绩效预算的目标

advertisement

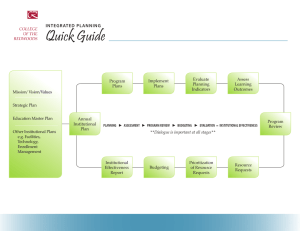

预算简介和绩效预算概况 Performance Budgeting Course, AFDC, Shanghai, October 2010 Prepared by Marc Robinson 课程概况 Objective 目标 ◦ Skills in PB design and implementation ◦ 绩效预算的设计和执行方面的技能 Content 内容 ◦ Core topical presentations 核心主题讲授 ◦ Case studies 案例研究 ◦ Interactive Exercises 互动练习 Emphasis on discussion & interaction 重视讨论和互动 ◦ Including during presentations 包括课程讲授时的讨论和互动 ◦ Comments and questions encouraged 鼓励发表见解和提出问题 介绍和课堂管理 Presenter introductions 教师介绍 Participant introductions 学员介绍 ◦ Your name, organization and a little about yourself ◦ 姓名、所在单位和自己的简介 Organizational matters: 组织事项 本节内容 Introduction to performance budgeting (PB) 绩效预算介绍 ◦ What it is 什么是绩效预算 ◦ Different forms of performance budgeting 绩效预算的不同形式 Before that, overview of budgeting在此之前,预算概况 ◦ Objectives 目标 ◦ Stages 阶段 ◦ Enables us to see PB in broader context 使我们更宏观地审视绩效预算 预算 Allocation & use of resources by government 政府对资源的分配和使用 ◦ Plus decisions on financing 以及融资决策 ◦ Mainly taxes & other compulsory transfers 主要是税和其它强制性转移 Doesn’t cover public corporations 不包括上市公司 ◦ Financed mainly by voluntary payments 主要由自愿支付来承担 ◦ Budget only includes subsidies & transfers 预算只包括补贴和转移支付 预算覆盖的部门 Public sector 公共部门 Financial 金融 institutions 机构 Central bank 央行 Non financial 非金融 public sector 公共部 门 Public sector Public commercial Corporations banks 上市公司 公共部门 商业银行 The Budget Sector 预算部门 Government 政府 预算流程 Aggregate Fiscal Policy 总财政政策 Accounting, Audit and Reporting Budget Preparation & Enactment 会计、审计和报告 预算准备和立法 Budget Execution 预算执行 预算的目标 1. Sound macro-fiscal outcomes 稳健的宏观财政 ◦ Deficits and debt don’t get out of control 赤字和债务不会失控 ◦ Fiscal sustainability first and foremost财政的可持续是首要目标 2. Appropriate allocation of funds (“prioritization”) 资金的合理拨付 (“依照重要性进行安排”) ◦ To most socially useful sectors & programs 拨付给对社会最为重要的 部门和项目 3. Service effectiveness and efficiency 服务的有效性和效率 ◦ Effectiveness through design & management通过设计和管理实现有 效性 ◦ Services delivered at lowest cost 以最低成本提供服务 PB directly targets objectives 2 & 3 绩效预算直接针对后两个目标 ◦ Although helps with objective 1 不过也有助于实现第一个目标 预算的准备和立法 Macro-fiscal framework 宏观财政结构 ◦ Deficit/debt etc objectives赤字/债务等目标 ◦ Revenue policies 税收政策 ◦ Aggregate spending consistent 总财政支出的一致性 Expenditure priorities 支出的优先次序 Estimates of spending requirements估算支出的要求 ◦ Capital and current expenditure 资本和经常性支出 Legislative debate and approval立法辩论和审批 预算的执行等 7. Auditing Stage: Reliability of accounts checked 7. 审计阶段 审查会计的可靠性 6. Accounting Stage: Transaction recorded in the books as complete 1. 授权阶段 1. Authorization Stage: 待支出的资金分配流程 Allotment process for money 要与法定拨付相一致 to be spent consistent with legal appropriations 2. 协议阶段 下采购订单或签 署合同的阶段 6. 会计阶段 2. Commitment Stage: when a purchase order is made or a contract is signed 完整地记录交易过程 3. 认证阶段 5. Payment Stage: paying the actual bill 5. 支付阶段 依据实际帐单付款 确保获得的产品或 服务符合合同要求 4. 