SURETY BONDS

Surety

Bonds

Managing the Risk of

Contractor Default

What Is Surety Bonding?

Principal Obligee

Surety

Types of Contract

Surety Bonds

• Bid Bond

• Performance Bond

• Payment Bond

Types of Contract

Surety Bonds

• Bid Bond

• Performance Bond

• Payment Bond

Types of Contract

Surety Bonds

• Bid Bond

• Performance Bond

• Payment Bond

How Surety Bonds Work

Protect owner against contractor failure

Protect subcontractors, laborers, & suppliers against nonpayment

Role of the Producer

Producer

• Prepare case for surety underwriting

• Preparation for prequalification

• Relationship between contractor & surety company

• Keep & increase surety capacity

Seeing

Projects

To Completion

Contractor Default

Number of Years Failed Contractors Were in Business

10+ Years

39%

6-10 Years

29%

Source: Dun & Bradstreet

0-5 Years

32%

Surety’s Areas of Expertise

Prequalification

Claims Handling

Prequalification

Capacity

Financial

Strength

Organization

Company

History

Continuation

Plans

References

Projects in progress

Surety Company’s

Checklist

Good character

Experience matching contract requirements

Financial strength

Excellent credit history

Established banking relationship

Line of credit

Necessary equipment

Benefits

Of Surety Bonds

Financial

Security

Construction

Assurance

Benefits

Of Performance Bonds

Performance

Bond

• Increase likelihood of timely project completion

• Assure compliance with contract

• Surety may resolve contractor problems

• Fulfills contractural obligations if contractor defaults

Benefits

Of Payment Bonds

Payment

Bond

• Protect certain subcontractors, suppliers, & laborers from non-payment

• Eliminates mechanics’ liens

• Competitive pricing

• No cost when purchased with performance bond

Cost of Surety Bonds

Project

Amount

Approx. Bond

Premium

$1 Million

$5 Million

$10 Million

$7,700 – $13,500

$33,200 – $47,250

$56,950 – $81,000

$101,950 – $146,000 $20 Million

* Premiums may vary depending on size, type & contractors bonding capacity.

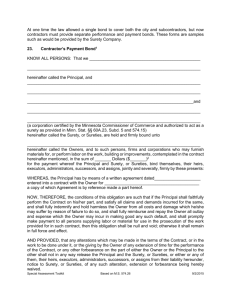

Responding to claims is the fulfillment of the surety’s promise made in its bond

Reasons For Contractor

Failure

Accounting

Problems

Change in

Leadership

Scope of

Business

Material/

Equipment

Shortages

Unrealistic

Growth

Labor

Difficulties

Failure

Protection

Surety

• Provide trained personnel

• Provide payment to subs

& suppliers

• Offer financial assistance to contractor

Steps in the Claims

Process

Declaration

Of Default

Claims

Investigation

Review

Options

Resolution

Completion

Steps in the Claims

Process

Declaration

Of Default

Claims

Investigation

Review

Options

Resolution

Completion

Steps in the Claims

Process

Declaration

Of Default

Claims

Investigation

Review

Options

Resolution

Completion

Actions of a Surety

Surety

• Re-bid job for completion

• Arrange for replacement contractor

• Retain original contractor

• Pay the penal sum of the bond

Case in Point

“Surety

Involvement

Saves

Projects”

The Facts

• Old line family-owned contracting company

• Company sold to 5 key employees

• 16 projects in progress

• $20 million school with cost overruns & schedule delays

The Problems

• Default on 3 senior citizen homes & 1 low income community rehab center

• Delays would hinder substantial HUD financing and tax credits

What Happened

• Contractor overextended

• Re-work slowed schedule

• Key subs not bonded

The Surety’s Solution

• Hired a replacement contractor with experience on HUD projects

• Assembled team to handle HUD, federal, & state requirements

• Retained and paid subcontractors, laborers & suppliers

• Financial help with schools

The Outcome

• Paperwork not delayed

• Work completed on time

• No loss of tax credits or financing

• Occupied in time to satisfy HUD deadlines

The Outcome

Surety protected school district and taxpayers from $1,865,753 loss

Premium paid for bonds:

$129,290

The Goal

Is Project

Completion

For More Information

Surety Information Office

1828 L St. NW, Suite 720

Washington, DC 20036

202-686-7463 | Fax 202-686-3656 www.sio.org | sio@sio.org