To derive AS relation, we need

advertisement

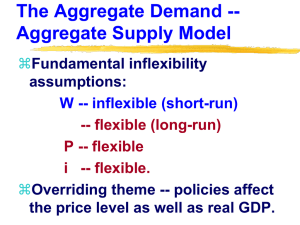

Projekt : „Odpowiedź na wyzwania gospodarki opartej na wiedzy: nowy program nauczania na WSHiP”. Projekt współfinansowany ze środków Unii Europejskiej w ramach Europejskiego Funduszu Społecznego. Aggregate Supply – Aggregate Demand Model MEDIUM RUN ANALYSIS To derive AS relation, we need: WS equation: W P f u , z e PS equation: P 1 W To derive AS relation, we need: Unemployment rate: u U L LN L 1 N 1 L Y L Assumption about a production function: Y AN Where A=1 and therefore Y=N Finally we receive: AS relation: Y P P 1 f 1 , z L e that shows a relation between current price level and expected price level and level of output. The Aggregate Supply curve (which probably could have a better name like for example ”labour market curve” )is illustrating this relation. It is an upward sloping curve, which shows a positive correlation between output and price level. To derive AD relation, we need: A basic knowledge of IS-LM model, how equilibrium in the goods and money market is defined there: IS : LM : Y C Y T M P I Y , i G Y L i Finally we receive: M Y Y , G, T P AD relation says that output is an increasing function of the real money stock and government spending and a decreasing function with respect to taxes. The Aggregate Demand curve is a downward sloping curve that shows a negative correlation between output and price level. INTERSECTION OF AS & AD CURVES IS… A newly defined equilibrium of the whole economy in the medium run while equilibrium in all three markets (labour, goods and money one) is considered. A new approach towards equilibrium: AS-AD model allows us to observe the adjustment of output over time. If Y≠Yn, say output exceeds the natural level of output (see figure 7-6), then: the price level is higher than the expected price level. WHAT WILL HAPPEN? The mechanism: 1. The wage setters will modify their expectations, they will increase the expected price level (AS shifts up). 2. Wage setters will set their wage higher due to the modified expectations [W=f(Pe)], therefore under the wage setters pressure the price setters will increase the price level [P=f(W)]. 3. The higher price level leads to a lower real money stock. 4. A lower real money stock leads to a higher interest rate (remember about IS-LM model). 5. A higher interest rate leads to lower demand for good Summing it up: If output is above the natural level of output, the AS curve shifts up over time, until output has decreased back to the natural level of output. Let’s check what are the policy effects in the medium run We will examine two cases: 1. Monetary expansion 2. A decrease in the budget defficit MONETARY EXPANSION 1. Y=Yn, If there is an increase of nominal money, the AD curve shifts to the right. 2. In a new intersection point of AD and AS output is higher than natural level of output, that will cause revision of price expectations – now the current price level is higher than expected one. 3. Revision of the expectations (the wage setters push the wages, the price setters increase the prices) can be illustrated by a shift of the AS to the left. The effects of monetary expansion in the medium run: The increase in nominal money is offset by a proportional increase in the price level. The real money is unchanged, therefore, output is back to its initial value Yn It looks like it is the road to NOWHERE, although… In the medium run expansionary monetary policy can help the economy to move out of recession and return faster to the natural level of output! The effects of monetary expansion in the medium run Summary: output level – unchanged interest rate – unchanged price level - increase A deficit reduction in the medium run 1. There is a decrease in G, while T is unchanged, the AD curve shifts to the left. 2. Output is below the natural level of output. Both the interest rate (the prices go down, the real money stock goes up and the interest rate goes down - see IS-LM model)and the output are lower . 3. The price level goes down (AS shifts to the right due to the price expectations revision) In the medium run, output returns to its natural level A deficit reduction in the medium run Summary: output level – unchanged interest rate – decrease price level - decrease What about the changes in the price of oil? 1. 2. 3. 4. An increase in the price of oil leads to lower real wage and higher natural rate of unemployment (see WS-PS relations). An increase of markup results from an increase in the price level and this shifts AS to the left There is a new level of natural output given (as there is a new natural unemployment rate) Output has decreased and natural level of output has decreased even more, therefore Y is still above the Yn, then the AS continues to shift up. The changes in the price of oil Summary: output level – decrease interest rate – increase price level - increase Projekt : „Odpowiedź na wyzwania gospodarki opartej na wiedzy: nowy program nauczania na WSHiP”. Projekt współfinansowany ze środków Unii Europejskiej w ramach Europejskiego Funduszu Społecznego.