LED market

advertisement

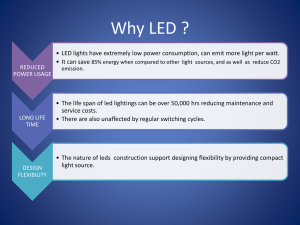

SPV-LED APPLICATIONS AND MARKET IN THE NEAR FUTURE FOR INDIA M.Siddhartha Bhatt, Additional Director CENTRAL POWER RESEARCH INSTITUTE, BANGALORE-560080 REPLACEMENT OF KEROSENE LAMPS BY SOLAR PV-LED LANTERNS • A 5 W solar PV powered LED can be a preliminary substitute for a kerosene lamp with much better distribution of illuminance across the room. Figure1D: Illuminance (lux) distribution-daylight Illuminance ( lux) 900 0 800 0.5 700 1 1.5 600 2 500 2.5 400 3 300 3.5 200 4 100 7 8 9 10 11 1 2 3 4 5 Points marked 6 0 1 2 3 4 0 t in m Dis Figure 3K: Illuminance (lux) distribution- kerosene lamp 25 0 0.5 15 1 1.5 10 2 2.5 5 3 0 m 1.5 1 2 3 4 0 5 Points m6 7 8 arked 9 10 11 Dis t in Illuminance( lux) 20 3 3.5 4 Figure 4L: Illuminance (lux) distribution - 5 W LED 30 Iluminance ( lux) 25 20 15 10 5 1 2 3 4 5 Points ma 6 7 rked 8 0 9 10 11 Figure 5L: Illuminance (lux) distribution- 10 W LED 80 70 50 40 30 20 10 Dis 0 11 rked 9 7 5 3 Points ma . .. 3 1.5 0 1 Iluminance ( lux) 60 Dis te 1.5 nce 3 0 PORTABLE LED LANTERNS CHARGEABLE THROUGH GRID/SOLAR PV • The replacement of CFLs by LEDs has already penetrated into the Indian market in the form of portable lamps and table lamps in electrified houses. The ‘zero’ watt incandescent lamp has already been phased out by LEDs. There is a very high potential for 5-10 W LED lamps in electrified Indian households. Because of their portability they can be moved to locations of interest. INTEGRTION OF LED TECHNOLOGY INTO SMART GRID CONFIGURATION • A smart grid is an electric grid using digital technology for duplex (two way) communication between the various entities like generators, end users and grid managers. The benefits of a smart grid are that because of the source-load communication energy is intelligently generated distributed and used. The smart grid aims at minimization of the usual sourceload (generator-end user) mismatch such as peaks and uneven behaviour of the load curve, manages end use requirement through demand side management (DSM) techniques and injects renewable energy components. • • • Some of the requirements of a smart grid are as follows: Self healing ability- auto reclosure, network re-configuration, renewable switching to restore power disruption under fault conditions. High level of involvement of end users in the grid operations. Presently, end users are ignorant of the load curve and the grid demand-supply dynamics. Involvement of end users through knowledge based planning of activities involving energy load would help to manage and smoothen the demand. Strengthening the security aspects of the grid through protection from cyber and physical attempts to disrupt the grid operations. • • Some of the requirements of a smart grid are as follows: Improvement of power quality (frequency, voltage, power factor, harmonics) and reliability of supply to much higher levels. Operation under multi-source, multivoltage level injection (33 kV, 11kV, 0.415 V), bi-directional flow of power in the 11 kV and 0.415 kV system; and absorption of excess power generated by end users through their captive renewables. • • • Some of the requirements of a smart grid are as follows: Introduction of a dynamic market mechanism for time of the day transaction of power between various entities. Enhancement of energy efficiency of the grid and minimization of the losses due to excessive capacity (iron losses in transformers) and point to point losses (copper losses). Enhancement of renewable energy component and gradually decreasing fossil/carbon components. The fossil component is nearly 60 % with 5 % renewable, 5 % nuclear and 30 % hydro. This has to gradually decrease to zero through enhancement of solar PV and wind components. The LED technology is naturally suited for smart grid environment because: – – It is a solid state digitally controllable technology unlike incandescent, fluorescent and ballasted technologies which need additional controller. The drivers are already a part off the LED system. It can be seamlessly integrated into the smart grid structure because of programmable and intelligence features of LED drivers. The LED technology is naturally suited for smart grid environment because: • It is continually evolving in energy efficiency and reliability. It is an ideal end use device in the lighting sector where the light peak in India is around 30 GW and the lighting energy consumption is nearly 18 % of the total energy generated. It is a good technology for DSM. The integration of LEDs into smart grid structures enters through the following ways: • • DSM measure to reduce the grid peak during the evenings as LEDs have lower power ratings than other lighting