Presentation - Claims Mangement Consulting Pty Ltd

advertisement

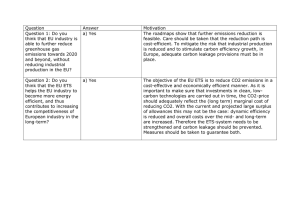

Claims Leakage Control Unique, Detailed and Independent “In a competitive insurance market, controlling claims costs is vital.” Traditional in-house audits may not be the answer Do you measure claims leakage? If so, is the process independent? What is Claims Leakage? Claims Leakage is the loss of time or money from current claims practices and procedures CMC’s Claims Leakage Program measures all aspects of claims cost management from small regular issues to major over payments. Claims costs are the single largest cost of running an insurance company. Why do insurers often only measure their claims service in terms of productivity levels and customer service? CMC’s Claims Leakage Program - improved profitability without additional costs or infrastructure. Benefits of Reducing Claims Leakage Reduce claims spend - every claim dollar saved = $1 profit Compare saving just 2% of claims cost with the effort and expense required to otherwise achieve a 2% increase in net profit Reduced claim expense = • Positive impact on RI costs • Positive impact on regulatory capital requirements Compliance Benefits for claims practices CMC has previously detected Claims Leakage levels ranging from 0.2% to a massive 41% Typically leakage levels of 2% -10% of untapped savings have been found What profit improvements can you make from reduced claims leakage levels? About Claims Management Consulting Pty. Ltd (CMC) CMC was launched in 2000 to provide high quality claims management services to the Insurance Industry CMC’s aim is to be a major reference point on claims cost control and claims service quality. CMC services are suitable for insurers or any organizations handling claims Mark Rayner (Director) has more than 35 years of experience in Insurance Claims Management including National Claims Management roles Mark is a Claims Leakage identification specialist with extensive experience in claims audits Why CMC’s Leakage Program? CMC’s Claims Leakage reviews: - Specialize in reviewing all general insurance classes - Use a purpose built claims leakage database that has been designed by an insurance claims professional - Provide a detailed and accurate measure of claims leakage within claims practices - Demonstrate where operational changes or training needs to be implemented to improve claims outcomes - Becomes the catalyst for positive change and improved operations and claims costs Basic Steps Agree Terms of review Detailed Report Analysis of result Data and Sampling On site Claim Review Data and Sampling Details of recently finalised claims are collected Using CMC’s database selection process a precise extract of claims is undertaken for review 150 claims are selected to accurately represent all recently finalised claims The strict selection criteria is vital to ensure an accurate reflection of all recently finalised claims This method is far more reliable than a random file selection process On Site Claims Review An extensive review of the 150 claims is then conducted by the CMC Representative and a senior local claims handler, using our leakage questionnaire The questionnaire asks over 70 questions of each claim reviewed based on the following common areas of claims leakage: Duplicates Policy Timeliness Adjusters Investigators Solicitors Service Providers Settlement Rework Recoveries Salvage Fraud The results of the review are shown by product, leakage severity, leakage frequency, cost band and in the above categories We comment on every leakage found and those where there is potential for leakage to occur On Site Claims Review 2 CMC works closely with the senior claims executive you nominate as your project leader to ensure we understand your claims systems, processes and procedures. This not only speeds up the file review process, but also ensures it is tailored for your business and produces meaningful results that accurately reflect the leakage outcome. Throughout the process, leakage areas identified are discussed with your nominated project leader. As a consequence, staff involved in the reviews see the leakage first hand and often become “champions” for anti-leakage practices and procedures. Analysis of the results File review data is entered into our database on site This enables constant monitoring throughout the process and enhanced areas of focus where trends are identified Once the File Review is completed and all results have been determined and analysed, we provide a detailed report The report contains: - an executive summary - a detailed commentary on leakages identified - recommendations for leakage control and reduction - a comprehensive set of leakage reports Case Study 1 Scope: Large Australian insurer with a significant commercial portfolio. CMC reviewed their large specialty commercial portfolio in all states Results: Identified claims leakage in all state offices. In one state we were able to identify a massive 41% leakage level due to an absence of recovery processes and checks Action: Recommendations included major process changes which when implemented resulted in immediate improvement in portfolio profitability Case Study 2 Scope: Large Personal Lines insurer requested review of Motor and Home claims Australia wide Results: Able to identify leakage percentage by state office in both motor and home portfolios ranging from under 1% to over 9% Action: The implementation of just one of CMC’s recommendations to change motor damage assessing methods in one state resulted in saving of over $1.7M in the first twelve months This saving represented a significant reduction to the average motor vehicle claims cost Summary CMC’s Claims Leakage Program: Is a powerful, robust yet flexible tool that can be modified to meet the individual needs of each and every client. Introduces claims leakage benefits without affecting customer service Determines the priorities for improvement in claims procedures and training Enable strategies to be developed that WILL positively effect results. Real results – Real savings Mark Rayner. Mobile:+61 403 434 204 Office: +61 2 9874 2727