ppt - GFOAz

advertisement

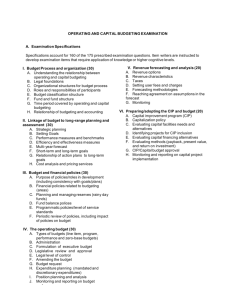

GFOA Best Practices in Budgeting Government Finance Officers Association of Arizona Thursday, October 25, 2012 Eric R. Johnson Hillsborough County, (Tampa) FL A GFOA best practice identifies specific policies and procedures as contributing to improved government management. It aims to promote and facilitate positive change rather than merely to codify current accepted practice. Partial implementation is encouraged as progress toward a recognized goal. GFOA has established standing committees to develop best practices in six functional areas – one of which is the Committee on Budgeting and Fiscal Policy. Nine best practices are highlighted here. Public Participation in Planning, Budgeting and Performance Management (2009) Background. Good public participation practices can help governments be more accountable and responsive, and can also improve the public’s perception of governmental performance and the value the public receives from the government. Public Participation in Planning, Budgeting and Performance Management (2009) Recommendation. GFOA recommends that governments incorporate public participation efforts in planning, budgeting, and performance management results processes; and that to ensure effective and well implemented public participation processes, governments include the following considerations in designing their efforts: Purposes for involving the public; assurances that they are getting the public’s perspective rather than only that of a small number of highly vocal special interest groups; approaches to eliciting public participation and the points in the planning-budgeting-performance management cycle those approaches are likely to be most effective; information that the process will be incorporated into decision making; communication to the public regarding how the information collected will be and was used; and buy-in from top government officials. The Overview of Performance Management: From Measurement and Reporting to Management and Improving (2011) Background. GFOA has long urged state and local governments to incorporate performance measurement as an integral part of their budget process, as recommended by the National Advisory Council on State and Local Budgeting. Likewise, the GFOA is persuaded that the full benefit of performance measurement can only be achieved when performance measures and performance reporting are further integrated into an overall framework of performance management. The National Performance Management Commission, representing eleven national public interest organizations of elected and appointed state and local government officials (including the GFOA), issued a report in 2010, A Performance Management Framework for State and Local Government: From Measurement and Reporting to Management and Improving. The Overview of Performance Management: From Measurement and Reporting to Management and Improving (2011) The National Performance Management Commission: Association of School Business Officials International Council of State Governments Government Finance Officers Association International City/County Management Association National Association of Counties National Association of State Auditors, Comptrollers, and Treasurers National Center for State Courts National Association of State Budget Officers National Conference of State Legislatures National League of Cities United States Conference of Mayors The Overview of Performance Management: From Measurement and Reporting to Management and Improving (2011) Background. The framework developed by the Commission is flexible and provides an overview for use by all state, provincial and local entities – cities, counties, special districts, schools, and the judiciary. It is conceptual, based on principles the Commission agreed are the foundation of sustainable and sound public-sector performance management systems. The Overview of Performance Management: From Measurement and Reporting to Management and Improving (2011) Background. The framework developed by the Commission : A results focus permeates strategies, processes, the organizational culture, and decisions. Information, measures, goals, priorities, and activities are relevant to the priorities and wellbeing of the government and the community. Information related to performance, decisions, regulations, and processes is transparent — easy to access, use, and understand. Goals, programs, activities, and resources are aligned with priorities and desired results. Decisions and processes are driven by timely, accurate, and meaningful data. Practices are sustainable over time and across organizational changes. Performance management helps to transform the organization, its management, and the policymaking process. The Overview of Performance Management: From Measurement and Reporting to Management and Improving (2011) Recommendation. The purpose of public-sector performance management (shown throughout the commission’s report) is to provide a systematic approach to managing performance through concepts, practices and processes that align governments’ efforts to achieve the best possible results for the public within available resources. Performance management emphasizes the importance of continuous learning, improvement, and accountability for results. Therefore, the GFOA strongly endorses the work of the National Performance Management Commission and encourages state and local governments to implement performance management systems consistent with its recommendations. The Overview of Performance Management: From Measurement and Reporting to Management and Improving (2011) http://www.pmcommission.org/APerformanceManagementFramework.pdf Appropriate Level of Unrestricted Fund Balance in the General Fund (2002 and 2009) Background. It is essential that governments maintain adequate levels of fund balance to mitigate current and future risks (e.g., revenue shortfalls and unanticipated expenditures) and to ensure stable tax rates. Fund balance levels are a crucial consideration, too, in long-term financial planning. Appropriate Level of Unrestricted Fund Balance in the General Fund (2002 and 2009) Recommendation. GFOA recommends that governments establish a formal policy on the level of unrestricted fund balance that should be maintained in the general fund. Such a guideline should be set by the appropriate policy body and should provide both a temporal framework and specific plans for increasing or decreasing the level of unrestricted fund balance, if it is inconsistent with that policy. The adequacy of unrestricted fund balance in the general fund should be assessed based upon a government’s own specific circumstances. Nevertheless, GFOA recommends, at a minimum, that general-purpose governments, regardless of size, maintain unrestricted fund balance in their general fund of no less than two months of regular general fund operating revenues or regular general fund operating expenditures – based on which is more predictable. Replenishing Fund Balance in the General Fund (2011) Background. It is essential that governments maintain adequate levels of fund balance to mitigate risks and provide a back-up for revenue