EULA presentation

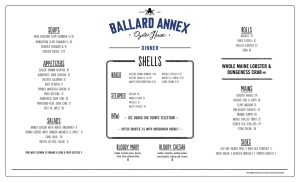

advertisement

The European lime outlook OCTOBER 2014 ILA, GENERAL ASSEMBLY, VANCOUVER MS. ELENI DESPOTOU Overview of the presentation • EuLA: who are we? • EU lime markets • Quicklime production • EU lime industry challenges • Conclusions Who we are: The European Lime Association, created in 1990, is the voice of the European lime sector. • EuLA provides sector-base representation for the lime industry at European level, including technical, scientific and administrative support to its members on noncommercial issues. This includes: • Addressing the current complex legislative framework; • Speaking with one voice on scientific and technical dossiers; • Managing horizontal sectorial issues of common concern including sustainable development, Corporate Social Responsibility, Health & Safety, Environmental Protection, Energy, Communications and end-of-use product legislation; • Promoting Best Practices. EuLA Members Country National association Austria Fachverband der Sten-und keramischen industrie Belgium FEDIEX Bulgaria Plena Bulgaria OOD Czech Republic Czech Lime Association Denmark Faxe kalk Estonia Nordkalk Finland Finish Lime association c/o Nordkalk Corporation France Union des Producteurs de Chaux Germany Bundesverband der Deutschen Kalkindustrie Greece Hellenic Lime Association Hungary Carmeuse Hungaria Kft Ireland Clogrennane Lime Ltd Italy CAGEMA Norway Franzefoss Bruk A/S Poland The Polish Lime Association Portugal Lucical/ Calcidrata Slovak Republic Carmeuse Slovakia Spain ANCADE Sweden Swedish Lime Association c/o SMA Svenske Mineral AB Switzerland Kalkfabrik Netstal AG United Kingdom British Lime Association What EuLA represents Structure General assembly Board Bureau Technical & Environment Committee Lime Application Committee “Task Forces” “Task Forces” Standardisation committee EU Lime Markets EU lime industry challenges • Limited growth or no growth • Stringent legislation (climate change, environment, energy) • EU policy environment • Neighbourhood political environment • High energy costs and cost competitiveness Result • Shrinking of the industry Lime sector – Total CO2 emissions 35,000,000 30,000,000 25,000,000 20,000,000 15,000,000 10,000,000 5,000,000 0 2007 Source: CITL 2008 2009 2010 2011 2012 Quicklime – Process & Combustion CO2 25,000,000 20,000,000 15,000,000 10,000,000 5,000,000 0 2010 Total Process CO2 emissions (tons) Source: EuLA (database) 2011 2012 Total Combustion CO2 emissions without biomass (tons) Manufacture of lime - Average share of CO2 emissions Manufacture of lime - fuel mix EU legislation • EU wordlwide pionner on climate change related legislation • New climate and energy package 2030 - 43% GHG emissions reductions for industry (binding) - 27% RES contribution (binding at EU level) - 30% Energy efficiency (indicative) VS - 20% target for industry contribution to the EU GDP. (aspirational) Source: European Commission report on “Energy prices and costs in Europe”, SWD(2014)20, January 2014 European Commission report on “Energy prices and costs in Europe”, SWD(2014)20, January 2014 Source: European Commission report on “Energy prices and costs in Europe”, SWD(2014)20, January 2014 European Commission report on “Energy prices and costs in Europe”, SWD(2014)20, January 2014 Source: European Commission report on “Energy prices and costs in Europe”, SWD(2014)20, January 2014 European Commission report on “Energy prices and costs in Europe”, SWD(2014)20, January 2014 Source: European Commission report on “Energy prices and costs in Europe”, SWD(2014)20, January 2014 European Commission report on “Energy prices and costs in Europe”, SWD(2014)20, January 2014 Source: European Commission report on “Energy prices and costs in Europe”, SWD(2014)20, January 2014 Source: European Commission report on “Energy prices and costs in Europe”, SWD(2014)20, January 2014 Energy and costs competitiveness • As of 2011 the EU dominates the export market for energy-intensive goods, accounting for more than two-thirds of export value, which makes it the largest export region for energy intensive goods. • One can expect that regional price disparities increase the risk of reduced production levels and investment in higher priced countries and bring changes in global trade patterns, in particular affecting industries that have a high share of energy costs and are exposed to international competition because their production is easy and relatively cheap to transport. • This is supported by analysis undertaken by the IEA in the 2013 World Energy Outlook, which shows that persistently high energy price disparities can lead to important differences in economic structure over time and have far-reaching effects on investment, production and trade patterns. CONCLUSIONS • Stagnante market due to stagnante economy • Limited new Investment • Limited perspective to reverse the trend in a short term • New mandate for the EU institutions in place… THANK YOU! www.eula.eu