Employment & Parsonage

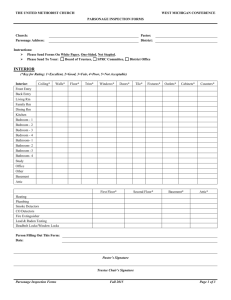

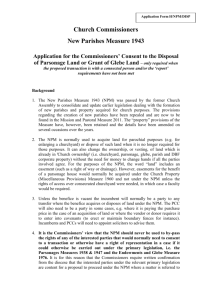

advertisement

Employment & Parsonage Interesting labor relations !!! Rabbis & Cantors Employees of congregations and also spiritual leaders ! Generally, there is a contract of employment. NY law - Rabbi’s contract must be voted on by congregation. Parsonage Sec. 107 of IRC Rental value of Parsonages In the case of a minister of the gospel, gross income does not include (1) The rental value of a home furnished to him as part of his compensation; or (2) The rental allowance paid to him as part of his compensation, to the extent used by him to rent or provide a home. Parsonage • This section of the tax code is quite old - hence the language of minister, gospel, etc. - originally for church circuit riders. • This has been expanded to include cantors • It has been expanded to include the fact pattern of a “minister” owning or renting a home and not just using congregational lodging. Parsonage Requirements for Synagogues Trustees need annual expense information from Rabbi / Cantor Actual expenses – based on reality Not for negotiation - Not a percentage of salary No “double-dip” – no congregational house + parsonage amount Annual decision by Trustees Formal action at a meeting before beginning of year Pass a resolution and give Rabbi a letter Parsonage Allowable Expenses Annual Action Must be submitted in writing to Board of Trustees – estimating, based on reality, payment for the next year. • • • • • • Fair market rental/mortgage Utilities Insurance Repairs & Maintenance Furnishings Other Parsonage Board of Trustees’ Action Resolution at a meeting The Board of Trustees at a meeting on December ___ after reviewing the parsonage expense form for the upcoming year, on motion duly made and seconded, adopted the following: RESOLVED, that the amount of $_______ be designated for ________ as parsonage allowance for the year ____. Parsonage Board of Trustees’ Action Annual Letter to Rabbi/Cantor Dear Rabbi ____ This is to advise you that at a meeting of the Board of Trustees on December ____, your parsonage allowance for the year ____ was officially designated and fixed in the amount of $_______. The balance of your compensation will constitute regular compensation. Under section 107 of the Internal Revenue Code, an ordained rabbi is allowed to exclude from gross income the parsonage allowance paid to him/her as part of his/her compensation to extent that it is used by him/her to provide a home. You should keep an accurate record of your expenses of providing a home in order to substantiate any amounts excluded from gross income in filing your federal income tax return. Sincerely