Financial Literacy - Colorado State Plan CTE

advertisement

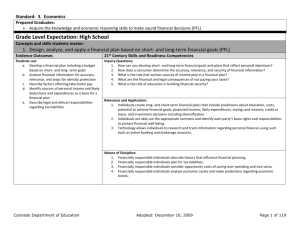

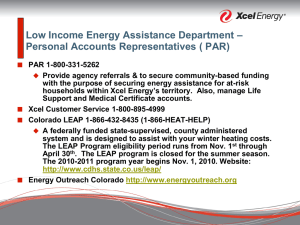

Personal Financial Literacy Implications for Colorado Teachers Colorado Academic Standards The Need for Personal Financial Literacy • 55% of parents with children 16-24 voiced concern over their child’s ability to become financially independent • 1 in 3 parents have taught their teen how to balance a checkbook, fewer (29%) explained how credit cards work Colorado Academic Standards • 93% of parents worry their teen will make financial missteps • 72% of parents acknowledge they are the primary source of PFL education • 1 in 4 parents are not currently saving for retirement or their child’s education Colorado Academic Standards • More than 2/3’s of parents feel less prepared to give financial guidance than they do talking about the “birds & bees” • 47% of teens between 12-17 have a savings account, 12% have a checking account, and 15% have an ATM Colorado Academic Standards Personal Financial LiteracyThe first approach…making it simple Colorado Academic Standards Agenda • Highlights: standards revision process • Key Features: PFL Expectations • Deeper Look: PFL expectations • Grounding: PFL expectations • Other Support Colorado Academic Standards How familiar are you with the PFL writing process? a. I heard something about that b. What is PFL? c. I am ready for implementation Colorado Academic Standards Phases of Implementation for Colorado’s Revised Academic Standards Awareness & Dissemination: What is new? Transition: Moving to the new standards Implementation: Transformation: Making Meaning Change in Teaching and Learning Colorado Academic Standards What are the of personal financial literacy within the standards revision process? Colorado Academic Standards Parameters for the standards revision process Research Based •West Ed and CDE collaborated to gather national and international research Inclusive •Educators, citizens, higher education, business & industry •Feedback ongoing from stakeholders throughout the process Transparent •All could see updates, notes, and deliberations Colorado Academic Standards National & International Review Stakeholders help frame the design Writing Subcommittees Feedback from National Experts & Colorado Citizens Colorado Academic Standards Colorado Academic Standards State Board of Education Colorado Department of Education Personal Financial Literacy Subcommittee Financial Literacy Recommendations Economics Grade Level Expectations Mathematics Evidence Outcomes Conference Committee Integrated into Economics and Mathematics Colorado Academic Standards What is your level of awareness of the PFL expectations? a. I have thoroughly read through ALL of the PFL expectations and made note of implications for my district. b. I have read the PFL expectations. c. I have skimmed the PFL expectations. d. I have not yet read the PFL expectations. Colorado Academic Standards Features of Personal Financial Literacy Expectations Colorado Academic Standards House Bill 1168 Manage savings, investments, checking accounts Design and maintain a household budget Manage personal debt Understand consumer credit & finance Manage personal credit options Select among short-term and long term investments Colorado Academic Standards Financial Literacy Four Key Areas Goal Setting, Careers, and Financial Responsibility Planning, Income, Saving, and Investing Credit Risk Management and Insurance Prepared Graduate Competency in Economics Acquire the knowledge and economic reasoning skills to make sound financial decisions (PFL) Colorado Academic Standards Assessing Personal Financial Literacy • Within the new Colorado assessment system • Within the mathematics assessment at each assessed grade level • Details available in the future Colorado Academic Standards A deeper look at the PFL expectations? Colorado Academic Standards The Template Content Area: Standard Prepared Graduates: High School and Grade Level Expectations Concepts and skills students master: Evidence Outcomes Students can: 21st Century Skills and Readiness Competencies Inquiry Questions: Relevance and Application: Nature of the Discipline: Colorado Academic Standards High School example Economics Expectation: Analyze the components of personal credit to manage credit and debt Economics Evidence Outcomes: Mathematics Evidence Outcomes: Analyze various lending sources, services, and financial institutions Investigate legal and personal responsibilities affecting lenders and borrowers Make connections between building and maintaining a credit history and its impact on lifestyle Evaluate the costs and benefits of credit (2.6f) Analyze various lending sources, services and financial institutions (2.6g) Colorado Academic Standards Content Area: Mathematics Standard: Patterns, Functions, and Algebraic Structures Prepared Graduate Competencies: Use critical thinking to recognize problematic aspects of situations, create mathematical models, and present and defend solutions High School Expectation Concepts and skills students know include: 6. Identify essential quantitative relationships in a real-world problem, use elementary functions to develop a mathematical model, and use all available tools, including technology, to find and interpret solutions. Evidence Outcomes 