Wealth Building and the Role of Charitable Planning

advertisement

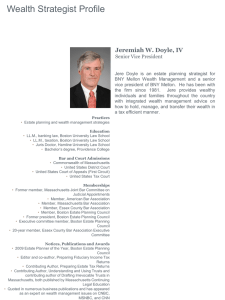

WEALTH BUILDING …and the role of Charitable Planning... By: K. Gene Christian, Regional Director Charitable Estate and Gift Planning Services Providence Health System - Oregon 503-216-2226/phone 503-216-4140/Fax gchristian@providence.org WEALTH BUILDING AND THE ROLE OF CHARITABLE PLANNING TRADITIONALLY, WHAT IS IT? Definition: Development and implementation of planning strategies which will minimize taxation while moving a person(s) toward financial independence. WEALTH BUILDING AND THE ROLE OF CHARITABLE PLANNING TRADITIONALLY, HOW IS IT ACCOMPLISHED? 1.Develop a unified credit shelter estate plan (will or living trust) WEALTH BUILDING AND THE ROLE OF CHARITABLE PLANNING TRADITIONALLY, HOW IS IT ACCOMPLISHED? 2. Fund 401Ks, IRAs, ROTHs, VULs, etc. for tax-sheltered growth WEALTH BUILDING AND THE ROLE OF CHARITABLE PLANNING TRADITIONALLY, HOW IS IT ACCOMPLISHED? 3. Buy Life Insurance to replace income earner(s)’ salary. WEALTH BUILDING AND THE ROLE OF CHARITABLE PLANNING TRADITIONALLY, HOW IS IT ACCOMPLISHED? 4. Place what is left into investments/real property to produce capital gain and/or high cash flow. WEALTH BUILDING AND THE ROLE OF CHARITABLE PLANNING WHAT IS THE ROLE OF CHARITABLE PLANNING IN WEALTH BUILDING? Definition: It assumes that wealth accumulation decisions should be based as much on what the wealth-holder values, as the value of the wealth-holder’s assets. WEALTH BUILDING AND THE ROLE OF CHARITABLE PLANNING WHY IS THIS IMPORTANT? Nearly 80% of all Americans have “charitable receptivity.” WEALTH BUILDING AND THE ROLE OF CHARITABLE PLANNING E. WHY IS THIS IMPORTANT? There are only three potential heirs in estate planning... $$$ People Government Charity WEALTH BUILDING AND THE ROLE OF CHARITABLE PLANNING OPPORTUNITIES IN THE NEW MILLENIUM? • The Nation is aging rapidly You bet! • Combined taxation remains relatively high • Financial markets over 15 years have soared • Huge transfer of wealth occurring • Three affluent generations alive simultaneously WEALTH BUILDING AND THE ROLE OF CHARITABLE PLANNING A CASE ILLUSTRATION WEALTH BUILDING ...and the role of Charitable Planning... WEALTH BUILDING AND THE ROLE OF CHARITABLE PLANNING CASE PROFILE •Bob (age 59) and Alice (age 58) Auburn •He owns/manages a small residential construction company •She is an independent contractor currently consulting for ODOT WEALTH BUILDING AND THE ROLE OF CHARITABLE PLANNING CASE PROFILE - cont. •Nearing retirement - they want to travel more •Don’t want to dramatically affect children’s inheritance - close family WEALTH BUILDING AND THE ROLE OF CHARITABLE PLANNING CASE PROFILE - cont. •They have a $1,865,000 estate: •$300,000 life insurance on him •$125,000 life insurance on her •$628,000 his SEP-IRA •$310,000 her 401(k) & IRAs from past employers •$12,000 in ROTH IRAs •$170,000 home paid off •$320,000 rental properties (four homes) WEALTH BUILDING AND THE ROLE OF CHARITABLE