slides_3e_chp17

advertisement

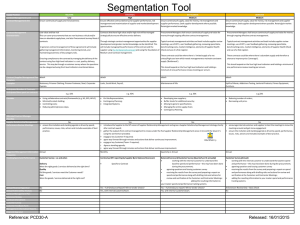

Matching Supply with Demand: An Introduction to Operations Management Gérard Cachon ChristianTerwiesch All slides in this file are copyrighted by Gerard Cachon and Christian Terwiesch. Any instructor that adopts Matching Supply with Demand: An Introduction to Operations Management as a required text for their course is free to use and modify these slides as desired. All others must obtain explicit written permission from the authors to use these slides. Slide ‹#› The Bullwhip Effect Slide ‹#› Supply chain demand and variability Over the long run the average inflow to a firm must equal the average outflow Inflow Firm Outflow (sales) However, the volatility of the inflow can differ substantially from the volatility of the outflow Inflow Firm Slide ‹#› Outflow (sales) What is the bullwhip effect? Demand variability increases as you move up the supply chain from customers towards supply Equipment Tier 1 Supplier Factory Distributor Slide ‹#› Retailer Customer Bullwhip effect in autos to machine tools 80% Machine tools Autos 60% % change in demand 40% 20% 0% -20% -40% -60% GDP = solid line -80% Source:Anderson, Fine and Parker (1996) Slide ‹#› Bullwhip effect in the US PC supply chain Changes in demand 80% 60% Semiconductor Equipment 40% 20% PC 0% -20% Semiconductor -40% 1995 1996 1997 1998 1999 2000 2001 Annual percentage changes in demand (in $s) at three levels of the semiconductor supply chain: personal computers, semiconductors and semiconductor manufacturing equipment. Slide ‹#› Consequences of the bullwhip effect Inefficient production or excessive inventory. Low utilization of the distribution channel. Necessity to have capacity far exceeding average demand. High transportation costs. Poor customer service due to stockouts. Slide ‹#› Causes of the bullwhip effect Order synchronization Order batching Trade promotions and forward buying Reactive and over-reactive ordering Shortage gaming Slide ‹#› Order synchronization Customers order on the same order cycle, e.g., first of the month, every Monday, etc. The graph shows simulated daily consumer demand (solid line) and supplier demand (squares) when retailers order weekly: 9 retailers order on Monday, 5 on Tuesday, 1 on Wednesday, 2 or Thursday and 3 on Friday. 70 60 50 40 Units 30 20 10 0 T im e (e a c h p e rio d e q u a ls o n e d a y ) Slide ‹#› Order batching Retailers may be required to order in integer multiples of some batch size, e.g., case quantities, pallet quantities, full truck load, etc. 70 60 The graph shows simulated daily consumer demand (solid line) and supplier demand (squares) when retailers order in batches of 15 units, i.e., every 15th demand a retailer orders one batch from the supplier that contains 15 units. Units 50 40 30 20 10 0 T im e (e a c h p e rio d e q u a ls o n e d a y ) Slide ‹#› Trade promotions and forward buying Supplier gives retailer a temporary discount, called a trade promotion. Retailer purchases enough to satisfy demand until the next trade promotion. Example: Campbell’s Chicken Noodle Soup over a one year period: One retailer’s buy Total shipments and consumption 7000 6000 S hipm e nts Cases Cases 5000 4000 3000 C ons um ption 2000 1000 Slide ‹#› Nov Oct Sep Aug Jul Jun Apr Mar Feb May T im e (w e e ks ) Jan Dec 0 Reactive and over-reactive ordering Each location forecasts demand to determine shifts in the demand process. How should a firm respond to a “high” demand observation? Is this a signal of higher future demand or just random variation in current demand? Hedge by assuming this signals higher future demand, i.e. order more than usual. Rational reactions at one level propagate up the supply chain. Unfortunately, it is human to over react, thereby further increasing the bullwhip effect. Slide ‹#› Shortage gaming Setting: Retailers submit orders for delivery in a future period. Supplier produces. If supplier production is less than orders, orders are rationed, i.e., retailers are “put on allocation”. … to secure a better allocation, the retailers inflate their orders, i.e., order more than they need… … So retailer orders do not convey good information about true demand … This can be a big problem for the supplier, especially if retailers are later able to cancel a portion of the order: Orders that have been submitted that are likely be canceled are called phantom orders. Slide ‹#› Strategies to combat the bullwhip effect Information sharing: Collaborative Planning, Forecasting and Replenishment (CPFR) Smooth the flow of products Coordinate with retailers to spread deliveries evenly. Reduce minimum batch sizes. Smaller and more frequent replenishments (EDI). Eliminate pathological incentives Every day low price Restrict returns and order cancellations Order allocation based on past sales in case of shortages Vendor Managed Inventory (VMI): delegation of stocking decisions Used by Barilla, P&G/Wal-Mart and others. Slide ‹#› An antidote to the bullwhip effect Is there any force in a supply chain that counteracts the bullwhip effect? Yes: If demand is seasonal (i.e., there are anticipated peaks and valleys in demand), then use production smoothing: If the firm’s orders are correlated with its production, the firm’s suppliers will see orders that are smoother than the firm’s demand. Quantity Demand exceeds production, drawing down inventory Production Production exceeds demand, building