Module 3.1. Analyzing Price Seasonality

advertisement

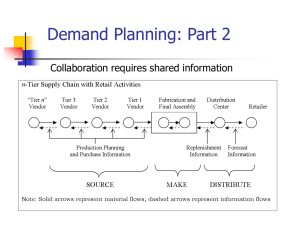

AAMP Training Materials Module 3.1: Analyzing Price Seasonality Asfaw Negassa (CIMMYT) & Shahidur Rashid (IFPRI) a.negassa@cgiar.org, s.rashid@cgiar.org Objectives • Understand the role of seasonality analysis in economic time series data • Review basic concepts of seasonality analysis • Compute seasonal indices • Forecast future prices using seasonal indices Background • Why Seasonality Analysis? • Basic concepts Why undertake seasonality analyses? • Economic time series variables (e.g., prices, sales, purchase, etc.) are composed of various components • One of the critical components is seasonality, especially in cases of: – Agriculture production – Marketing of goods – Commodity pricing Why undertake seasonality analyses? • Understanding patterns of movement in time series variables is useful for making better forecasts in – Marketing decisions • When to buy? • When to sell? • How long to store? – Production decisions • Seasonality in rainfall (timing of different operations) • Seasonality in insect infestation (timing of insecticide application) – Food security interventions • Determine periods when households are most vulnerable (e.g., seasonal price highs) • Monitoring changes in households food security situations (e.g., deviations from known seasonal price patterns) Basic concepts • A time series variable (e.g., prices, sales, purchases, stocks, etc) is composed of four key components: – – – – Long-term trends (T) Seasonal components (S) Cyclical components (C) Irregular or random components (I) • These components, when examined individually can help to better understand the sources of variability and patterns of time series variables – hence time series decomposition Basic concepts • There are several ways of decomposing time series variables (e.g., additive model, multiplicative model) • The basic multiplicative model is given as: Pt = Tt x St x Ct x It Where: Pt Tt St Ct It is the time series variable of interest is the long-term trend in the data is a seasonal adjustment factor is the cyclical adjustment factor represents the irregular or random variations in the series Time series price variables Include long term, cyclical, seasonal and irregular trends 45,000 40,000 35,000 30,000 25,000 20,000 15,000 10,000 5,000 1 8 15 22 29 36 43 50 57 64 71 78 85 92 99 106 113 120 127 134 141 148 155 162 169 176 183 190 197 204 - DSM Maize Price Computing seasonal indices • There are several different techniques which are used to isolate and examine individually the different components of time series variables • Here we focus on the ratio-to-moving average method, which is commonly used Computing seasonal indices Step 1: Deseasonalizing • Remove the short-term fluctuations from the data so that the long-term and cyclical components can be clearly identified – The short-term fluctuations include both seasonal (St) patterns and irregular (It) components – The short-term fluctuations can be removed by calculating an appropriate moving average (MA) for the series – Assuming a 12-month period, the moving average for a time period t (MAt) is calculated as: MAt = (Pt – 6 + … + Pt + … + Pt + 5) / 12 Computing seasonal indices Step 1: Continued…. • For monthly data, the number of periods (12) is even and is not centered – need to center it – To center the moving averages, a two-period moving average is calculated as follows: CMAt = (CMAt + CMAt +1) / 2……… = Tt x Ct……... – Seasonal and irregular components are removed Centered Moving Average (CMA) Seasonal and irregular components removed 45,000 40,000 35,000 30,000 25,000 20,000 15,000 10,000 5,000 1 8 15 22 29 36 43 50 57 64 71 78 85 92 99 106 113 120 127 134 141 148 155 162 169 176 183 190 197 204 - DSM Maize Price CMA Computing seasonal indices Step 2: Measuring the degree of seasonality • The degree of seasonality is measured by finding the ratio of the actual value to the deseasonalized value SFt = Pt / CMAt = Tt x St x Ct x It / Tt x Ct = St x It • Where SFt is the seasonal factor and others are defined as before. Seasonal Factor (SF) Actual price (P) / Deseasonalized price (CMA) 1.6 1.4 1.2 1 0.8 0.6 0.4 0.2 1 7 13 19 25 31 37 43 49 55 61 67 73 79 85 91 97 103 109 115 121 127 133 139 145 151 157 163 169 175 181 187 0 SF Computing seasonal indices Step 3: Establishing average seasonal index • This is obtained by taking the average of seasonal factors for each season – Take the sum of SFs for the month of January and divide by the number of SFs for January over the entire data period – Pure seasonal index (S) obtained, irregular component removed – Note: the sum of