授权支付阶段 采购人与授权人需 独立 3. Verification Stage: ensuring that goods or service has been delivered as per the contract 4. Payment Authorization Stage: Ordering person is different from the authorizing person 绩效预算的含义 Objective of Performance Budgeting绩效预算的目标 ◦ Efficient and effective expenditure既有效果又有效率的支出 ◦ Including better prioritization 包括更合理的支出安排 Means of achieving this objective 实现预算目标的方法 ◦ Linkage of funding and results 将资金支出和结果相结合 ◦ Using Performance Information (PI) 使用绩效信息 Increased flexibility: especially inputs 更高的灵活性:尤其是投入 Government-wide and sectoral systems 整个政府和各部门的预算体 系 绩效的压力 Compensate for weaknesses of other performance pressures 弥补其它绩效压力的缺陷 ◦ Absence of market pressure 市场压力的缺失 ◦ Political accountability insufficient 政治责任的不足 PB seeks to drive improvements in 绩效预算是为了改善 Program effectiveness 项目的有效性 ◦ Deliver intended benefits to community为公众带来预期效益 Productive efficiency 项目的效率 ◦ Minimum cost while maintaining quality 既保证质量,又实现低 成本 对资金拨付次序进行优化的必要性 Funds go to where benefits greatest 资金要投入到能带来最大 收益的地方 ◦ Allocative efficiency 拨付的效率 Prioritization often weak 拨付的优先次序往往不合适 ◦ Incrementalism 渐进主义 ◦ Budget process focused on new initiatives预算过程关注新的项目 ◦ Budgetary ‘base’ not scrutinized 预算的“基础”没有得到审核 ◦ Reliance on across-the-board cuts 依赖于全面消减 More sustainable public finances 更有持续性的公共财政 ◦ As a result of better prioritization 需要由更好的拨付次序安排来 实现 “结果管理”的背景 Broader set of performance reforms 更大范围的绩效改革 ◦ PB as one element 绩效预算是一个因素 ◦ Close links between PB and other elements绩效预算和其它因 素的紧密联系 Results-oriented HR management 以结果为导向的人力资 源管理 Customer orientation measures 客户导向的方法 Market-type reforms 市场化的改革 Many MFR reforms use performance indicators and targets 很多结果管理改革都使用绩效指标和目标 绩效预算的各种形式 Differing objectives 目标不同 ◦ Emphasis on prioritization vs. efficiency 强调拨付次序或强调拨付 效率 Different funding/results link 资金支持和结果之间的不同联系 Differing PI requirements 绩效信息要求不同 ◦ Performance measures 绩效方法 ◦ Evaluation etc 评价等 Common theme of budgetary de-control预算的非控制共同 主题 ◦ Input choice freedom 投入选择的自由 项目预算 Key goal is better expenditure prioritization首要目标是更好的支出 优化 Spending classified by objective: programs按目标分类的支出: 项 目 ◦ Instead of classification by input type不按投入类型分类 Budget process uses these programs for expenditure priority decisions预算过程利用项目实现支出优先决策 ◦ PI to assess costs and benefits of programs绩效信息用于评价项目的成 本和收益 ◦ Budget planning, including budget bids预算计划,包括预算投标 ◦ Program appropriations, or budget documents计划拨款或预算书 项目结构一例 Police Force 警力 Program 1 Public Order Program 2 Crime Prevention Program 3 Road Safety 项目1 公共秩序 项目2 预防犯罪 项目3 道路安全 Sub-Program 1.1 Sub-Program 1.2 Community Police Response Services Event Management 子项目1.1 社区警察反应服务 子项目1.2 事件管理 Program 4 Emergency Response & Management Program 4 Criminal Justice Services 项目4 项目4 紧急反应与管理 刑事司法服务 零基预算 How much to vary program spending? 项目支出应该有多大 变化? ◦ Requires info about impact of changes需要关于变化之影响的信息 ZBB:零基预算 ◦ ‘Decision packages’/ ‘service increments’整体决策/服务盈余 ◦ Comparing impacts of changes with their cost比较变化的影响及 其成本 ZBB proper requires evaluation of changes right up to total elimination零基预算本身要求变化的评价同总体消除相等 ‘Alternative budgeting’替代性预算 ◦ Couple of expansion/reduction options扩张/削减选择的组合配对 项目预算的新形式 Go beyond program budgeting超越项目预算 Aim for tighter results/funding link目标指向更紧密的结果/ 资金联系 Very much