Marilou Uy

The Seoul Post-2015 Conference: Implementation and Implications

Seoul, Korea

October 7, 2013

•

The original MDGs were articulated independently of a financing framework (Monterrey 2002).

•

In a context of fiscal consolidation and an evolving landscape of development financing, discussion of post-2015 goals would need to be integrated with consideration of a supporting financing framework for implementation.

•

The purpose of this presentation is to present some elements of a financing framework for the post 2015 development goals.

2

Good policies and credible institutions to:

Increase impact of available resources

Leverage additional resources

Good policies and credible institutions enhance the impact of available resources and leverage additional resources from both domestic and foreign sources.

3

At the country level:

•

•

•

•

Design targeted, evidence-based policies and support sound institutions

Generate more revenues

Ensure efficient public spending

Promote financial deepening and inclusion

Globally:

Maximize the impact of ODA

Support new development partners

Leverage the private sector

Tap into new sources of finance

Deliver global public goods

4

15

10

25

20

5

0

35

30

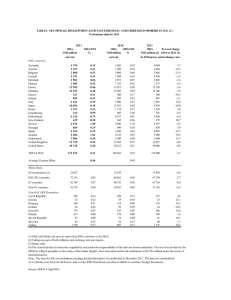

Tax Revenue (in % of GDP) by Income Groups, 1994-2009

28,4 28,4

29,3

21,2

18,8

17,1

19 19,3

13,6

11,3

10

10,5

1994

High Income

1998

Middle Income

2003

Low Income

2009

Source: World Development Indicators

5

Subsidies are an inefficient means of assisting the poor: only 8% of the $409 billion spent on fossil-fuel subsidies in

2010 went to the poorest 20% of the population.

Fossil fuel consumption subsidies measure what developing countries spend to provide below-cost fuel to their citizens. High-income countries offer support to energy production in the form of tax credits or loan guarantees, which are not included in these calculations since they are directed towards production rather than consumption of the fuel.

Source: World Energy Outlook, IEA,

2011

6

Improve the allocation of resources

How do financial institutions contribute to economic growth?

Lower the cost of financial and nonfinancial transactions

Facilitate efforts to reduce and trade risks

7

Source: World Bank CFP Working Paper No.

8, Finance for Development

Source: Fragile States 2013, OECD

NB: Based on OECD definition of fragile states

8

Estimated aid from BRICS, 2003-2009 (USD billion)

4,50

4,00

3,50

3,00

2,50

2,00

1,50

1,00

0,50

0,00

2003 2004 2005 2006 2007 2008 2009

China India Russia Brazil South Africa

Source: World Bank CFP Working

Paper No. 8, Finance for

Development

For the purpose of comparison, in 2009, net ODA from DAC members was 119.8 bn USD.

9

ODA from Saudi Arabia, South Korea, and Turkey, 2003-2009 (Gross disbursements, US$ billion)

ODA from non-DAC donors excluding BRICS, 2003-2009 (Net disbursements, US$ billion)

DAC Annual Reports and IDS Statistics; Zimmerman and Smith, 2008

10

•

Global funds: trust funds that pool resources for specific issues of global importance

– Global Partnership for Education

– GAVI Alliance (formerly the Global Alliance for Vaccine and Immunization)

– Global Fund to Fight AIDS, Tuberculosis and Malaria (GFATM)

– Global Environment Fund (GEF)

•

Scattered data – available estimates for private aid to developing countries in 2009 range from USD 22 billion to USD 53 billion

•

Low estimate is equivalent to 16 percent of ODA from all donors in the same year, and up from 2005 (12 percent of ODA)

•

Private philanthropy to fragile states increasing in recent years

•

South-South philanthropy also on the rise, especially in the Arab world

•

Philanthropic giving highly sensitive to factors such as media coverage, timing, geopolitical considerations

11

M a h a r a s h t r a & T a m i l N a d u , I n d i a

C L I F F C O M M U N I T Y S A N I T AT I O N

P R O J E C T

K e n y a

P R I V AT E S E C T O R P O W E R

G E N E R AT I O N P R O J E C T

T o t a l i n i t i a l i n v e s t m e n t : $ 7 . 2 m i l l i o n

- H o m e l e s s I n t e r n a t i o n a l

- S P A R C ( N G O i n I n d i a )

- C o m m u n i t y - b a s e d O r g a n i z a t i o n s

T o t a l i n i t i a l i n v e s t m e n t : $ 6 2 3 m i l l i o n

- K e n y a P o w e r a n d L i g h t i n g C o m p a n y

- I F C

- M I G A

- C o m m e r c i a l B a n k s

Emerging

Partnerships

S a o P a u l o , B r a z i l

M E T R O L I N E 4

L a k e K i v u , R w a n d a

K I V U W AT T

T o t a l i n i t i a l i n v e s t m e n t : $ 4 5 0 m i l l i o n

- C o m p a n h i a d o M e t r o p o l i t a n o d e S a o

P a o l o

- 5 E q u i t y S p o n s o r s

- I D B

- C o m m e r c i a l B a n k s

T o t a l i n i t i a l i n v e s t m e n t : $ 1 4 2 . 2 5 m i l l i o n

- C o n t o u r G l o b a l

- E n e r g y A u t h o r i t y o f R w a n d a

- M I G A

- E m e r g i n g A f r i c a I n f r a s t r u c t u r e F u n d

- F M O

- A f D B

- B e l g i a n D e v e l o p m e n t B a n k

Source: Emerging Partnerships, IFC, 2013 and World Bank, Africa Region.

12

Total assets by type of institutional investors in the OECD, 1995-2011 (USD trillions)

13

A g Re s u l t s I n i t i at i ve

I n t e r n a t i o n a l F i n a n c e F a c i l i t y f o r I m m u n i z a t i o n ( I F F I m )

Inputs increasing yields

Outputs post harvest management

Livestock Nutrition

Linking spending to actual development outcomes

14

•

Global public goods lie at the intersection of national development priorities and global interests

•

The under-provision of GPGs disproportionately affects the poor

•

GPGs are at the center of the post-2015 agenda:

– International financial architecture

– Trade/market access

– Peace and security

– Climate change

– Communicable diseases

– Knowledge for development

– Statistical capacity-building

15

•

•

Promote targeted policies and support accountable, efficient institutions for shared growth

Mobilize domestic resources for development through:

– Broader tax coverage and increased taxation capacity

– Efficient public spending and greater accountability

– Management of natural resource revenues

– Deeper domestic financial sector

– Vibrant private sector development for job creation and shared growth

•

•

•

•

Maximize the impact of ODA

Leverage more private resources

Draw on emerging and innovative sources of finance

Deliver global public goods

The range of financing sources and instruments have different challenges and comparative advantages. Mobilizing a broad range of financing and using the right combination of instruments to meet a given goal, in a given country context, would be important tasks ahead to implement the next development framework post-2015.

16

Marilou Uy

Senior Adviser

The World Bank muy@worldbank.org

17