Lecture 19 Price Discrimination

advertisement

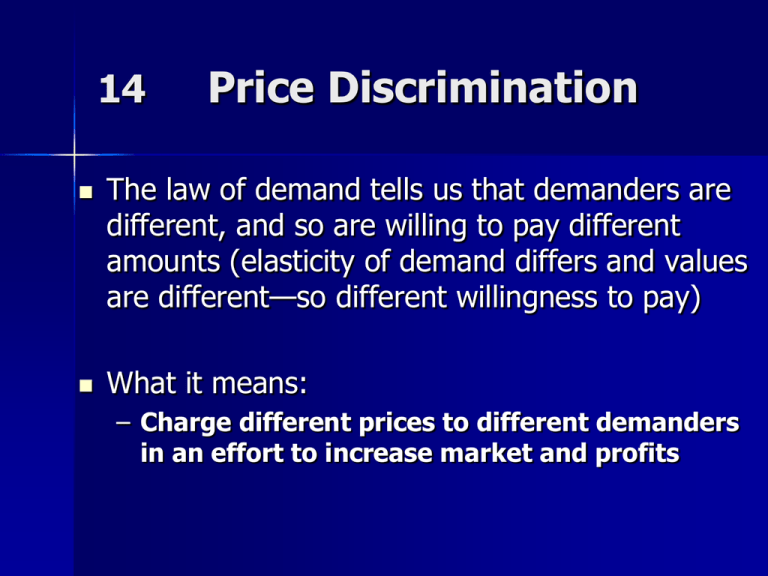

14 Price Discrimination The law of demand tells us that demanders are different, and so are willing to pay different amounts (elasticity of demand differs and values are different—so different willingness to pay) What it means: – Charge different prices to different demanders in an effort to increase market and profits It Is Done Everywhere (Especially to Foreigners) P&G products for upper income & middle income customers Is this a sale? The Goal: Higher Profits by Serving the Customer “Whether it’s a deli or SAP, it’s always about differentiating and serving the customers so they want to come back to you.” Bill McDermott, CEO of SAP Americas SAP Americas tripled market share in four years by: segmenting customers into different groups based on their size, industry, location and needs—by getting to know their customers better. The Grand Master of Price Discrmination! Google runs a continuous auction where demanders (advertisers) bid against each other and Google adjusts price based on results. E.g., surfer who googles “digital camera” and then clicks - $0.75 charge. Surfer who googles “digital cameras” and then clicks - $1.08. Based on experience—different likelihood of a purchase. Mobile phone user ads have different prices than computer users. I.e., ad for smartphone user near a particular store at certain time of day. A simple example Suppose demand for your product $ is Q = 100 - P Could be 100 – One demander with declining willingness to pay, or – Different demanders with 50 different willingness to pay for one unit each MC is zero (all fixed costs) The single price solution is 0 P = $50, Q = 50 So that TR = $2500 D MR 50 100 Q The ideal solution Charge a different price for each unit (assume MC = $0) Thus, P = $100, $99, $98, $97, ……, $1 Yields an average price of $50 per unit; 100 units sold – Then, TR = $5000 (think of a real world example) Suppose there is one demander, then “all or nothing” pricing – Take all 100 at a fixed fee of $5000, or take nothing (a bag of diamonds at de Beers) In practice, multiple pricing classes are common – For example, an airplane with 100 seats may have 43 different prices A common problem… How to change different prices? There are two key issues: – Correctly identify demanders Age (retired or students) Appearance (local or not; rich or poor) Time (day of week—airline tix cost less on certain days Cookie information – Prevent resale (and be polite) Picture ID (airlines) Arbitrage difficult or not worthwhile (hotel rooms) Been There; Done That http://disneyworld.disney.go.com/florida-resident-ticketspasses/ * 1-Day Magic Your Way Ticket– Special online savings for Florida Residents** * 3-Day Play Pass (Save 39% off the price of a 3-Day ticket†) Proof of a Florida residential address for each Guest age 18 or older is required for purchase and use. Dilbert Has It Right Remember this sale? No sale at all—the “discount” was built into the price No discount on “Black Friday”—all well planned. Ex: Retailer pays $14.50 for sweater. Suggested retail price, $50. Initial “sale” is $44.99. Most sell for with a huge markdown for $21.99 (average retail price for this good was $28. Over time, “discounts” larger as retailers compete on that margin—so begin with higher listed price. Amazon holiday special 2013: Samsung 60” HDTV 45% off $1799 price for $999. Same price can be found via search of other retailers. Moving a went away from it does not produce good results Delta tried “simple fares”—no fare over $499 one way and most restrictions eliminated. Result: Delta ended up earning only 86% of industry average revenue per aircraft mile-seat. JC Penney went to no coupons, no sales—used “fair and square” fixed pricing. No 99 cent prices— round prices at 00. Result: Profits/sales fell, stock price fell from $42 to $17 by early 2013. People say they want clear pricing—not so in practice. Example from Belkin Ethernet cables made in a factory in China for a U.S. company sold for: $29.95 with brand name wrapper $19.95 with chain store wrapper $15.95 on eBay under no name Exact same product (purchased for $3) Cost Is Not Pricing: iPhone 4S $188 parts for 16-GB model, $649 $207 parts for 32-GB model, $749 $245 parts for 64-GB model, $849 ($30-40 cost differential relates to $100 higher price—other costs assumed same) * Carriers may cover $450 of price with 2year contract A Common Successful Practice Tesco, the largest supermarket in UK with 31% share of grocery sales. Third largest retailer in the world; $120 billion sales. It uses barcode information from sales to learn how to improve service and profits. What goods are complementary? Diapers and beer. High quality toilet paper and skin care products. 