It`s all about Standards–Standardizing and implementing standard

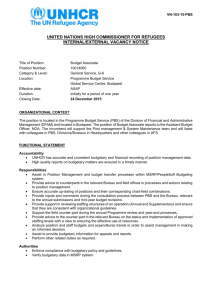

advertisement

Building on Governmentwide Standards for Tomorrow’s Financial Management and Reporting Holden Hogue, Director Accounting Systems and Standards Directorate Governmentwide Accounting Financial Management Service U.S. Department of Treasury Our Shared Common Goals and Interests Provide for reliable, timely, and useful financial and budgetary information To the President, Congress, and the public For use by management and decision-makers at all levels The Financial Report of the United States Government Remove the Disclaimer Build and implement efficient and cost effective financial management systems that meet information and transparency needs Continue to build on data and business process standards Financial and Budgetary Current Reporting Challenges Financial and budgetary data is not available from a single source Data must be obtained from multiple entities, locations and applications Substantial resources are required to establish and maintain multiple data exchange schemas with multiple partners Not all data is available electronically Data exchange standards do not exist There are inconsistencies between apportionment document (SF-132) and the budget execution (SF-133) These must be eliminated to support automation and standard data exchange Financial and Budgetary Reporting Data Exchange Current Structure OMB Treasury Deficiencies: •No single source of data Agencies •Multiple data exchanges between multiple partners •Multiple schemas based on data being exchanged •Data not available electronically Financial and Budgetary Current Reporting: Proposed Solution Create a mechanism that will: Provide a single point of data for financial and budgetary transactions Provide a standard data exchange schemas Eliminate the need to exchange data in paper form Eliminate conflicts between reported financial and budgetary data Financial and Budgetary Data Exchange Concept Model: Data Exchange Proposed Structure Treasury OMB Data Exchange Concept Model Benefits: •Provides a single source for budgetary and financial data •Reduces required number of exchanges •Standard data exchange schema Agencies •Makes data available electronically Financial and Budgetary Current Reporting A Starting Point Obtain the following data for use: Apportionment data from OMB FACTS I and FACT II data from Agencies FACTS II required data elements (i.e., discretionary, non-discretionary, X year, multiyear, etc… ) from OMB MAX Map budget execution processes Develop model data table requirements Develop data exchange standard GTAS Keys Replace FACTS 1, FACTS 2, IFCS and IRAS with one integrated system that includes budgetary and proprietary reporting. Edit reports using the rules of the USSGL. Check consistency against central accounting data. Provide instant feedback. Steadily improve agency accounting, which will improve agency reporting GTAS Keys (continued) This will help us achieve our objective, which comes from the CFO Act, purpose #3: Provide for the production of complete, reliable, timely, and consistent financial information for use by the executive branch of the Government and the Congress in the financing, management, and evaluation of Federal programs. Contact Information and Websites • Contacts: – Rita Cronley, Financial Management Service Email: rita.cronley@fms.treas.gov Phone: 202-874-9902 – Beth Angerman, Financial Management Service Email: elizabeth.angerman@fms.treas.gov Phone: 202-874-1544 • GTAS Website www.fms.treas.gov/gtas New Standard Interagency Agreement (IAA) Under Development 2009 due to: inability to account for and reconcile intragovernmental transactions between departments = audit finding on US financial report FY 2012 is the target to reduce the intragovernmental transactions material weakness to an immaterial level Future Benefit: facilitates communication between the Buyer/Requesting Agency and Seller/Servicing Agency enables trading partners to agree on the terms of reimbursable transactions before business begins Implementation and Direction: OMB to issue IAA Implementation Memorandum Summer 2010 OMB/FMS partnering for agency outreach, communication and training NSF piloting form – offering lessons learned Paradigm Shift Program Program Acquisition BUYER Finance Acquisition Seller Budget IAA Finance Budget Key: Initiates Approves 12 Contact Information and Websites • Contacts: – Kim Farington, Office of Management and Budget Email: kfarington@omb.eop.gov Phone: 202-395-3053 – Robin Gilliam, Financial Management Service Email: robin.gilliam@fms.treas.gov Phone: 202-874-9133 • Websites: – Max Homepage https://login.max.gov/cas/login?service=https%3A%2F%2Fmax.omb.gov%2Fco mmunity%2Fx%2FwoOoGg – Financial Management and Budget Standardization [Sign up for email updates] http://www.fms.treas.gov/finstandard/index.html