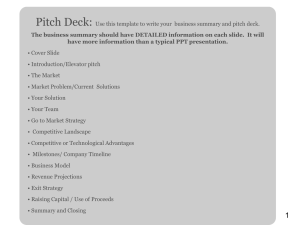

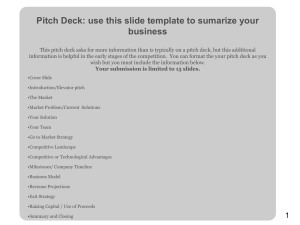

The Business Plan

advertisement

The Business Plan Why write a business plan? • Always when a new venture needs outside funding • Early in the planning process when you are looking at a large-scale project • Later or not at all when you are bootstrapping Dollinger, 2008 Costs and benefits of planning • Writing a plan takes considerable time, money, and energy • Every plan deals with economic uncertainty and risks posed to new venture – founders may be uncomfortable confronting risks and uncertainties and avoid writing a plan • Writing the plan helps founders confront risks and conflicts before they become serious problems Dollinger, 2008 The plan demonstrates how you 1. Create or add significant value to a customer or end user 2. Solve a significant problem or meet a significant need for which someone is willing to pay a premium 3. Have robust market, margin, and money-making characteristics 4. Have a good fit with the founders, management team at time of market entry, and the risk/reward balance Timmons, 1999 After you write the plan • It becomes a point of departure for due diligence for potential investors and to determine risks of venture (technology, market, management, competitive, financial risks) • This homework is crucial even if you don’t try to raise outside capital • The most valuable investors will see weaknesses, even flaws, and will propose tactics and people to fix them Timmons, 1999 Tips for business planning and raising outside funds RE: Venture capitalists • There are a lot of them; don’t talk to all of them • Getting a “no” is as difficult as getting a “yes;” qualify your targets and force others to say no • Be vague about which other VCs you are talking to • Do not meet with an associate or junior member twice without a partner Timmons, 1999 Tips for business planning and raising outside funds RE: The plan • Stress your business concept in the executive summary • The numbers matter less than the economics (value proposition and business model) • Make the business plan look and feel good w/o using “filler” • Be prepared to provide copies of published articles, contracts, market studies, purchase orders, resumes, etc. Timmons, 1999 Tips for business planning and raising outside funds RE: The Deal • Make sure investors want you as bad as you want them • Create a market for your venture • Never say no to an offer price • Use a lawyer with venture deal experience • Don’t stop selling until the money is in the bank Timmons, 1999 Tips for business planning and raising outside funds RE: The fund raising process • It is much harder than you ever thought it would be • You can last much longer than you ever thought you would • The venture capitalists have to do this the rest of their careers Timmons, 1999 Critiquing the plan – General criteria • Comprehensiveness – use a template to help • Analysis – resource, industry, competitor and product analysis; financial projections with percentages, returns, and comparisons with analogs • Reasonableness – assumptions are comparable to benchmarks and facts • Writing and presentation – well written and organized Dollinger, 2008 Critiquing the plan – Specific criteria • Management – experience, honesty, integrity • Resources – rare, valuable, hard to copy, unique • Projections and returns – all data must have solid foundation in reality, yet optimistic enough to attract investors • Exit – how and when will investors recoup money? Dollinger, 2008 P r o d u c t / s v c l e v e l Level 4 Product/ svc fully developed Many users, established mkt 4/1 4/2 4/3 4/4 Level 3 Product / svc fully developed Few users, mkt assumed 3/1 3/2 3/3 3/4 Level 2 Product / svc pilot operable, not developed for production, mkt assumed 2/1 2/2 2/3 2/4 Level 1 Product / svc idea but not operable, mkt assumed 1/1 1/2 1/3 1/4 Evaluation System Level 1 Level 2 Single would- 2 founders, be entrep Level 3 Level 4 Partly staffed Fully staffed, mgt team, experienced mgt team Management status and experience levels Writing and editing the plan • Steps: Prewriting, writing and rewriting/editing, editing – despite importance of good writing: Research on 20 business plans in a competition: • 30% didn’t include specific strategy • 40% of teams had no marketing experience • 55% failed to discuss technical idea protection • 75% failed to identify details of competitor • 10% had no financial projections; 15% omitted balance sheets; 80% failed to provide adequate details of the financial projections Dollinger, 2008 Exercises 1. Draft an outline of your business plan – What information do you already have? – What information is still required? How will you get it? 2. Prepare as much of the executive summary as you can. Be concise and informative 3. Critique a business plan – How well does the plan address key issues? – What changes and improvements would you make to the plan? – How well done is the presentation and writing? – Would you invest in this business? Why or why not? Dollinger, 2008