponsor of the Project must raise the balance of the funds, $7.3m in our example, and if it does so by borrowing, the Project generally cannot be mortgaged to secure such borrowing. What are New Market Tax Credits (NMTCs)? - Introduction Historical Community Renewal Tax Relief Act of 2000 Are they still available? What is the forecast for 2010/2011? NMTC provides investors (individuals, financial institutions, other corporations, etc.) with a tax credit for investing in communities that are economically distressed or consist of low-income populations. Boston, MA NTMC Qualifying Census Tracts New York City, NY NTMC Qualifying Census Tracts How do they work? Terminology – Community Development Financial Institutions Fund (CDFI Fund) Part of U.S. Treasury Community Development Entities (CDEs) Qualified Equity Investments (QEIs) Qualified Active Low Income Community Business (QALICBs) Qualified Low Income Community Investments (QLICIs) NMTC Investor/Leverage Fund Leverage Lender (can be project sponsor but not QALICB) CDFI Fund Application/Approval Process NMTC Financing Structure: Overview Lender (Sponsor) NMTC Financing Structure: Community Development Entities (CDEs) NMTC Allocatees, typically banks and other for-profit entities, nonprofits and state agencies, create these vehicles through which NMTCs investments are made. Must apply for certification by the CDFI Fund in order to receive tax credit allocations. Must show that their primary mission is to serve the needs of, or provide investment capital via equity or loans to, low-income communities or individuals. Must be either partnerships or corporations for tax purposes. NMTC Financing Structure: Qualified Equity Investments (QEIs) Investors’ equity investment in the CDE CDE sells NMTCs for cash to investors in exchange for investors’ equity investment in the CDE Includes proceeds from the Leverage Loan New Markets Tax Credit amount equals 39% of the QEI and is claimed over 7 years, beginning in the year the QEI is made: 5% of the QEI in each of the first three years and 6% of the QEI in each of the next four years Current pricing of the NMTC is in the range of $.65-$.70 for each $1 of credit In our example, $10m of QEI generates $3.9m of NMTC which, in turn, generates $2.7m of NMTC investment. NMTC Financing Structure: Qualified Active Low Income Community Business (QALICBs) Real Estate Owner. May be either a for-profit or nonprofit entity. Nonprofits often create 501(c)(3) supporting organizations to hold real estate for lease to sponsor. QALICB must: generate at least 50% of its annual gross income by conducting business in a low-income community use at least 40% of its tangible property within a lowincome community and perform at least 40% of their services in a low-income community (if no employees, 85% of its assets are located in such a community.) not more than 5% of the assets of a Qualified Business can consist of “collectibles” or “nonqualified financial property” be either a partnership or corporation for tax purposes. NMTC Financing Structure: Qualified Low Income Community Investments (QLICIs) Capital or equity investment in, or loan to, a QALICB from CDE Includes proceeds from the NMTC Equity Includes proceeds from the Leverage Loan Must be either partnerships or corporations for tax purposes. NMTC Financing Structure: NMTC Investor/Leverage Fund Purchaser of New Market Tax Credit Typically banks, insurance companies or other financial/investment institutions Invests equity and proceeds of Leverage Loan into CDE through an entity created by NMTC Investor as funding vehicle for QEIs (“Leverage Fund”). Leverage Fund is Borrower of Leverage Loan Equity investment of NMTC Investor in exchange for Leverage Fund interest Combines both NMTC equity investment and Leverage Loan into one or more QEIs, which is the equity investment in the CDE. NMTC Financing Structure: Leverage Lender Sponsor makes one or more Leverage Loans to Leverage Fund. Increases amount of QEI, which increases the amount of NMTC available to be sold. NMTC Financing Structure: Lease to Sponsor Nonprofits often create 501(c)(3) supporting organizations to hold real estate for lease to sponsor. Leasehold Mortgage may be available because leasehold is not a QALICB asset. 3rd Party Lenders 3P Lender Secured by Sponsor’s assets but not QALICB’s assets Project Sponsor / 501(c)(3) Project Sponsor / 501(c)(3) QALICB New 501(c)(3) (Property Owner) Alternative structure may have 3rd party lender lending directly to the leverage fund with Sponsor as guarantor of loans. NMTC Financing Structure: Exit Step 1 – Investor Exits through an exercise of a Put/Call – Sponsor acquires ownership of the Leverage Fund or its interest in the CDE. Step 2 – Structure collapsed through the cancellation of QLICI and QEI financing – Sponsor dissolves CDE and acquires QLICI loan in satisfaction of Leverage Loan. EAPD Contacts Steven L. Paul, Partner Boston 617 239 0442 spaul@eapdlaw.com Nicholas V. Romanos, Partner Boston 617 239 0379 nromanos@eapdlaw.com Andrew M. Grumet, Partner New York 212.912.2753 agrumet@eapdlaw.com