part of overall MFR package MFR整体中的一部分 Three mechanisms 3个机制 ◦ Budget-linked performance targets预算相关的绩效目标 ◦ Formula funding公式拨款 ◦ Funding incentives for performance绩效的资金激励 把目标与预算联系起来 Agency level performance targets操作层面的绩效目标 ◦ For outcomes and/or outputs为了产效和/或产出 ◦ But this is a general MFR theme但这是一个总体的MFR(结果管 理)主题 Requires also that level of funding be linked to targets 同样要求资金的水平同目标联系起来 ◦ E.g. more funding brings tougher targets例如,更多的资金意 味着更难实现的目标 Issues:问题 ◦ Knowing what targets are appropriate for a given level of funding知道什么样的目标对于一定程度的资金资助是匹配的 ◦ Danger of behavioral distortion行为扭曲的危险性 英国公共服务协议 Targets set in the multi-year budget process通过多年预算过 程来设定目标 Link between funding and targets 将资金与目标相结合 Examples of PSA Targets 公共服务协议目标举例 Health医疗: Reduce health inequalities by 10% by 2010 as measured by infant mortality and life expectancy at birth. 到2010年,通过婴 儿死亡率和出生时的预期寿命来将医疗不平等减少10%。 Crime 犯罪: Reduce crime by 15% and further in high crime areas by 200709. 在2007-2009年间,将高犯罪区的犯罪率减少15%以上。 Environment环境: Eliminate fuel poverty in vulnerable households in England by 2010 in line with the Govt’s Fuel Poverty Strategy objective. 按照《政府燃料缺乏战略》中的目标,到2010年时消除英 国弱势群体的燃料缺乏状况 基于成本的公式拨款 Example: project school budget requirements using: 例:学校的项 目预算要求使用: ◦ Cost per student每个学生的成本 ◦ Demographic projections of student numbers学生人数的统计学预测 Output unit cost times expected quantity产出单位预计所需时间量 Can be a ‘mere’ estimation tool 可能“只是”一个预测工具 Or can set implicit performance target也可以形成隐含的绩效目标 ◦ In which case, it’s performance在这样的例子中,这就是绩效预算 机构的拨款激励 Like performance pay for agencies:如同绩效偿付机构 ◦ Extra funding if good performance绩效良好的话可能有额外资金 ◦ Maybe cuts if bad performance绩效不佳可能削减资金 Sectoral bonus funding部门奖金资助 ◦ University funding scheme with extra money on graduate employment rates在毕业生就业率方面有额外资金的大学资助计划 How does it impact motivation?它如何影响动机? ◦ How does it impact on individuals?如何影响个体? 购买方-供应方 Hybrid of formula funding & incentives公式拨款和激励的结合 A simple market transaction model一个简单的市场交易模型 Elements:元素: ◦ Payment of ‘price’ for outputs产出的”价格“支付 ◦ Payment-for-results结果导向的支付 ◦ Price ideally based on cost of efficient production完全基于有效生产成本的价格 Result: profit if efficient, loss if inefficient 结果:高效率产生利润,低效率导致损失 ◦ Strong financial incentives for performance面向绩效的强大财政刺激 医院系统中的DRG系统 Payment for output types 产出类型的支付 ◦ $x for treatment of a hip fracture patient 盆骨骨裂治疗X美元 ◦ $y for treatment of heart attack 心脏病治疗X美元 ◦ Based on cost estimates基于成本估计 Powerful incentive for efficiency效率的有效激励 ◦ Helps to attack cost blow-out problem有助于解决超支问题 Challenges:挑战: ◦ Maintaining quality维护质量 ◦ Preventing abuse防止滥用 资金/结果联系 紧密联系 松散联系 Loose link …………………………………………..Tight link Program Budgeting Zero Base Budgeting 项目预算 零基预算 Targets linked to budget 与预算相连的目标 Formula funding 公式拨款 Purchaser Provider 购买方 提供方 结论 PB has proven potential to improve 绩效预算已证明可以改善 ◦ Expenditure prioritization 支出的优先次序安排 ◦ Efficiency and effectiveness of spending支出的效率和有效性 But success not guaranteed 但是无法保证能否取得成功 Major reform requiring big effort重大改革需要更大的努力来推进 Coupled with broader public sector reforms 涉及更多公共部门的改革