systems. LED technology enables demand modulation and enables demand response to change in load patterns in the grid. Renewable energy integration with solar PV. Solar PV –LED are naturally compatible technology. The integration of LEDs into smart grid structures enters through the following ways: • Automation and control of lighting. The LED being a solid state device is easily controllable via the driver for illumination intensity, on/off operations and colour rendering. The light output itself is now being explored as a possible communication medium between the end use equipment and electrical source. CAPITAL COST FACTOR • The capital cost of incandescent lamps is Rs. 1/W while that of fluorescent lamps is Rs. 5-10/W. The cost of 1 W unbranded LED is Rs. 250-450/W while for that of branded LED it is Rs. 800-1000/W. The cost of branded bare LED is around Rs. 100-150/W (upper end) while that of unbranded it is around Rs. 55-80/W. The cost of the bare LED forms 50+ % of the product cost. The LED market has adapted itself by reducing the wattage by equivalence ratio typically (60-100 W incandescent ↔40-50 W TFLs ↔ 20-30 W CFLs ↔ 9-11 W LEDs). Bulbs are available in 1 W and 3 W. Significant cost reduction is anticipated in near future based on the trends and factors like the indigenous manufacturing capability, production volumes, etc. MARKET POTENTIAL FOR LEDS IN NEAR FUTURE • The lighting market is worth Rs. 7,500 crores of which CFL market is around Rs. 2,000 crores and incandescent lamp market is around Rs. 60 crores. The balance is composed of other gamut of lighting systems like sodium vapor, tubular fluorescent lamps, mercury vapor lamps, etc. The value of LED business is around Rs. 200-250 crores which forms nearly 3 % of the total lighting business. The lighting sector is poised for a general annual 11 % growth. The share of LEDs is likely to go up to 5-6 % in the immediate future and 10 % with the implementation of smart grids. This means that the growth of LEDs is likely to be around 20 % in the immediate future and 30 % in the near future as compared to the present sale. MARKET POTENTIAL FOR LEDS IN NEAR FUTURE • The largest share is in the solar PV lantern and • non solar lantern sectors. The digitally controlled LED market is the next largest upcoming market after the lantern segment. The sale of CFL (2010) are around 100 million pieces/year and GSLs (incandescent lamps) are around 600 million pieces/year. The LED replacements for GSLS and CFLs is going to increase in the near future. The present scale of LEDs is around 2 million pieces/year. 90 % of the LEDs are sold in the lantern sector and balance in the street lighting sector. R&D • The R & D in India is on new O-LEDs and polymeric LEDs at National Institutes (like IISc) and national Laboratories (like CSIR). The R & D investment in India is around Rs. 30-40 crores. The R & D investment of Japanese is around Rs. 5,000 crores by Nichia alone. R & D investment in drivers and balance of systems by few Indian players is around 5 % of the turnover. For development of reliable efficient product R & D investment is required by every Indian LED vendor. An investment of 4 % of the turnover is rather average, 6 % is good while 8-10 % is considered exceptionally good. CONCLUSIONS • The market for LED lighting technology • in India has three segments- kerosene lamp replacement, portable LEDs in electrified areas and controllable LEDs through integration into smart grid structures. The kersosene lamps in the rural sector can be replaced by solar PV-LED of 5 W. Possible 10 W and 20 W capacity can be considered for future. CONCLUSIONS • • Portable LED lanterns chargeable through solar as well as grid power for localized lighting, table lamps, portable lamps, etc. is a major market in India. This is a popular technology and is likely to penetrate higher with reduction in costs of reliable systems. Integration of LED lighting systems into street lighting systems and building lighting systems with intelligence and controllable features, has a fair share of potential as a substitute for fluorescent and ballasted technology. CONCLUSIONS • • The LED sector is poised for an increase in its market share from 3 % to 5-6 % in near future. Besides, a general growth of 11 % is already assured. Thus the composite growth rate of LED technology may be around 20-30 % compared to the present sale. One of the main deterrents to penetration of LED technology is high capital cost. The cost of the bare LED is over 50 % of the system cost. Significant cost reduction is expected in LED costs following the present trends and factors like indigenous manufacturing capability, volumes as well as the innovative manufacturing processes.