Non-Life insurance 65.12

advertisement

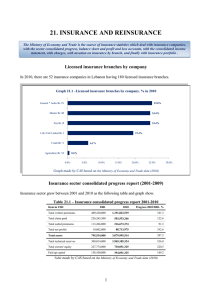

65.12 Non-Life Insurance Developing a new industry index Susanna Tåg 15.5.2014 Agenda Background Classification Definition About the industry Different approaches Methods Situation in some other countries Data collection and weights Challenges Background Developing industry-specific indices for K Financial and insurance industry Direct banking: calculating, not yet publishing FISIM: following, from NA, not yet published Next starting to develop the index for insurances, firstly for non-life insurances 3 Classification 65 Insurance, reinsurance and pension funding, except compulsory social security 65.1 Insurance 65.11 Life insurance 6511 65.12 Non-life insurance 6512 65.2 Reinsurance 65.20 Reinsurance 6520 65.3 Pension funding 65.30 Pension funding 4 Definition … according to ESA2010: ” Insurance is an activity whereby institutional units or groups of units protect themselves against the negative financial consequences of specific uncertain events. Two types of insurance can be distinguished: social insurance and other insurance.” 5 About the industry (1/4) The insurance policy defines the roles of the parties involved, which are as follows: (a) the insurer providing cover; (b) the policyholder responsible for paying premiums; (c) the beneficiary who receives compensation; (d) the insured person or object that is subject to the risk The most common form of insurance is called direct insurance, which can be divided into life insurance and non-life insurance 6 About the industry (2/4) The output of 65.1 Insurance in 2010: €1.9bn euro From which the output of 65.12 non-life insurance €1.0bn BtoB €584M, BtoC €420M 7 About the industry (3/4) Non-life insurance: premiums written (BtoAll) - Premiums written include reinsurers’ part, not credit losses - Premiums written (BtoAll) were in 2012 €3.6bn. (The Federation of Finnish Financial Services) Fire and other damage to property Motor liability Motor vehicle Workers’ compensation Other accident and health General liability Marine, aviation and transport Legal expenses Other direct insurance Credit and suretyship 8 About the industry (4/4) Non-life insurance: premiums written (BtoB) - Premiums written (BtoB) were in 2012 €1.7bn (The Federation of Finnish Financial Services) Workers’ compensation Fire and other damage to property Motor vehicle General liability Motor liability Other accident and health Marine, aviation and transport Other direct insurance Credit and suretyship Legal expenses 9 Different approaches Activity-based premiums + invested income - claims Assumption of risk premiums + invested income 10 Methods Model pricing Difficult to maintain? Unit value Quality changes? Premiums Method in CPI; claims (compensations paid) are deducted from the value weight of insurance premiums Inconsistencies between nominal value and production volume? (NA) 11 Situation in some other countries The Czech Republic Motor damage insurance, fire insurance, theft or robbery insurance, agriculture insurance Method: combination of model pricing/direct use of repeated services Japan Voluntary motor vehicle insurance, compulsory motor vehicle insurance, fire insurance, marine and other transportation insurance services 12 Situation in some other countries USA Direct Health and medical insurance carriers, direct property and casualty insurance carriers Methods: model pricing (estimated premiums for “frozen” policies) or actual premium charged Canada Direct Life, health and medical insurance carriers, direct insurance (except life, health and medical) carrier, reinsurance carriers Methods: model pricing or unit value 13 Data collection and weights Sample 4 largest companies cover over 90 % of the insurance market Administrative data Questionnaire response burden Weights Statistics on Insurance Activities 14 Challenges (1/2) “It is widely recognised that the insurance industry is one of the most difficult parts of the national accounts to deal with “ (Chessa, 2010) 15 Challenges (2/2) Definition of output premiums + investment income earned - the expected claim = margin (ESA 2010) Use as a deflator? “Given that the premiums are set with the future expected claims and investment earning in mind; a deflator constructed from premiums data alone, though not ideal, may be sufficient” (Yocom et al. 2011) 16 Thank you for your attention! Questions? Susanna Tåg susanna.tag@stat.fi tel. +358 9 1734 2991 Anna-Riikka Pitkänen anna-riikka.pitkanen@stat.fi tel. +358 9 1734 3466 17 Sources Chessa, A.G. 2010. A new method for price and volume measurement of non-life insurance services for the Dutch national accounts. Statistics Netherlands. European System of National Accounts (ESA 2010) Yocom, J., Opsitnik, L. and Neofotistos, S. 2011. ”Direct Insurance Carriers Services in Canada ”. Statistics Canada. 18