Implementation Bellin tm5 at EBN

advertisement

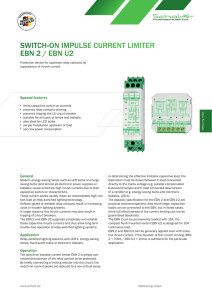

Restructuring Treasury EBN DACT Treasury Beurs Noordwijk, 11 November 2011 Jeroen Piket, Treasurer jeroen.piket@ebn.nl EBN B.V. Moreelsepark 48 3511 EP Utrecht http://www.ebn.nl EBN General • Wholly state owned company managing exploration, production, storage and sale of Dutch State’s oil and gas reserves, on-shore and off-shore • EBN participates in any license to explore and produce Dutch territorial gas and oil reserves (EBN share appr. 40%) • Currently approximately 176 partnerships with oil & gas companies • Investment and costs are shared pro rata parte and partners separately sell their share output • EBN key figures 2010 Sales € 6.5 billion Net profit € 2.1 billion Capital expenditure € 607 million EBN In 2011 • 5% increase in number of participations in exploration and production partnerships • Capital expenditure € 800 million (EBN share) • Further focus on development unconventional gas projects (shale gas) • Reactivation of on-shore oil production in Schoonebeek • Development underground gas storage Bergermeer EBN Funding • Strong credit profile, stable Aaa/AAA rating, despite low equity base and high leverage • Funding sources Short term: commercial paper Long term: loans and bonds (a.o. CHF public bonds, JPY private placements) • Highly seasonal working capital flows a.o. following large production volumes in winter, low volumes in summer EBN Treasury restructuring - background • EBN’s Treasury historically 100% outsourced • Decision to set up own EBN Treasury taken in 2008/2009 with targeted live date 1 July 2010 Therefore: • Treasurer and Cash manager hired as per 1 October 2009 • Treasury accountant hired as per 1 November 2009 EBN Treasury restructuring - scope Scope of the project • Education new Treasury staff • Selection treasury management system (TMS) • Implementation TMS • Selection and set up other Treasury infrastructure • Market data (Reuters) • Counterparty risk tools (Moody’s Market Implied Ratings) • Electronic banking • Trading portals (360T and MyTreasury) • Implement new dealing mandate structure • Establish new Treasury Policy EBN Treasury restructuring - scope Scope of the project • Education new Treasury staff • Selection treasury management system (TMS) • Implementation TMS • Selection and set up other Treasury infrastructure • Market data (Reuters) • Counterparty risk tools (Moody’s Market Implied Ratings) • Electronic banking • Trading portals (360T and MyTreasury) • Implement new dealing mandate structure • Establish new Treasury Policy EBN Treasury restructuring - project organization • Project manager (Treasurer), Cash Manager, Treasury accountant • Steering group • EBN Board • Consultancy (Zanders, E&Y) • • • to EBN board prior to 1 October 2009 During project: TMS-selection only Pre-live review • Also involved: Legal, ICT EBN Selection EBN TMS • Business case: description of EBN processes, EBN system infrastructure etc. • Translate this into TMS requirements • Request for proposal to three pre-selected vendors • Response vendors / demonstrations • Three reference visits • Evaluation, scoring, selection, decision • EDP audit @ vendor • Contract negotiation EBN Selection EBN TMS • Business case: description of EBN processes, EBN system infrastructure etc. • Translate this into TMS requirements • Request for proposal to three pre-selected vendors • Response vendors / demonstrations • Three reference visits • Evaluation, scoring, selection, decision • EDP audit @ vendor • Contract negotiation EBN EBN’s TMS criteria related to • • • • • • • • • • Forecasting Cash management Implementation Pricing Reporting Deal capturing Security Static data management Support Accounting All of this in a context of single entity company, with large transaction sizes of all natures, but low transaction volumes EBN Implementation Bellin tm5 at EBN • Set-up / training / portfolio input: • • • • Set up of System settings (master data, entities, counterparties, users, rights, bankaccounts, currencies, etc.: 2 days Configuration and Setup of TT Contract, configuration of LMCash and LMStatus: 2 days, followed by entry ytd transactions Setting up and using LMPlanning: 2 days @ vendor Configuring TTRiskWatch training (scenario analyses): 2 days • Testing, problem solving 2 weeks • Pre-live review by E&Y With scope system access and authorization levels in Bellin, electronic banking systems, trading portals: 3 days • Go-live EBN Implementation Bellin tm5 at EBN • Set-up / training / portfolio input: • • 2 months • • Set up of System settings (master data, entities, counterparties, users, rights, bankaccounts, currencies, etc.: 2 days Configuration and Setup of TT Contract, configuration of LMCash and LMStatus: 2 days, followed by entry ytd transactions Setting up and using LMPlanning: 2 days @ vendor Configuring TTRiskWatch training (scenario analyses): 2 days • Testing, problem solving 2 weeks • Pre-live review by E&Y With scope system access and authorization levels in Bellin, electronic banking systems, trading portals: 3 days • Go-live EBN What do we have now A system that facilitates: • Cash planning with a.o. upload from G/L • Cash reconciliation • Cash positioning • Deal capturing • Reporting • MtM valuation • Scenario analyses • Integrated market data (yields, exchange rates) • On-line internet access (system is hosted by vendor) EBN What did we choose not to implement • Direct feed of bank statements (Swift MT940) • Interface to accounting system • Netting (not applicable) • Interface with payment systems EBN Lessons learned • Understand your needs and focus on what you really need • How much flexibility do you need? • Focus on standard functionality • Include case-studies in the RfP’s • Reference visits • Create broad awareness of planning in organization and stick to it • Search for the best fit, not necessarily for the best system • Stay hands-on involved in implementation process, limit consultants’ work as much as possible to advice EBN Questions