inventory Demand Time Slide ‹#› Production smoothing - U.S. monthly trade sector sales and production Slide ‹#› Production smoothing at Walmart (quarterly sales and production) Slide ‹#› Supply chain contracting Slide ‹#› Double marginalization at Umbra Visage (UV) Suboptimal supply chain performance occurs because … Each firm makes decisions based on their own margin, not the supply chain’s margin. This is called double marginalization. Example: Zamatia makes sunglass at a cost of $35 and sells them to UV for $75. UV sells them for $115 and salvages left over inventory for $25 per unit. Demand is normal with mean 250 and standard deviation 125. UV faces a newsvendor problem. UV: Cu = 115 - 75 = 40, Co =75 - 25 = 50, Critical ratio = 40 / 90 = 0.44 Supply chain: Cu = 115 - 35 = 80, Co =35 - 25 = 10, Critical ratio = 80 / 90 = 0.89 Supply chain’s critical ratio is much higher than UV’s critical ratio! Slide ‹#› The cost of double marginalization UV: Optimal order quantity = 234 (critical ratio = 0.44) Expected sales = 192 Expected profit = $5,580 Zamatia: Sales = 234 Profit = $9,360 Total supply chain profit = $5,580 + $9,360 = $14,940 Supply chain potential: Order quantity = 404 (critical ratio = 0.89) Expected sales = 243 Expected profit = $17,830 …. 19% higher than $14,940. Slide ‹#› A solution to double marginalization: share risk Suppose Zamatia offers to buy-back unsold sunglasses at b per unit: UV incurs a $1.5 cost to ship sunglasses back. b < $75 so that UV doesn’t make money returning merchandise. b > $26.50 so UV prefers to return rather than salvage. Zamatia salvages sunglasses for $26.50. UV’s overage cost, Co =75 – (b – 1.5) > 50, is reduced … … so UV’s critical ratio increases! Choose b to make UV’s critical ratio equal the supply chain’s critical ratio: Buy back price Shipping cost Price Price Salvage value Price - Wholesale price Price Cost $115 $25 Buy back price $1.5 $115 $115 $75 $71.5 $115 $35 Slide ‹#› Potential allocations of profit: Wholesale price ($) 35 45 55 65 75 85 95 105 Buy back price ($) 26.50 37.75 49.00 60.25 71.50 82.75 94.00 105.25 C u ($) 80 70 60 50 40 30 20 10 C o ($) 10.00 8.75 7.50 6.25 5.00 3.75 2.50 1.25 Critical ratio 0.8889 0.8889 0.8889 0.8889 0.8889 0.8889 0.8889 0.8889 z 1.23 1.23 1.23 1.23 1.23 1.23 1.23 1.23 Q 404 404 404 404 404 404 404 404 Expected sales 243 243 243 243 243 243 243 243 Exp. left over inv. 161 161 161 161 161 161 161 161 Expected profits: Umbra 17,830 15,601 13,373 11,144 8,915 6,686 4,458 2,229 Zamatia 0 2,229 4,458 6,686 8,915 11,144 13,373 15,601 Supply chain 17,830 17,830 17,830 17,830 17,830 17,830 17,830 17,830 As the buy-back price is increased, risk is shifted from UV to Zamatia along with profits. There is a wholesale/buy back price combination that makes both firms better off! Slide ‹#› Buy-back contracts summary What are they? Retailer is allowed to return to the supplier goods left over at the end of the selling season. How do they improve supply chain performance? The retailer’s overage cost is reduced, so the retailer stocks more. Allows for the redistribution of inventory risk across the supply chain. Could protect the supplier’s brand image by avoiding markdowns. Allows the supplier to signal that significant marketing effort will occur. What are the costs of buy-backs? Administrative costs plus additional shipping and handling costs. Where are they used? books, cosmetics, music CDs, agricultural chemicals, electronics … Slide ‹#› Other solutions to supply chain coordination failure Quantity discounts: Used to induce larger downstream order quantities so that downstream service is improved and/or handling and transportation efficiency is improved. Franchise fees: Marginal cost pricing coordinates actions, but leaves the upstream party with no profit. So charge a franchise fee to extract profit from the franchisee. Also known as a “two-part tariff”. Slide ‹#› Options contract example: semiconductors Setting: Supplier invests in capacity (fabs cost $3Billion+), then … Random demand occurs. Scenario 1: Buyer decides how much to buy after observing demand. Supplier bears all risk of idle capacity, so supplier under invests in capacity … … buyer can’t get needed product if demand is high Scenario 2: option contact: Buyer purchases options before demand is observed, p0 per option Buyer exercises options, pe to exercise each option, after observing demand Now risk is shared (supplier gets p0 per option up front even if demand is low) Supplier builds more capacity because she bears less risk … … and more capacity is available to the buyer if demand is high … … so they both can be better off. Where else are option contracts used? Energy markets (electric power), commodity chemicals, metals, plastics, apparel retailing, air cargo, … Slide ‹#› Summary Coordination failure: Supply chain performance may be less than optimal with decentralized operations (i.e., multiple firms making decisions) even if firms choose individually optimal actions. A reason for coordination failure: The terms of trade do not give firms the proper incentive to choose supply chain optimal actions. Why fix coordination failure: If total supply chain profit increase, the “pie” increases and everyone can be given a bigger piece. How to fix coordination failure: Design terms of trade to restore a firm’s incentive to choose optimal actions. e.g., with revenue sharing a retailer can justify holding more tapes. Slide ‹#›