indices for all months add-up to 12. • Issues: – Predictability of seasonal patterns – Changes in seasonal patterns Seasonal index (S): Multiple years Pure seasonal component (S) without irregular component 1.600 1.400 1.200 1.000 0.800 0.600 0.400 0.200 1 7 13 19 25 31 37 43 49 55 61 67 73 79 85 91 97 103 109 115 121 127 133 139 145 151 157 163 169 175 181 187 193 199 - S Seasonal Index (S): One year The seasonal Index helps predict price extremes Seasonal Index (S) 1.4 Seasonal High 1.2 Seasonal Low 1.0 0.8 0.6 0.4 0.2 0.0 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Computing seasonal indices Month Seasonal Index Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec 0.965522624 0.921371556 0.942636238 0.945834259 1.011026204 1.101787997 1.110037521 Aug Nov Sum of indices Seasonal High Seasonal Low 11.99961488 1.170524076 1.093278943 0.959423752 0.883398512 0.8947732 Completing the price decomposition • In order to complete the price decomposition, three components must be computed – Long term time trend of deseasonalized data (CMAT) – Cyclical Factor (CF) – Irregular Factor (I) • The combination of CMAT and S is a useful method for forecasting future prices Computing other components Step 4: Finding the long-term trend • The long-term trend is obtained from the deseasonalized data using OLS as follows: CMAt = a + b (Time) Where Time = 1 for the first period in the dataset and increases by 1 each month thereafter • Once the trend parameters are determined, they are used to generate an estimate of the trend value for CMAt for the historical and forecast period. Long term trend (CMAT) OLS on deseasonalized price (CMA) 40000 35000 30000 25000 20000 15000 10000 5000 1 7 13 19 25 31 37 43 49 55 61 67 73 79 85 91 97 103 109 115 121 127 133 139 145 151 157 163 169 175 181 187 193 199 0 CMA CMAT Computing other components Step 5: Finding the cyclical component (CF) • The CF is given as the ratio of centered moving average (CMAt) to the centered moving average trend (CMATt) as follows: CF = CMAt / CMATt = Tt x Ct x It / Tt =Ct Cyclical Factor (CF) Deseasonalized price (CMA) / Long-term trend (CMAT) 1.6 1.4 1.2 1 0.8 0.6 0.4 0.2 1 7 13 19 25 31 37 43 49 55 61 67 73 79 85 91 97 103 109 115 121 127 133 139 145 151 157 163 169 175 181 187 193 199 0 CF Computing other components Step 6: Finding the irregular component (It) • The It is given as the ratio of seasonal factor (SF) to pure seasonal index (S) as follows: It = St It / St = It • This completes the decomposition Irregular component (I) Seasonal Factor (SF) / Seasonal Index (S) 1.8 1.6 1.4 1.2 1 0.8 0.6 0.4 0.2 1 7 13 19 25 31 37 43 49 55 61 67 73 79 85 91 97 103 109 115 121 127 133 139 145 151 157 163 169 175 181 187 193 199 0 I Forecasting using seasonality analysis • Forecasting time series variables – Prices for the next year can be forecasted – Timing of price changes • When will prices be low? • When will prices be high? – Magnitude of price level at specific future dates – Magnitude of temporal price differential (between seasonal high and low) • Is storage profitable? Forecasting using seasonality analysis • Two main ways of forecasting 1. Forecast monthly values by multiplying estimated average value for the next year by the seasonal index for each month– this assumes no significant trend, 2. First estimate the 12-month trend for deseasonalized data and then apply the seasonal index to forecast the actual prices for the next year Forecast Pt = Tt x St Forecasting using method 2 CMAT x S 45000 40000 35000 30000 25000 20000 15000 10000 5000 1 7 13 19 25 31 37 43 49 55 61 67 73 79 85 91 97 103 109 115 121 127 133 139 145 151 157 163 169 175 181 187 193 199 0 Forecast DSM Maize Price DSM Maize Price Forecasting limitations • The seasonal analysis is used under normal conditions and there are several factors which alter the seasonal patterns – Drought, floods, earthquake, etc. – Government policy changes • Abnormal years should not be included in the computation of seasonal indices Exercises • Open Module 3.1 Excel workbook • Read over the notes in the [NOTES] sheet • In [Dar Maize Price Analysis] sheet, replicate the outcomes in the [Tanzania Example] – First, calculate seasonality indices (MA, CMA, SF and S) – Then, forecast future prices (CMAT, CF, predicted price) • Make sure to understand what each component does • Don’t just copy and paste the formulas. References • Tschirley, David. 1995. Using microcomputer spreadsheets for spatial and temporal price analysis: an application to rice and maize in Ecuador. In Prices, Products, and people: Analyzing agricultural markets in developing countries (Scott, G., editor) International Potato Centre, Lima, Peru.