12 million UK customers have “Clubcards.” Six million versions of a newsletter go to customers based on buying history and personal characteristics. Each newsletter offers slightly different discounts. Know your customers. After annual minimum purchase made, 1% discount received for using Clubcard. Tesco: Data Uses Location of products on shelves adjusted in each store and product mix changed. High-income shoppers wanted higher quality goods. Asian customers wanted large sacks of rice and certain spices. The spices attracted non-Asian upper-income buyers, so were then added in upper-income area stores. Database is sold to Tesco suppliers such as Coca-Cola and Procter & Gamble so they can study data. Result: Tesco beat Wal-Mart in UK and in South Korea. How to differentiate in U.S.? “Big Box Discounts without the Big Box” 2007 launch in Southern California, Arizona, and Nevada—just as crash hit. 2010—announced plans to open 400 stores by 2013. Built less than 200. Stores did poorly; 2/13 Tesco exit with $1.6 b. loss. Some analysts—stores not American enough—a cross between convenience and regular grocery with ready-to-eat meals and house brands. Dynamic Pricing: Follow the Internet Leader Price Based on Location of Online Searcher Cost-Side Data Use Wal-Mart and other large retailers use sales data (15 minute increments) from one year to forecast for the next year when peak customer loads will occur. Employee schedules are set based on when they are likely to be most needed, getting away from traditional eight hour shifts. Customers served better; higher output per employee. Price Discrimination: Get Higher Profits Coke customers can buy one Coke for $1 (the profit maximizing price) or a pack of six cans for $3. Why would Coke offer the six cans for $3? $ $1 D MC $0.25 0 Q* MR Quantity Price Discrimination Why would Coke offer the 6 pack for $3? It sells to all customers at $1 for one can, but also moves down the D curve and sells 5 more cans for $0.40 each. Extra consumer surplus (profit) captured. $ $1 D $.40 MC $.25 0 Q* Quantity MR Give consumers what they want: Potato Chips— one company with two brands. One brand focused on “natural” and other so-called health claims. Charge higher price even though identical to its regular chips. Reward and Keep Loyal Customers Cellphone companies rank the value of current customers to decide on price to charge. Based on history of revenue and problems, loyal customers are offered better deals on new phones and more service. Bad customers are offered no special deals. The company can predict expected future revenue (and cost of service) from customers’ history. Sophisticated customers order over Internet—get better price than in-store customers. Dump High Cost Customers? When we sell products for the same price to all customers we price discriminate because some customers cost more to service. It may be more profitable to charge higher-cost customers more or get rid of them. Does the additional (marginal) revenue justify the additional (marginal) cost? Example from website company Websmith Group develops and maintains websites for various firms. Some were “high-maintenance” and others were chronic late payers. Eliminating 5% of its clients reduced time costs by 20%, leading to 10% growth in 2009 during the recession. Example from Mail-Order Company The best customers buy the most. 16% of customer base, but 40% of profits. 25% of customers generate almost no profits. Other customer groups in between these two. Management must decide—should the worst (high cost) customers be dropped or made to bear more of their costs by price discrimination? Is that possible? Some Customers More Costly to Serve: Price Discriminate Between the Two High maintenance customers impose greater costs on seller. £ Higher cost customers Low maintenance customers impose fewer costs on seller. £ Lower cost customers P MC MR P D Q/time Q high D MC MR Q low Q/time Example Coach, a maker of expensive leather handbags and other goods, has two methods of sale: 1. Full price at its own stores and at selected retailers (and on the web). Full price only; never any discounting. Average age of shopper is 35; average expenditure is $1,100. 