Simplified tax refund in CDG

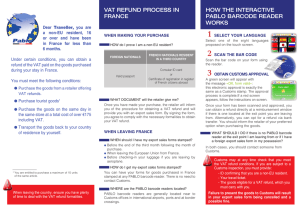

advertisement

Tax refund: use « PABLO » at the airport An automated visa to perform the tax refund formalities for purchases bought in France. At the time of the purchase, the retailer gives a VAT refund form signed by the retailer and the buyer featuring PABLO logo and barcode. The traveler needs to certify the form at a PABLO kiosk to obtain the electronic certification. At the PABLO kiosk, the «Ok form validated » that appears at the end of the transaction, is the equivalent of a Customs stamp. There is no need to then mail the form to the retailer. The PABLO optical barcode reader are available in CDG, Orly South, Nice, Lyon, Marseille, and Geneva. PABLO kiosks are usually located near a customs office. PABLO process Select the language Presentation of the VAT refund form Validation = customs stamp In case of refusal contact customs December 2013 Baggage check in Conditions You must be a resident in a country outside the European Union at the date of purchase be over the age of 16 and visit France for less than 6 months Obtain the tax refund When you make your purchase the retailer will give you a VAT refund form signed by the retailer and yourself. Before checking your luggage, you must present the goods and the form together for certification by Customs at the time of your final departure from the European Union. Eligible goods • • goods purchased for exportation (outside European Union) goods purchased as retail purchases not be for business purposes The total value of your purchases (including VAT) at a single shop on the same day must be strictly over €175. The formality must be completed before the end of the third month following the month when goods were purchased. December 2013 You must be able to provide proof of requirements at the time of purchase: identity papers ticket goods VAT refund form As from 1 January 2014, all VAT refund forms will be issued using the PABLO system. Advantages The PABLO system allows to carry out the tax refund formalities faster by the simple presentation of the VAT tax refund form to a kiosk. The traveler then obtains the immediate repayment of the VAT of exchange. Watch the YouTube video: http://www.youtube.com/watch? v=InXHKcNqIGU&feature=yout u.be December 2013