The Boston Matrix

The Boston Matrix

Tom Lu

To Know Boston Matrix

To understand the Boston

Matrix, you need to understand how market share and market growth interrelate.

Market Share and Market Growth

Market share

Market share is the percentage of the total market that is being serviced by your company, measured either in revenue terms or unit volume terms. The higher your market share, the higher the proportion of the market you control.

Market growth

Market growth is used as a measure of a market's attractiveness. Markets experiencing high growth are ones where the total market is expanding, meaning that it’s relatively easy for businesses to grow their profits, even if their market share remains stable.

Function of

Boston Matrix

The Boston Matrix is a well known tool for the marketing manager. It was developed by the large US consulting group and is an approach to product portfolio planning. It has two controlling aspect namely relative market share and market growth.

General Summary of Boston Matrix

•

•

•

•

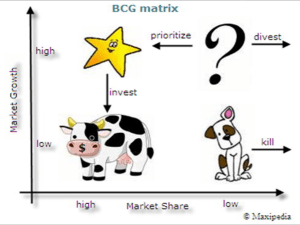

T he BCG matrix was introduced in the late 1960’s, the concepts underlying this matrix are those of the experience curve and the product life cycle. The matrix is made up of four quadrants and the circle size lends a third dimension – turnover.

Cash cows are cash generators and require an invest or hold strategy while maximizing cash flow.

Stars are potential cash cows and require adequate funding to establish a dominant position before the market growth rate slows down and they become cash cows.

Question marks do not have market share on their side. They are found in growing markets and require funding if they are to become stars. If not withdrawal is possible.

Dogs are neither cash generators nor in many instances cash drains.

They can be left alone or removed from the portfolio.

The aim is to achieve a balanced portfolio, sustaining or holding the Cash Cows, investing in the Stars and some select Question Marks and divesting or holding

Dogs. If necessary, Questions marks could also be divested if they do not have a chance of becoming a Star.

The Boston Matrix

The matrix is made up of four quadrants and the circle size lends a third dimension

– turnover.

Details of the sections

Cash cows

- Cash cows are low-growth businesses or products with a relatively high market share.

- These are mature, successful businesses with relatively little need for investment.

- They need to be managed for continued profit - so that they continue to generate the strong cash flows that the company needs for its

Stars.

Stars

- Stars are high growth businesses or products competing in markets where they are relatively strong compared with the competition.

- Often they need heavy investment to sustain their growth.

- Eventually their growth will slow and, assuming they maintain their relative market share, will become cash cows.

Details of the sections

Question marks

- Question marks are businesses or products with low market share but which operate in higher growth markets.

Dogs

- Unsurprisingly, the term

"dogs" refers to businesses or products that have low relative share in unattractive, low-growth markets.

- This suggests that they have potential, but may require substantial investment in order to grow market share at the expense of more powerful competitors.

- Dogs may generate enough cash to breakeven, but they are rarely, if ever, worth investing in.

The Boston Matrix for KFC

Type SBU

STAR

Cash Cow

Question Mark

DOG

Strategy

Hold/Increase

Hold

SBU profits

High

High

Increase/Divest 0 or -

Harvest or Divest Low or-

Required Investment

High

Low

Very High or Disinvest

Disinvest

Net Cash Flow

-or+

High+

High-or+

+

• Continuously generate cash cows and use the cash throw-up by the cash cows to invest in the question marks that are not self-sustaining

• Stars need a lot of reinvestments and as the market matures, stars will degenerate into cash cows and the process will be repeated.

• As for dogs, segment the markets and nurse the dogs to health or manage for cash Three Paths to Failure

• Over invest in cash cows and under invest in question marks

• Trade further opportunities for present cash flow

• Under invest in the stars

• Allow competitors to gain share in a high growth market

• Over milked the cash cows

Advantage/Disadvantage of The Boston Matrix

- Biggest advantage of the

Boston Matrix is take very complex scenarios and allow for a rapid and easy assessment.

- Biggest disadvantage of the

Boston Matrix is it over simplifies a complex decision so the Boston

Matrix should only be used for planning.