shortfalls. Replenishing Fund Balance in the General Fund (2011) Recommendation. GFOA recommends that governments adopt a formal fund balance policy that defines the appropriate level of fund balance target levels. Also, management should consider specifying the purposes for which various portions of the fund balances are intended. This additional transparency helps decision makers understand the reason for maintaining the target levels described in the fund balance policy. Governments should also consider providing broad guidance in their financial policies for how resources will be directed to fund balance replenishment. Finally, a government should consider including in its financial policy a statement that establishes the broad strategic intent of replenishing fund balances as soon as economic conditions allow. This emphasizes fund balance replenishment as a financial management priority. Presentation of the Capital Budget in the Operating Budget Document (2008) Background. A government should decide how to best present major capital program highlights in the operating budget document. An exceptional capital presentation enhances the transparency and accountability to citizens. It gives a broader context for citizens to understand major components of the capital budget and its relationship to the operating budget. Presentation of the Capital Budget in the Operating Budget Document (2008) Recommendation. GFOA recommends that governments consider the following guidelines when incorporating information on the capital budget within the operating budget document. Presentation of the capital section should include a summary of the multi-year capital plan as well as detailed information related to the budget. Each government will need to establish the appropriate balance between summary-level and detailed information. Guidelines: Placement of information, definition of capital expenditures, sources and uses, capital process, recurring vs. nonrecurring projects, project description, operating impact, timetable, graphics, links to additional information. Presentation of the Departmental Section in the Operating Budget Document (2012) Background. The departmental section traditionally has focused on accomplishments and detailed financial schedules. Emphasis is also being placed on describing programs or services and how their objectives will be met. A well-designed departmental section can enhance a reader’s understanding of the purpose of funded programs or services, as well as their cost. Presentation of the Departmental Section in the Operating Budget Document (2012) Recommendation. GFOA recommends that governments consider the following guidelines when presenting information in the departmental section of the operating budget document: The formatting/design; avoiding excessive detail; including a description of services or functional responsibilities; discussing challenges, issues, and opportunities; showing revenues that may include any fees or charges that the department generates; analysis of expenditures in a broad manner; staffing information; explaining how services are prioritized; and including performance measures. Budgeting for Results and Outcomes (2007) Background. A growing number of governments use the budgeting for results and outcomes approach – they begin with available revenues, continue with a consideration of desired results and strategies, and then conclude by deciding what activities and programs can best achieve desired results. Budgeting for results and outcomes links strategic planning, long-range financial planning, performance measures, budgeting, and evaluation. It also links resources to objectives at the beginning of the budgetary process, so that the primary focus is on outcomes rather than organizational structure. Budgeting for Results and Outcomes (2007) Recommendation. GFOA recommends that governments consider budgeting for results and outcomes as a practical way of integrating performance into the budgetary process. The following steps should help a government in making this successful transition: Determine how much money is available; prioritize results; allocate resources among high priority results; conduct analysis to determine what strategies, programs, and activities will best achieve desired results; budget available dollars to the most significant programs and activities; set measures of annual progress, monitor, and close the feedback loop; check what actually happened; and communicate performance results. Managing the Salary and Wage Budgeting Process (2010) Background. Accurate expenditure projections are more important than ever. Since salaries make up the greatest portion of the expenditure budget, it is logical to apply forecasting techniques that can provide a true picture of where payroll dollars are headed. Governments can use various mechanisms to manage headcount levels in light of cost constraints. Managing the Salary and Wage Budgeting Process (2010) Recommendation. GFOA encourages governments to consider forecasting procedures that would result in more accurate expenditure projections, especially as they relate to personnel. The items shown below provide governments with the areas in which they should consider adopting practices to more effectively budget salary and wages. Additionally, in order to analyze total compensation, benefits need to be considered. Use a personnel tracking system; adjust for vacancies (start dates, trends, frozen positions, attrition); recognize the impact of collective bargaining units; consider the impact of inflation; determine optimal staffing levels; consider the approach to compensation (steps vs. merit pay) and personnel categorizations (e.g., in-house vs. contracted); and monitor expenditures. Inflationary Indices in Budgeting (2010) Background. Governments are under considerable pressure to relate their spending and taxation levels to cost inflation, yet each local government’s experience with inflation can differ greatly from a national average. Local governments would benefit from having a well-constructed index of the changing costs of providing municipal services, but few governments have attempted to build and effectively use such a measure. This best practice reviews some of the options available for creating a municipal price index, and for dealing with some of the problems inherent in developing a cost index. Inflationary Indices in Budgeting (2010) Recommendation. GFOA encourages every government to consider using the inflation indices that work best as a predictor. This may mean the use of different indices depending on the expenditure category. The government should define the purpose for using an inflationary index and then select the appropriate index. Referenced indexes include the Consumer Price Index, Producer Price Index, Employment Cost Index, Construction Price Index, Municipal Cost Index, Personal Consumption Expenditures Index, and the Gross Domestic Product Deflator. Inflationary Indices in Budgeting (2010) Municipal Cost Index August 2012 For a complete list of Best Practices, go to www.gfoa.org and select the link for “Best Practices and Advisories” and then select the category “Budgeting and Fiscal Policy”