PF PPT template

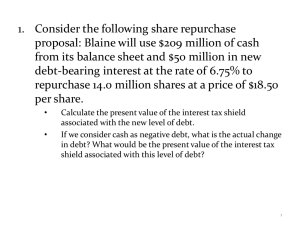

advertisement

Managing Turnaround of the Slovenian Economy: Restructuring of Banking, Corporate and State Sectors Prague, November 2013 prof. Marko Simoneti marko.simoneti@pf.uni-lj.si Content Background on Slovenia: - economic transition and domestic ownership, - current financial and economic conditions Bad bank approach to bank rehabilitation Restructuring of the corporate sector CG in the SOEs, Privatization and FDIs Public sector Debt to GDP State bailouts and financial crisis Too important to fail (externalities!) Do nothing, “Zombie banks” and economic activity Act quickly and strongly ! Everything was possible, but not any more ! EU Banking union: supervision, resolution, deposit insurance Protecting government budgets from banking crisis ! Moral hazard in banking bailouts: who should pay ?? EU bank resolution in the future Special regime for troubled banks (2016?) Burden sharing: shareholders first, non-secured creditors second, taxpayers last, Restructuring tools by authorities: - Sale of the business on behalf of shareholders - Set up the bridge bank (the good bank approach) - Separation of bad assets (the bad bank approach) - Bail-ins of unsecured creditors Create Good bank ! Troubled bank transfers good assets and deposits on its 100% owned new Good bank Bad assets and non-secured liabilities stay with the Old bank which has to be liquidated Owners and non-secured creditors pay the bill State funds (if needed at all) go to Good bank Modern solution for leveraged banking! Seite 11 Good bank approach Good Bank Stara Assets banka Labilities Good assets A Old bank Assets Debt 1 1. Starting capital Good assets A 2. STATE CAPITAL INCREASE 1) Transfer of good assets and secured deposits 2) State capital increase in Good bank 3) Liquidation of Old bank Liabilities Debt 1 Debt 2 Debt 3 Bad asssets XY Debt 4 Capital 3. Create Bad bank Separate troubled assets from good assets Recapitalize troubled banks and start new lending by the “problem free” banks Restore market confidence in the “problem free” bank: refinancing and recapitalization Better management of bad assets Bad assets: NPLs, non-core assets, toxic: difficult to value or sell? Bad bank approach (BAMC) Bad bank Assets Laibilities Bad assets XY Bonds Old bank Assets Liabilities Debt 1 Good assets A Debt 2 1. Debt 3 1) Transfer of bad assets with discounts 2) Write offs of capital and subordinated debt and forced conversions of debt 3) State capital increase in Old bank Bad assets XY Debt 4 2. Kapital 3. STATE CAPITAL INCREASE Current status on bank rehabilitation and sequencing of structural reforms AQR, stress testing and assets transfer on BAMC Big banks recapitalized, small orderly closed down Government financing: on the market or troika? Fiscal consolidation Corporate sector: active management of NPLs and deleveraging as a precondition for growth Re-nationalization of the economy, Corporate governance and privatization Perfect storm for corporate balance sheets in the crisis High leverage:LBOs and Financial holdings Debt financing of speculative investments Short term financing of long term projects • Stop on foreign financing of banks • Recession and export revenues down • Collapse of the balance sheets: real estate (-30%), capital markets (-70%) NPLs in banks are a mirror picture of corporate debt overhang in Slovenia !! Figure 1: Distribution of financial debt of industrial companies in Slovenia according to Debt/EBITDA in 2012 [v mio EUR], AJPES Institutional framework for workouts Out of court restructuring is the way to go (flexibility, speed, costs,..) Insolvency regime is the benchmark: - Compulsory Consolidation (CC) - Liquidation Main problems: - CC abused by debtors and owners-managers - CC complex and time consuming - Collective action by banks Modernizing the insolvency law (1) Survival of the debtor vs best repayment for creditors More powers to creditors: start and lead the process Write-offs for shareholders if liquidation value negative APR rule based pay-offs Inclusion of secured creditors and adequate compensation (split of claims into secured and non-secured part) Pooling of collateral CC for a selected group of creditors and shareholders Modernizing the insolvency law (2) Automatic stay and super priority for new financing Spin offs to Good Co. and liquidation of Bad Co. Pre-bankruptcy procedure for large firms and financial creditors Limited capacity of Courts: small number of creditor classes, no Court fairness hearing ?? Complexity of the rules ?? Limited capacity of insolvency administrators ?? Can bank creditors play the active role ?? No forced debt to equity conversions (Germany) ?? Collective action by bank creditors ?? New lead bank and consolidator: BAMC !! Re-nationalization of the corporate sector BAMC is run by foreign experts and might be partially privatized/financed on the market Ljubljana banking club rules AQR and new reality in valuating corporate loans New insolvency rules Temporary debt to equity for banks ?? Financial vs. operational restructuring by bankers ?? FDIs and political will for the structural reforms ?? THANK YOU FOR YOUR ATTENTION. marko.simoneti@pf.uni-lj.si