ULine Presentation (final)

advertisement

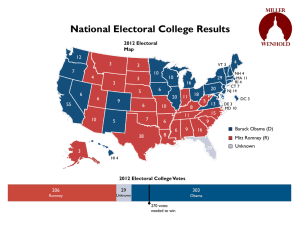

Uline Presentation Bill Broydrick Principle Broydrick & Associates 444 N Capitol Street NW DC 20001 Unemployment—The Big Issue The unemployment rate declined by 0.3 percentage point to 7.8 percent in September and for the first 8 months of the year, the rate held within a narrow range of 8.1 and 8.3 percent, according to a U.S. Bureau of Labor Statistics report released in early October Employment increased in health care and in transportation and warehousing but changed little in most other major industries. The number of unemployed persons, at 12.1 million, decreased by 456,000 in September 2012. Economic Growth Real gross domestic product -- the output of goods and services produced by labor and property located in the United States -- increased at an annual rate of 1.3 percent in the second quarter of 2012 (that is, from the first quarter to the second quarter), according to the "third" estimate released by the Bureau of Economic Analysis. In the first quarter, real GDP increased 2.0 percent Fiscal Policy In January 2009 the US Congress passed and President Barack Obama signed a bill providing an additional $787 billion fiscal stimulus to be used over 10 years - twothirds on additional spending and onethird on tax cuts - to create jobs and to help the economy recover. Monetary Policy The Fed last month announced a program of openended bond purchases that will be continued until there is substantial improvement in labor market conditions, barring a sustained and unexpected spike in inflation. To start off, the central bank will buy $40 billion in mortgage-backed securities each month. The Fed will announce a new target at the end of this month, and every subsequent month, until the labor market outlook improves “substantially,” as long as inflation remains in check. Monetary Policy (Continued) The scale of the Fed’s new effort is smaller than the Fed’s previous asset purchases. The first round, starting in 2008, averaged more than $100 billion a month. The second, beginning in 2010, averaged $75 billion a month. The current round will begin at a pace of $40 billion a month, although the volume remains subject to adjustment. This is the first time that the Fed has tied the duration of an aid program to its economic objectives. Thus, this policy also represents more of a concern for unemployment, rather than the Fed’s traditional concern of inflation (Inflation is now running below the Fed’s 2 percent annual target). World Conditions - China o China holds an estimated 1.2 trillion of US debt, which is about 7.3 percent of all U.S. debt September 1st, 2012 article appearing in The Economist stated the following: The Chinese economy has a habit of beating expectations. For ten years in a row, from 2001 to 2010, its growth rate exceeded the IMF’s spring forecast, often by a big margin. But this year it is likely to disappoint. In recent months, industrial output has slowed sharply; stocks of unsold goods are piling up; and Shanghai’s stockmarket is at a three-year low. For the first time this century, in 2012 China’s growth rate may dip below 8%. With the world ever more dependent on China’s economy, that is worrying. – World Conditions - Europe The European sovereign-debt crisis is the Energizer Bunny of financial catastrophes. Unlike the 2008 financial crisis in the U.S., which unfolded quickly, this latest meltdown just keeps going... and going... and going. Issues - Deficit Both President Obama and Governor Romney have promised to reduce the deficit, but their plans have been heavily criticized for not containing specific details. A new estimate puts the deficit for the just-completed 2012 budget year at $1.1 trillion. The Fiscal Cliff Federal Reserve Chairman Ben Bernanke and a number of observers have used the term “fiscal cliff ” to describe several big fiscal events set to occur in the U.S. at the end of this year and in early 2013. Among them: •$606 billion of expiring tax cuts, new taxes, and automatic spending cuts are set to take effect at the end of 2012 •The expiration of fiscal stimulus measures, such as the payroll tax cut and extended unemployment benefits. •Spending cuts scheduled to be triggered automatically (sequestration) in January 2013 as a result of the failure of the deficit reduction super committee last year. Effects Fiscal Cliff Effects: Taxes Taxes would rise about 20% Lowest income tax would rise from 10% to 15% while highest income tax would rise from 35% to 39.6% Phase out of Earned Income Tax Credit Child tax credit will fall to $500 per child from $1000. Refundable portion will also be reduced Expiration of the “Payroll tax holiday," a 2 percent Social Security tax cut on the first $110,000 in wages, will mean a tax hike of $1,000 per year. Tax rate on dividends would jump to ordinary tax rates of 39.6% Fiscal Cliff Effects: Spending Cuts Under the so-called “sequestration” plan hatched in the summer of 2011, cuts totaling $1.2 trillion over 10 years — The cuts are also evenly split between defense spending — with spending on wars exempt — and discretionary domestic spending, which exempts most spending on entitlements like Social Security and Medicaid The sustainable growth rate formula is scheduled to reduce Medicare physician pay rates by a double-digit amount — 27% according to the most up-to-date projection from the Centers for Medicare & Medicaid