21st Century Skills and Readiness Competencies Students can: Inquiry: What phenomena can be modeled with particular functions? Which financial applications can be modeled with exponential functions? Linear functions? How can patterns, relations, and functions be used as tools to describe and explain real-life situations? What elementary function or functions best represent(s) a given scatter plot of two-variable data? How much would today’s purchase cost tomorrow? (PFL) What is the difference between simple and compound interest and how do these relate to linear and exponential growth? (PFL) a.Represent and solve problems in various contexts using linear and quadratic functions b.Represent and solve problems in various contexts, including investment growth and depreciation, using power and exponential functions c. Represent and solve problems involving direct and inverse variations and a combination of direct and inverse variation d.Analyze the reasonableness of a solution in its given context and compare the solution to appropriate graphical and numerical estimates e.Analyze the impact of interest rates on a personal financial plan (PFL) f.Evaluate the costs and benefits of credit (PFL) g.Analyze various lending sources, services and financial institutions (PFL) Applying Mathematics in Society and Using Technology: Use translations of elementary functions to model real-world data Use functions to represent population growth Use spreadsheets to calculate loan amortization and make predictions about a personal financial plan (PFL) Investigate the implications of inflation on income, budgets, savings and spending. Apply interest formulas to explore the effect of compound interest on an investment over time (PFL) Compare the costs of different ways of obtaining credit (PFL) Analyze the most cost-effective option for a large purchase (PFL) Colorado Academic Standards Nature of Mathematics: Mathematicians represent concepts concretely and use multiple representations Content Area: Social Studies Standard: Economics Prepared Graduates: Acquire the knowledge and economic reasoning skills to make sound financial decisions (PFL) Grade Level Expectation: High School Concepts and skills students master: 6. The components of personal credit to manage credit and debt(PFL) Evidence Outcomes Students can: a. Analyze various lending sources, services, and financial institutions b. Investigate legal and personal responsibilities affecting lenders and borrowers c. Make connections between building and maintaining a credit history and its impact on lifestyle 21st Century Skills and Readiness Competencies Inquiry Questions: Why is it important to know the similarities and differences of revolving credit, personal loans, and mortgages? How does the law protect both borrowers and lenders? Why is a good credit history essential to the ability to purchase goods and insurance, and gain employment? When should you use revolving credit and/or personal loans? Relevance and Application: The understanding of the components of personal credit allows for the management of credit and debt. For example, individuals can use an amortization schedule to examine how mortgages differ, check a credit history, know the uses of and meaning of a credit score, and use technology to compare costs of revolving credit and personal loans. Knowledge of the penalties that accompany bad credit, such as the inability to qualify for loans, leads to good financial planning. Nature of Economics: Financially responsible consumers know their rights and obligations when using credit. Financially responsible consumers frequently check their own credit history to verify its accuracy and amend it when inaccurate. Financially responsible consumers make decisions that require weighing benefit against cost. Colorado Academic Standards Directions 1. At your table, choose a partner 2. The table then decides which set of partners will review P-K 1-2 3-4 5-6 7-8 3. Partner Discussion • What concepts & skills do you see emphasized at the grade levels? 4. Table Discussion: • Overview of what is emphasized at each grade level Colorado Academic Standards Colorado Academic Standards Colorado Academic Standards URL http://www.cde.state.co.us/action/Finan cial_Literacy/index.htm Colorado Academic Standards What are the implications for your work? Colorado Academic Standards Multi-Dimensional Support from CDE Tools • • • • • FAQs Timeline for support Online, searchable standards Early Childhood Education companion materials Standards crosswalk documents, integration documents, etc. Communication and Collaboration • • • • Web tools and resources Regional meetings Content area support and partnerships Online office hours Professional Development PD development tools for districts including: • Crosswalk documents, integration documents, alignment tools, guiding questions, promising practices • Personal Financial Literacy Summit and training Colorado Academic Standards Crosswalk Document Standard Crosswalk Documents District Notes Intention Implication Grade Expectation Referent http://www.cde.state.co.us/cdeassess/UAS/Crosswalk/CAS_Crosswalk.html Colorado Academic Standards Communication opportunities Professional development opportunities Collaboration opportunities Sharing opportunities How to Partner with CDE Colorado Academic Standards