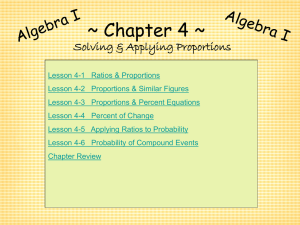

Chapter 5

advertisement

Chapter 5 The Theory of Trade and Investment 1 Learning Objectives To understand the traditional arguments of how and why international trade improves the welfare of all countries To review the history and compare the implications of trade theory from the original work of Adam Smith to the contemporary theories of Michael Porter To examine the criticisms of classical trade theory and examine alternative viewpoints of which business and economic forces determine trade patterns between countries To explore the similarities and distinctions between international trade and international investment 2 Evolution of Trade Theory The Age of Mercantilism Classical Trade Theory Factor Proportions Trade Theory International Investment and Product Cycle Theory The New Trade Theory: Strategic Trade The Theory of International Investment 3 The Age of Mercantilism The evolution of trade into the form we see today reflects three events: The Collapse of Feudal Society The Emergence of the Mercantilist Philosophy The Life Cycle of the Colonial Systems of the European Nation-States 4 Mercantilism Mixed exchange through trade with accumulation of wealth Conducted under authority of government Demise of mercantilism inevitable 5 Classical Trade Theory The Theory of Absolute Advantage The ability of a country to produce a product with fewer inputs than another country The Theory of Comparative Advantage The notion that although a country may produce both products more cheaply than another country, it is relatively better at producing one product than the other 6 Classical Trade Theory Contributions Adam Smith—Division of Labor Industrial societies increase output using same labor-hours as pre-industrial society David Ricardo—Comparative Advantage Countries with no obvious reason for trade can specialize in production, and trade for products they do not produce Gains From Trade A nation can achieve consumption levels beyond what it could produce by itself 7 Factor Proportions Trade Theory Developed by Eli Heckscher Expanded by Bertil Ohlin 8 Factor Proportions Trade Theory Considers Two Factors of Production Labor Capital 9 Factor Proportions Trade Theory A country that is relatively labor abundant (capital abundant) should specialize in the production and export of that product which is relatively labor intensive (capital intensive). 10 The Leontief Paradox The Test: Could Factor Proportions Theory be used to explain the types of goods the United States imported and exported? The Method: Input-output analysis 11 The Leontief Paradox The Findings: The U.S. exported labor-intensive products and imported capitalintensive products. The Controversy: Findings were the opposite of what was generally believed to be true! 12 Overlapping Product Ranges Theory: Staffan Burenstam Linder Trade in manufactured goods dictated not by cost concerns, but by similarity in product demands across countries. Work focused on preferences of consumer demand. Today, termed market segments. 13 Product Cycle Theory Raymond Vernon Focus on the product, not its factor proportions Two technology-based premises 14 Product Cycle Theory: Vernon’s Premises Technical innovations leading to new and profitable products require large quantities of capital and skilled labor The product and the methods for manufacture go through three stages of maturation 15 Stages of the Product Cycle The New Product The Maturing Product The Standardized Product 16 The Product Cycle and Trade Implications Increased emphasis on technology’s impact on product cost Explained international investment Limitations Most appropriate for technology-based products Some products not easily characterized by stages of maturity Most relevant to products produced through mass production 17 The New Trade Theory: Strategic Trade Two New Contributions Paul Krugman-How trade is altered when markets are not perfectly competitive Michael Porter-Examined competitiveness of industries on a global basis 18 Strategic Trade Krugman’s Economics of Scale: Internal Economies of Scale External Economies of Scale 19 Strategic Trade Government can play a beneficial role when markets are not purely competitive Theory expands to government’s role in international trade Four circumstances exist that involve imperfect competition in which strategic trade may apply 20 Strategic Trade The Four Circumstances Involving Imperfect Competition: Price Repetition Cost Externalities 21 Strategic Trade Porter’s Diamond of National Advantage Innovation is what drives and sustains competitiveness Four components of competition Factor Conditions Demand Conditions Related and Supporting Industries Firm Strategy, Structure, and Rivalry 22 Michael Porter’s Competitive Clusters Critical masses of unusual competitive success in particular fields, located in one place 23 The Theory of International Investment The movement of capital has allowed foreign direct investments across the globe 24 The Theory of International Investment Firms as Seekers Seeking Seeking Seeking Seeking Seeking Resources Factor Advantages Knowledge Security Markets 25 The Theory of International Investment Firms as Exploiters of Imperfections Imperfections in Access Imperfections in Factor Mobility Imperfections in Management Firms as Internalizers Establish their own multinational operationsinternalize production Competitive advantage due to confidentiality 26