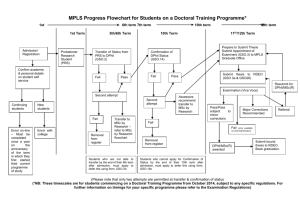

Agenda for BTMSL Leadership day

advertisement

Service Management Global Network Operations CWU and Prospect Q1 business review Marc de Wit Service Management GSO Our priorities for 11/12 Q1 review Global Service Operations in 11/12 Our team make up internationally 61% UK based 46 team members 150 reward framework Country Vs People Row Labels Band 1 Band 2 Band 3 No Role code Non UK Role Skill Band C Skill Band D (blank) Grand Total Count of OUC 108 40 2 37 154 29 17 387 United States 16% United Kingdom 61% France Germany 2% Belgium 2% 6% India 0% Netherlands 13% Sweden 0% Global Strategy Network operational efficiency Professional services Enable global finance Work anywhere Networked IT operational efficiency Global Service have now rigorously re-focused – and now offer eight core “close to the network” propositions underpinned by a streamlined product portfolio Optimise networkcentric security Enable voice and unified communications Make contact centres efficient Transformation Plan to implement Control in GSO is based on “Control in a box” methodology: • In the ‘Control’ phase, the focus is on: standardisation of processes and systems, supported by…. standardisation of roles and accountabilities, underpinned by …. robust process measurement, allowing…. rationalisation and efficient use of resources in responding to demands. • Control Capabilities Survey 100% completed with managers for 3 Operational Areas in scope: Data Network Management, Voice Data Management, Complex Contracts • Produce report for state of control in each team and heat map by 8th July • Analyse areas of improvement and prepare analysis report with recommendations for action by 15th July. • Deliver Control in GSO by end of Q4 by implementing agreed improvement actions GSCO/BTO Operational Alignment Programme • Identify key opportunities for GSCO/BTO alignment with associated highlevel E2E operational and business benefit across 6 Programme workstreams by end of July 11. Service Management GSO People trends for 11/12 Care Agile Q1 GSO in Q1 Headlines (UK survey data): • very slight drop in EEI from Q4 3.77 to 3.76, almost unchanged • EEI remains higher than Service Management Q1 average, 3.65 •very slight drop in PCI from Q4 3.90 to 3.87 • PCI remains higher than Service Management Q1 average, 3.78 • B&H trend downwards from 3% Q4 to 2% Q1 Highest scoring questions GSO My manager works with other managers across the business 4.15 My manager values people who do the right thing for the customer 4.11 I am confident I can help BT be number one as I have the right skills 4.09 Question we are lower than SM in GSO SM Working at BT makes me want to do the best work I can 3.73 3.76 People share what they know and learn from each other 3.83 3.86 Organisation Culture Index The first view of GSO in Q1 GSO ARM1 GSO ARM2 Service Management Q1 Global Voice and Media Operations Sickness / Stress Increased productivity must not come at the expense of spoiling our sickness trends SM and SI trend 2010/11 % Calendar Days Lost Service Management (mth/YTD) 300 50 250 40 200 Stream assessments (new cases) 20 Total Sick absences (left scale) 50 10 0 0 AU 3 30 150 100 4 Stress related absences AUA 2 AUB 1 AUC 0 AUD April Breakdown view of GSO UK population: May-11 Jun-11 YTD Total Resourcing – challenge for 11/12 and plans for delivery 15% TLR reduction challenge July and August 10fte are not reductions but absorbing growth Next meeting and Close