PERILLISET NEWBIZ - Family Business Conference 2014

advertisement

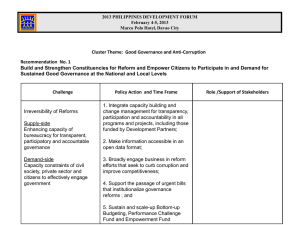

Thomas Ahlström September 2014 Governance and Education • Creating the right preconditions for family company survival • Preparing the Next Generation Survival rates of family companies (world wide) Generation Survival percentage 2nd 30 3rd 10-15 4th 3-5 5th 1-2 6th <0,5 The stakeholders shareholders debt providers employees pressure groups The shareholder – the most important stakeholder Family Private Institution Activist Hedge Fund Raider The family shareholder - The Superstakeholder “In a listed, or a privately held company, there is always a possibility to exit, one way or the other, whereas the fundamental idea about family ownership - in its purest form is to keep the company, own it as a going concern, and pass it on to the next generation”. The ”Golden Cage” I can’t eat my cake! How does this effect governance? If you can’t (or are not supposed to) vote with your feet – you probably want to exercise influence over the company, and ideally, in a much more rigourous way than the average shareholder in the average company Owner – management interest alignment? Governance models Multiple families Single family Complexity³ 1-2 generations Several generations Annual General Meeting Family assembly - Family council Holding company – Supervisory board Big Family - Big Challenges Generation Persons Year of birth 4. 50 1930 - 1960 5. 147 1951 - 2002 6. 137 1980 - 2014 7. 6 340 2008 - 2014 The Ahlström family - direct involvement • Some 340 family members including children and in-laws • Widely spread share ownership, 230+ family shareholders • The fifth generation has taken over at board level • 13 family members serve on 6 different boards, some on 2 boards • 6 family members are nomination board – or committee members • 14 family members serve on the holding company supervisory board • 3 family members are employed in two different companies About 30 persons How do you secure a generation shift • Trust or foundation • Family governance • Traditions, mindset, education, agreed principles • Controlled shift of power At what point do you engage the next generation? Early! Education Courses Mentoring External evaluation Factory visits Finance for family business Ahlström Business Academy I Summer Investor Day Camp Ahlström Business Academy III Strategic thinking - Insead Ahlström Business Academy II Leadership today - MIT Family business - IMD Other external External – private economy 12 18 ”Equal opportunities” General Education 30 ”Based on track record and potential” Specific Education Age How to get the Family Governance Working - our case 1991 1994 1995 1996 1998 2002 First session, Professor John Davies, Harvard Second session First Family Document Third session, Professors A. Lank & F. Neubauer, IMD, Switzerland Family Document 2nd edition ”Family Values and Policies” Family Document 3rd edition Governance & the Family Council Family General Meeting Family Assembly Board Family Council Mgmt Why do Family Councils fail? • The Family Council is a ”fair weather” institution • The power structure of the Family Council is assymetric in relation to the Companies Act, and Articles of Association • It does generally not take into account share based voting rights • It is distant from the real corporate world Back to the drawing board.... 2010 Dr. Annelie Karlsson 2011 Fine tuning of the governance mode 2012-14 Changing the corporate structure Ownership Structure 2014 Ahlström Family 230 shareholders Diffuion Antti Ahlström Perilliset Holding OWNERSHIP ISSUES Ahlström Capital Private equity, industrial investments, real estate, forestry, listed shares, cleantech OPERATIONAL ISSUES Ahlstrom plc Munksjö plc Fiber Technology Specialty Paper Simplyfing a complex world Social Capital Trust and Respect Vision, Mission, Owner Strategy Economic Capital Intellectual Capital Holding Company Operating Company ”And they lived happily ever after” Thomas Ahlström