Services. State of the Election •Tonight's Debate May decide the election •If Romney keeps up his momentum he may surpass the President who has a slight lead •If Obama wins, he may strengthen his slight lead and improve his chances •12 Swing States ( Colorado, Florida, Iowa, Michigan, Nevada, New Hampshire, New Mexico, North Carolina, Ohio, Pennsylvania, Virginia ,and Wisconsin Likely Voters Romney 50% Obama 46% N=869 Registered voters Obama 49% Romney 47% N=1,023 The Electoral Vote / Source: http://fivethirtyeight.blogs.nytimes.com/author/nate-silver Presidential Election in the Swing States Colorado Romney 48% Obama 47.4% Florida Romney 49.3% Obama 46.8% Iowa Romney 45.8% Obama 48.5% Nevada Romney 46.6% Obama 48.2% N. H. Romney 47.3% Obama 48% N.C. Romney 50% Obama 45.3% Ohio Romney 46.1% Obama 48.3% Virginia Romney 47.6% Obama 48.45 Wisconsin Romney 47.4% Obama 50% Key Senate Races Current Senate 53 D 47 R Arizona Flake (R) 43.3% Connecticut McMahon (R) 45.3% Florida Mack (R) 40.8% Indiana Mordock (R) 47% Carmona (D) 42.5% Murphy (D) 48.7% Nelson (D) 47.5% Donnelly (D) 42% Massachusetts Brown (R) Montana Rehberg (R) 46% Tester (D) 44.3% Nevada Heller (R) 45% Berkley (D) 42% North Dakota Berg (R) Heitcamp (D) 47% Ohio Mandel (R) 42.2% Brown (D) 47.2% Wisconsin Thompson 46.3% Baldwin 49.3% 46% 47% Warren (D) 48.5% Campaign Issues Obama on Taxes According to a recent IRS study, President Obama's proposal to let the Bush tax cuts expire for top earners would hit only a tiny fraction of all small businesses, but it includes nearly 1 million companies that employ people No household making more than $1 million each year should pay a smaller share of their income in taxes than a middle-class family pays according to President Obama’s website Romney on Taxes Romney has said he will slash income tax rates for everyone -- including the rich -by 20 Romney has also promised to pay for his tax reform plan, which is estimated to reduce revenue by $5 trillion over a decade. One way he says he would do so is by reducing tax breaks that disproportionately benefit the rich. Obama on Medicare The proposal would mostly maintain Medicare in its current form, while implementing structural payment reforms to encourage the utilization of high-value rather than high-cost services. ◦ Thus, Obama focuses his Medicare reform proposal on two main areas: (1) altering the current payment system, and (2) reducing fraud and waste in the system. The Office of Management and Budget estimates that the reforms in the president’s budget for Medicare, Medicaid, and other health programs will save $364 billion over the next 10 years Romney on Medicare Nothing changes for current seniors or those nearing retirement Medicare is reformed as a premium support system, meaning that existing spending is repackaged as a fixed-amount benefit to each senior that he or she can use to purchase an insurance plan All insurance plans must offer coverage at least comparable to what Medicare provides today If seniors choose more expensive plans, they will have to pay the difference between the support amount and the premium price; if they choose less expensive plans, they can use any leftover support to pay other medical expenses like co-pays and deductibles “Traditional” fee-for-service Medicare will be offered by the government as an insurance plan, meaning that seniors can purchase that form of coverage if they prefer it; however, if it costs the government more to provide that service than it costs private plans to offer their versions, then the premiums charged by the government will have to be higher and seniors will have to pay the difference to enroll in the traditional Medicare option Lower income seniors will receive more generous support to ensure that they can afford coverage; wealthier seniors will receive less support Competition among plans to provide high quality service while charging low premiums will hold costs down while also improving the quality of coverage enjoyed by seniors Obama on Spending Romney on Spending Mitt’s goal will be to bring federal spending below 20 percent of GDP by the end of his first term: Reduced from 24.3 percent last year; in line with the historical trend between 18 and 20 percent Close to the tax revenue generated by the economy when healthy Requires spending cuts of approximately $500 billion per year in 2016 assuming robust economic recovery with 4% annual growth, and reversal of irresponsible Obama-era defense cuts Dold vs. Schneider Robert Dold The Issues: •Voted to cut House budget legislative budget by 5% •Doesn’t believe in raising taxes •Empower small businesses •Wants to repeal Affordable Care Act •Supports converting Medicare into a voucher program •Women’s right to choose •Supports civil unions, but not gay marriage Brad Schneider The Issues: •Allow the Bush tax cuts for income above $250,000 to expire, returning to the Clinton-era rates, to begin addressing our deficits. •End tax breaks for companies shipping jobs overseas •Supports Affordable Health Care, yet believes it drives up costs •Against Medicare becoming a voucher program •Anti-privatization of Social Security •Women’s right to choose •Supports Gay Marriage Modest Reform Proposal A. Independent Reapportionment Iowa and California Example of success Iowa lost a seat but have four competitive races B. Top Two Primary Vote Getters California and Washington Stark Berman vs. Sherman Waxman examples