Digital Panel - ACP: The Coupon Professionals

advertisement

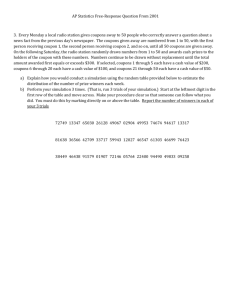

Tracking the Progress of Digital Coupons YOUR MODERATOR: MARK HECKMAN, PRINCIPAL OF MHC…. Over 30 years of supermarket retailing experience as VP of Marketing at Marsh, Randalls-Tom Thumb and Food Industry Service Providers such as VRMS, Sorensen Research, and MARC Advertising Our Discussion Last Year…. Are We Truly Entering the Age of Dominant Digital Content? What Remain the Biggest Inhibitors to Digital Couponing Growth? Going Forward, How Do Our Panelist See the Future of the Coexistence of Paper and Digital? As Coupon Professionals, How Will our Skill Sets and Professional Activities Change with the Emergence of Digital? Our Conclusions from 2013 • Digital Coupon volume and quality will grow at a steady pace as more retailer engage….but not likely a “hockey stick” shaped inflection point. • The volume of Digital Coupon offers and content, while improving, yet still is not sufficient to attract a critical mass audience. • Paper coupons, while diminishing in its dominance, is not going away…at least anytime soon. There are viable roles, uses, and audiences for both. • Digital Coupon accelerates the process of distribution, clearing and accounting. Industry pros will need to adapt to the speed and the inherent need from brands and retailers to understand impact in near real time. The Digital Lexicon • • • Print at Home (PAH), Digital FSI, NET: – Coupons delivered digitally to the consumer on website for selection, but are printed on home printers to bring to store. Load to Card, Save2Card, Load to Account, Direct to Card, eWallet, eCoupon: – Coupons that are delivered digitally to the consumer on website or mobile device that are either selected or directly placed in the shopper’s account. These digital coupons are activated when shopper purchases the associated item and identifies themselves as the account holder at the point of sale. Clips: A digital coupon that is either loaded to card or printed at home Much Attention, Financial and Otherwise…Being Given to Digital But the Paper Mills are Still Humming Coupons Offered FSI All Other 12.7% Source: Inmar Coupon Trends Study, 2013-2014 87.3% FSI 87.3% of Coupons Offered Digital Remains Small But Growing % of Coupons Redeemed All Other 28% Checkout 8% Digital 2% PAH 5% Source: Inmar Coupon Trends Study, 2013-2014 2013 66 Million Digital Coupons Redeemed …2.3% of Total FSI 41% Instant Redeem 16% Tracking the Digital Numbers 2012 2013 L2C L2C • Coupons Issued – 250 Million Digital Clips • Coupons Redeemed – 27 Million --- RR 11.20% • Face Value --- $1.23 • 15,000 Retail Roof Tops Offering Open Network L2C Coupons • Coupons Issued – 1.1 Billion Digital Clips • Coupons Redeemed – 66 Million --- RR 6.23% • Face Value --- $1.40 • 17,000 Retail Roof Tops Offering Open Network L2C Coupons Source: Inmar Coupon Trends Study, 2013-2014 Tracking the Numbers 2012 2013 PAH PAH • 1.35 Billion Coupons Issued • 137 Million Coupons Redeemed • RR --- 17.7%,. • Face Value --- $1.74 • Approximately 1.27 Billion Issued • 145 Million Coupons Redeemed • RR --- 17% • Face Value --- $1.86. Source: Inmar Coupon Trends Study, 2013-2014 Today’s Panel Henri Lellouche: GM Smartsource iGroup Today’s Panel Travis Lewis, President, Promotion Network Patrick Moorhead Today’s Panel Franklyn Farace Today’s Panel Cheryl Black, President, CEO YOU Technology Today’s Panel Brian Brinkley, CTO Barriers to Digital Couponing • Lack of Technology Integration (In-store) – POS integration and L2C or L2A Capabilities • Competing Value Propositions – Brands and Retailer still Vested in Paper Coupons and Traditional Promotions • Dearth of Digital Content – Too few Digital Offers – Low Household Penetration Categories • Restrictive Purchase Requirements • For L2C, Still Too Few Retailers Offering the Service Discussion Topics this Year • Overall, given the trends in Digital Coupons over the last two years, how would you characterize the results…. Surprisingly Strong, As Expected, or Disappointing? • Off the barriers to growth we have cited, which are the most formidable and how can we as agents of the industry, help mitigate those barriers? • As consumer adaptation of smart phone technology and other shopper aides, increase, is there a case to be made, especially to food retailers, that digital couponing can be leveraged as a competitive advantage? Discussion Topics this Year • Unlike FSI, L2C coupons require retailer engagement and support. How would you characterize this support currently and what could or must retailers do to help L2C/L2A coupon programs become more effective and mainstream? • Finally, crystal ball time. Given the trends and numbers we are experiencing in L2C/L2A and PAH, how will we be characterizing digital coupon growth next year at the ACP? – Steady, more of the same steady growth – A big year, some real breakthroughs occurred – We’ve hit a saturation point, growth is slowing