PLANNING A VISUAL LOOK AT THE AUBURN’S ESTATE... Life Insurance His SEP IRA Home ROTHS Her 401(k) & IRAs Rental properties WEALTH BUILDING AND THE ROLE OF CHARITABLE PLANNING Sale vs. Unitrust I. Analysis of Increased Income Sale vs. CRT • Value of Rentals $320,000 $320,000 • Closing Costs ($ 22,400) ($ 22,400) • Taxable Value $297,600 $297,600 WEALTH BUILDING AND THE ROLE OF CHARITABLE PLANNING Sale vs. Unitrust I. Analysis of Increased Income - cont. Sale vs. CRT • Taxable Value $297,600 $297,600 • Or. Cost Basis $ 88,000 N/A • Cap. Gain Tax ($ 55,963) $ -0- • Dep. Cost Basis $ N/A • Cap. Gain Tax ($ 26,311) 5,000 $ -0- WEALTH BUILDING AND THE ROLE OF CHARITABLE PLANNING Sale vs. Unitrust I. Analysis of Increased Income - cont. Sale • Legal/App. Fees $ ? • Investable Funds $215,326 vs. CRT ($ 2,500) $ 297,600 • Pre-Tax Income (6%) $ 12,920 $ • 31.1-YR Exp. $770,854 $1,065,390 • PV of Income $264,440 $ 365,480 17,856 WEALTH BUILDING AND THE ROLE OF CHARITABLE PLANNING Sale vs. Unitrust II. Analysis of Tax Deduction Sale vs. CRT • Tax Deduction $ -0- $64,171 • Tax Savings (34%) N/A $21,891 WEALTH BUILDING AND THE ROLE OF CHARITABLE PLANNING Sale vs. Unitrust III. Analysis of Estate Tax Sale vs. CRT • Asset Included In Estate $215,326 $ -0- • Estate Tax (37%) ($ 79,671) N/A WEALTH BUILDING AND THE ROLE OF CHARITABLE PLANNING SUMMARY OF BENEFITS KEEP IN ESTATE PUT IN CRT 1. Lifetime after tax cash flow from rentals: 1. Lifetime after tax cash flow from 6% pay CRT: $751,808 $752,151 NOTE: See footnotes section in booklet for formulas used WEALTH BUILDING AND THE ROLE OF CHARITABLE PLANNING SUMMARY OF BENEFITS KEEP IN ESTATE 2. Lifetime value of income tax deduction benefit: -0- PUT IN CRT 2. Lifetime value of income tax deduction benefit: $159,244 NOTE: See footnotes section in booklet for formulas used WEALTH BUILDING AND THE ROLE OF CHARITABLE PLANNING SUMMARY OF BENEFITS KEEP IN ESTATE PUT IN CRT 3. Rentals value at the end of lifetime: 3. CRT value at the end of lifetime: $653,869 $965,235 NOTE: See footnotes section in booklet for formulas used WEALTH BUILDING AND THE ROLE OF CHARITABLE PLANNING KEEP IN ESTATE vs. UNITRUST KEEP CRT 1. $ 751,808 1. $ 752,151 2. -0- 2. $ 159,244 3. $ 653,869 3. $ 965,235 $1,496,913 $1,959,345 PERSONAL ESTATE PERSONAL AND CHARITABLE ESTATE WEALTH BUILDING AND THE ROLE OF CHARITABLE PLANNING STANDARD WEALTH ACCUMULATION TODAY $1,865,000 31.1 years pass 2033 AD NICE & BIG PERSONAL ESTATE WEALTH BUILDING AND THE ROLE OF CHARITABLE PLANNING Adding the Charitable Dimension TODAY Rentals CRT 2033 AD …………………………………………………………………………. NICE & BIG BIG ESTATE PLUS BIG CRT = MUCH LARGER PERSONAL & CHARITABLE ESTATE!! REFERENCE MATERIAL Special Committee on Again (U.S. Senate) American Association of Retired Persons (AARP) Social Security Administration The Oregonian OHSU notes and material The National Committee on Planned Giving National Woodlands Magazine Successful Money Management Seminars Fortune Magazine Crescendo Software Company The Legacy Companies, LLC