Solutions 2

advertisement

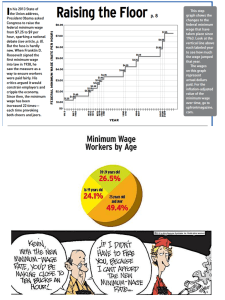

1) Provide three original examples of positive economics and the three associated cases of normative economics • In college, there are more women than men / Colleges should have the same number of men and women. • Fewer and fewer students decide to go to college / The number of students who choose to study at university should be larger. • There are two million pigeons in Barcelona / Tourists who feed them should be fined. 2) Provide one example of positive externality and one example of negative. Try to be original and do not use examples from class • What’s an externality? • An externality is an unexpected result in some economic activity which can have a positive or a negative social consequence; that is, a benefit or cost which is not reflected in the market • Intervention? Solution to 2) • Positive externality: Under my house they opened a bakery and the aroma of bread improves my morale in the mornings • Negative externality: Under my house they opened a bakery and the aroma of bread makes me hungry, … I gained two kilos as a result. • The state can sanction and fund various activities, according to the externality produced. • An externality has to be the result of economic action. For example, the fact that others have flu, by itself, is not an externality 3) Discuss a case in favor of the income tax. Discuss another one against it. Think in terms of the efficiency and equality concepts and the relation with positive/normative economics • It is necessary to argue the reasons regarding positive and normative economics • Example: – We want to ensure state services, defense, etc (normative economics). – In order for the state to have this money, it should collect taxes (Positive Economy) – The state could control some companies to make money, but history has shown that public business often have losses (Positive Economy). – An income tax can “solve” this problem, because it does not distort the incentives of the population in the activity they want to develop, but it reduces incentives to work in general (Positive Economy). – A "per capita" tax does not distort anyone and is simpler to calculate (positive economics) – We might “prefer” the tax on income because is more equitable – We might “prefer” the per capita tax because is more efficient 4) The minimum wage • What’s the minimum wage? • What’s its purpose? • What’s its real effects? • Who promotes it? 4) The minimum wage a) There will be unemployment, because at the minimum wage there are more people willing to work than jobs available Real wage Labor supply N Eq Minimum wage Eq Labor demand No. workers/hours 4) The minimum wage b) No effect Real wage Labor supply N Eq Eq Minimum wage Labor demand No. workers/hours