File

advertisement

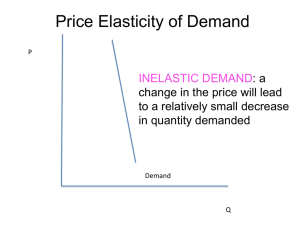

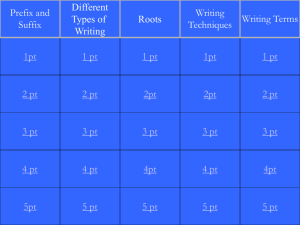

Assignments! ● ● If I handed back an assignment that was marked in red, please hand it back as I have to record the marks : ( Thank You Economics Students. Elasticity Continued: Determinants of PED and the Price Elasticity of Supply, or PES. Determinants of PED: Substitutability ● ● ● The larger the number of substitute goods, the greater the PED. The elasticity of demand for a product can depend upon how narrowly the product is defined. Demand for a specific brand is MORE elastic than demand for the product in general. The more competition, the higher the elasticity. Determinants of PED: Proportion if Income ● ● The higher the price of a good relative to a consumer's income, the greater the PED. The PED on a house might be higher than the PED on a package of gum because the price increase on a house is higher as a percentage of the buyers income. Determinants of PED: Luxuries or Necessities ● ● ● The more that a good is considered a luxury rather than a necessity, the higher its PED. Electricity has a PED of 0.13, Bread has a PED of 0.15 and Restaurant Meals have a PED of 2.27. If a PED of less than 1 is in-elastic, why is the PED of Bread 0.15 but restaurant meals have a PED of 2.27? Determinants of PED: Time ● ● PED is more elastic the longer the time period under consideration. Consumers need time to adjust their habits and decisions. It simply takes time to think and experiment with substitutes. ● Short-run PED for gasoline = 0.2 ● Long-run PED for gasoline = 0.7 ● Why is PED more elastic over the long-run? Price Elasticity of Supply ● ● PES is the ratio of the percentage change in quantity supplied of a product or resource to the percentage change in price. It is the responsiveness of producers/firms to a change in the price of a product. ● Change in Quantity / Average Quantity ● ● Divided By Change in Price / Average Price PES and Time... ● ● Time is the primary influence on PES. If a producer has enough time to shift resources to something else that makes more money, they will... Therefore, PES increases for each period. Economists break this concept down into 3 periods: ● 1) Immediate / Market Period ● 2) The Short-Run ● 3) The Long-Run PES & Figure 6-3 ● ● ● ● Figure 6-3 Illustrates the time and the elasticity of supply for a tomato farmer. In the Immediate period, it is perfectly inelastic... he/she is already at the market so the slope is perfectly vertical. In the Short-run, it is more elastic, the farmer can shift some more resources to tomatoes. In the Long-run, it is very elastic. If the price of tomatoes rises, he will shift more production. Cross Elasticity of Demand ● ● ● ● The ratio of the percentage change in quantity demanded of one good to the percentage change in price of another good. A positive number indicates they are substitutes. A negative number indicates they are complementary. The formula is essentially the same as for PES or PED. Refer to page 140. Income Elasticity of Demand ● ● ● ● ● The ratio of the percentage change in quantity demanded to a percentage change in consumer incomes. It measures the responsiveness of consumer purchases to changes in income. For Normal Goods, the Income Elasticity of Demand is positive. For Inferior Goods it’s negative. The formula is essentially the same as for PES or PED. Refer to page 141. Questions 8, 12, and 13. ● These are excellent prep for Friday's Test. Elasticity and Taxes Taxes have the effect of increasing the marginal cost of the products. This shifts the supply curve up by the amount of the tax. ● ● ● The 5 Minute Video Below will help as an intro: The Incidence of Tax - An Overview Tax Incidence (Who Feels the Pain?) Tax burden on consumer. When demand is inelastic the tax burden is mainly on the consumer. Tax burden on producer. When demand is elastic, the tax burden is mainly on the producer. Example - the incidence of a tax on cigarettes ● The government puts a £1 tax on each packet of cigarettes because they are harmful to your health. The legal incidence is on the cigarette smoker. However, the local market may have many sellers, and be highly competitive. This means that a retailer, fearing they will lose sales, may decide to put up the price by only 50p, and pay the balance of 50p to the government themselves. In this case, the economic incidence is shared and both are worse off. The smoker is worse off because of the price increase of 20p, and the seller is worse off because 10p must come out of their revenue to pay the government. PES and Tax Incidence ● ● ● With a highly inelastic PES, the tax incidence will mainly fall on the producer. With a highly elastic PES, the tax incidence will mainly fall on the consumer. This is also true, as we saw, for PED. ● ● Question 14 & 15. These are excellent prep for Friday's Test.