2. Discount outlet stores that sell last season’s products for less. Stores usually long way from nearest full-price retailer. Average age of shopper is 45; average expenditure is $770. Example: Jewelry Retailing Signet Group (U.K.) operates two sets of jewelry stores in the U.S.: Kay Jewelers focuses on middle class with lower price diamonds, etc. 781 stores average $1.65 million sales. Jared focuses on upper income with expensive diamonds and Swiss watches. 110 stores with $5.6 million avg. sales. Kindle: Price Discrimination Over Time Kindle 1, 11/07, $399, “sold out” instantly Kindle 2, 2/09, $399; 7/09, $299 10/09, $259 6/10, $189 Kindle 3, 8/10, $139 9/11, $79 8/13, $69 (better tech) Avoiding consumers using price apps such as RedLaser Smartphone apps allow instant price comparisons by shoppers. How to avoid? Private label goods and variations on a theme from major suppliers. Be Careful About Internal Competition Common form of price discrimination—different brands from same company. Presume a parent company has three brands of shampoo. If one is a discount brand, or if discounts offered on one brand, how much will that cut sales of other brands? Suppose price is cut 10% on one brand and result is 30% increase in sales. Is that good? How much does that add to the net revenue of the parent company? If sales of two other brands fall as customers move to cheaper brand, may be a net loss. Know your elasticities. Bundling Consumer A will pay $100 a year for Disney. Consumer B will pay $10 a year for Disney. Consumer A will pay $10 a year for ESPN. Consumer B will pay $100 a year for ESPN. Solution: Bundle Disney & ESPN for $109 per year ($218 revenue from A&B). If sell Disney and ESPN for $99 per year, then only $198 revenue. BUT—Spirit Airlines does anti-bundling—base ticket price very low; add on for every little service. Works very well for it. Does Headquarters Know Best? CEO centralized buying for Home Depot in 2001. Local managers could not order what they believed customers wanted. Lock step for stores: too many snow shovels in Arizona; not enough power tools. Good managers left; Lowe’s moved in. Mixing buying power and standardization with local interests is tough. How Do You Want Your Drink? Starbucks menu: Regular coffee Tall (small) cappuccino Caffe Mocha Grande (medium) latte Venti (large) cappuccino Venti mocha w/ vanilla $2.05 $2.55 $2.75 $3.35 $3.85 $4.25 Cost difference to make these different drinks? Why would they do that? Travelers, Farmers and others announce they will discount up to 10% on car insurance rates for hybrid and electric cars. Applauded for being sensitive to the environment. Are they really? Coupon Question When Disney sells a new DVDs of a movies, it often has a mail-in coupon that allows the customer to get a rebate (price discount). On a $20 DVD, there may be a $5 mail-in coupon. These are expensive to process, so why does Disney not just sell the movies for $15? Common Mistakes (Thanks to Peter Drucker) 1. Short term high profit margins. Remember—the competition is coming. Xerox dominated copier market in early 1970s. High prices and profit margins. Canon entered with simpler, cheaper machines and swept the market away from Xerox. High profit margins today do not mean maximum profits over time. Price elasticity of demand drops over time due to alternatives. Common Mistakes 2. Cost-Driven Pricing. Many companies derive prices based on cost recovery plus profit margin. The goal should be price-led costing. What will customers pay, given current and future competition? That is, what is the demand? Can your costs fit within those prices? Toyota and Nissan use that model and have taken larger and larger market shares away from German and American auto makers. Common Mistakes 3. Using revenues to feed problems and starve opportunities. Many firms incur high costs trying to solve problems (often assigning the best people to solve problems). Problems are usually due to changes in competition and changes in technology—a sign that demand has changed. Opportunities should be the focus— look forward. GE dumps weak products rather than trying to fix them.