M Smith - Maths

advertisement

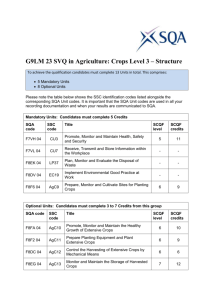

A Teacher’s Perspective Personal Finance Award Mike Smith Curriculum Leader: Mathematics & Numeracy Trinity Academy, Edinburgh Involved since launch by SQA, ifs, LTS Involved in revising Units Involved in development of assessments What do I hope to achieve today? Outline changes and/or revisions to the Units Compare content of ifs / SQA units Give an overview of the (SQA) Units Indicate links to Curriculum for Excellence Indicate some useful resources Describe a way to deliver the Award Changes 1: ‘Structure’ Foundation Certificate in Personal Finance Understanding Money Managing your Money Personal Finance Award Principles of Money Money Management Assessment through SQA Dual certification Changes 2: ‘Content’ – Unit 1 Ifs Principles of Money – What money is? – Where the term money comes from – Where money can be stored – How to open a bank account – Features of current account – Ways money can be debited from account – How to manage cash SQA Principles of Money – Identify money – Identify and describe different forms of income – Describe ways to store and access money – Create and use a budget – Describe how to open a bank account – Foreign exchange Changes 2: ‘Content’ – Unit 2 Ifs Money Management – Sources of income – Features of different savings products – Providers of borrowing products – Items exchanged for money – Different types of spending – Personal budget – Protecting items of value SQA Money Management – – – – In Principles of Money Costs and calculate bills Different forms of borrowing Insurance and long term financial planning – Buying and spending (including auctions) Comparison Has to be ‘comparable’ - for delivery across UK Mostly same material Perhaps ordered differently Changes to fit with CfE Changes to fit with ‘Scottish cohort’ Principles of Money (SCQF level 4) Task 1 Identify Money » Main features of coins and banknotes » What is accepted and recognised as money » Identify what makes money legal tender Task 2 Identify/describe different forms of income » Different ways of earning money » Payslips » Minimum wage, benefits, tax credits Task 3 Store and access money » Personal bank accounts » Accessing money » Debit/credit cards (including costs) Principles of Money (SCQF level 4) Task 4 Creating/using a budget/open bank account » Areas to consider in a personal budget » Short term savings and financial planning » Opening a personal bank account Task 5 Foreign currencies and foreign exchange » Features of some foreign currencies » Currency exchange » Commission or no-commission Money Management (SCQF level 4) Task 1 Investigate costs and calculate bills » Utility bills » Mobile phones and packages » Motoring and travel Task 2 Different forms of borrowing » » » » Task 3 Sources of borrowing How products are promoted Loans and repayments Credit and store cards Insurance and long term planning » Types of insurance, and costs » State pension, private pension » Long term savings accounts Money Management (SCQF level 4) Task 4 Buying and spending » » » » Hire Purchase Discount schemes Buying and selling at auctions Profit and Loss More detailed information in Personal Finance Award section of SQA website where you can download full Unit specifications. Links to CfE All the “money” type Experiences and Outcomes are covered over the two Units These are to be found in the MNU codes There are obvious links to other curricular areas such as Social Subjects, Technology and Health and Well-being Thus inter-disciplinary working is possible Mathematics Outcomes Principles of Money Task 1 Experiences and Outcomes Task 2 MNU4 09 b Task 3 MNU4 09 a Task 4 MNU2 09 a Task 5 MNU3 08 a MNU4 09 c Mathematics Outcomes Money Management Task 1 E and O MNU3 09 a Task 2 MNU2 09 b MNU3 09 a, MNU3 09 b Task 3 Task 4 MNU2 09a, MNU2 09b MNU2 09c MNU4 09a Other Curricular areas Social subjects Technology SOC2 15, SOC2 16, SOC2 21 SOC3 04, SOC3 20, SOC3 21 SOC4 20, SOC4 21 TCH1 03, TCH2 03 TCH3 02, TCH3 07 TCH4 07 HWB HWB3 19 Literacy LIT3 14, LIT 3 15 LIT4 14, LIT4 15 Resources Number of on-line resources which can be done ‘interactively’, or worksheets etc can be downloaded for use in class Ifs website (if previous access) Download pdfs from SQA www.scotbanks.org.uk www.pfeg.org.uk www.moneymadeclear.org.uk www.bbc.co.uk/raw/money (now deleted) www.rbsmoneysense.co.uk www.moneysavingexpert.com www.teachers.tv Other Resources General/Intermediate 1 type material HP Wages Insurance Foreign Exchange etc All readily available from existing resources Spending Sense cd Adds up to a lifetime resource Delivery Mixture of online and workbook Mini-project (‘case study’ type activity) Perhaps do Unit 1 of Intermediate 1 PoM Aug – Nov/Dec (3 hours per week) MM Jan – Easter (3 hours per week) Gives about 40 hours per Unit Allows time for Int 1 unit 1 if desired Delivery My class ‘visits’ four times per week (just over 1 hour) 1 visit could be Unit 1 Int 1 work (or further research) Over about 14 weeks @ 3 visits per week gives a comfortable 40 hours per Unit PoM Aug – Nov/Dec (3 hours per week) » Allows about 8 visits per task » About 2 visits per ‘bullet point’ » But, obviously, adjust to suit » Final visit a review time MM is similar (Jan – Easter) Last slide . . . Thank you for listening mike.smith@trinity.edin.sch.uk