Berkshire Red 8 Performance - South Central Ambulance Service

advertisement

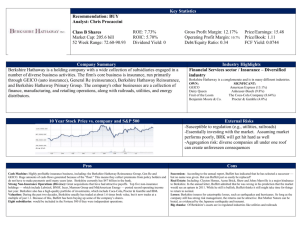

Operational Performance Update John Nichols Interim Chief Operating Officer SCAS Agenda • • • • • • Summary Activity Performance Action Plans Risks Conclusions Summary SCAS 6% Demand Increase Performance Impact Telephony “White Noise” Red 8 - 1.5% Berkshire 8% - 1.5% -2% -1.5% Sickness EOC “Wokingham/Berkshire” changes - 0.5% - 0.5% - 0.5% - 0.5% - 2% Total - 4% - 6.5% SCAS Demand 2004 to date Demand rising at above assumed growth rate Weekly Activity vs. 2011/12 Demand particularly high during May Demand and Performance Demand at +6% for SCAS +8% for Berks 1.5 -2% loss on Red 8 .7 -1% loss on Red 19 Source: national REAP document Red1 Performance 2012/13 Averaging 15 Red 1 calls per day 6.5% of all Red Calls 1.5% of all E&U Calls National Indicator (75%) Standard from April 2013 (80%) Red8 Performance vs Trajectory Red 8 performance for July (to date) holding well, at above 76% Red19 Performance vs Trajectory 97.00 96.50 96.00 95.50 95.00 Actual 94.50 Trajectory 94.00 93.50 93.00 09 /0 4/ 20 12 16 /0 4/ 20 12 23 /0 4/ 20 12 30 /0 4/ 20 12 07 /0 5/ 20 12 14 /0 5/ 20 12 21 /0 5/ 20 12 28 /0 5/ 20 12 04 /0 6/ 20 12 11 /0 6/ 20 12 18 /0 6/ 20 12 25 /0 6/ 20 12 02 /0 7/ 20 12 92.50 Red 19 performance for July (to date) remains above 95% Red8 Performance – Q1 Cluster Red8 Performance Trajectory Berkshire 71.45% 73.3% Hampshire 79.85% 76.6% Ox Bucks 75.75% 76.8% Red19 Performance – Q1 Cluster Red19 Performance Trajectory Berkshire 96.00% 95.5% Hampshire 95.1% 95.8% Ox Bucks 95.98% 95.8% Red 8 &19 YTD (to 23rd July) Cluster Red8 Performance Red 19 Performance Berkshire 71.1% 95.83% Hampshire 76.83% 95.18% Ox Bucks 79.95% 95.6% Red 8 &19 Q2 to date Cluster Red8 Performance Red 19 Performance Berkshire 69.72% 95.14% Hampshire 77.75% 95.47% Ox Bucks 77.63% 94.2% Handover delays April –June, 2011 vs 2012 2011 2012 Circa 500 additional lost hours per month Operational improvement plan • Relocate Wokingham EOC Completed on 12th July Benefit realisation (plan compliance/resilience) from end July onwards • Expand/exploit CSD Recruitment now – nurses and ECPs • Deliver enhanced EOC staffing Increase establishment by12 WTE Call takers Senior call takers at North EOC Full establishment by November • Improved EOC performance management Call centre metrics Operational improvement plan • Improve consistency of number of hours on road Enforced Rota lock down at 2 weeks Abstraction management Focused additional resourcing to compensate for high demand • Better matching hours on road with anticipated and actual demand (performance consistency) Weekly demand reviews based on forward look • Increase effectiveness and efficiency of hours Further improve efficiency of OSD (Fleet and equipment availability) Additional short term “drivers” – vehicle movements Increased focus on reducing response ratios Operational improvement plan • Expand indirect resources Review of all potential static sites (care homes etc) Introduce 20 new static sites by end August Focused new CFR schemes (South Bucks and North Hants) Review Co responder contribution (North Hants) • CAD changes to aid Red1 Implemented 19th July Key word recognition/”purple” highlight high suspicion red 1 calls • MDT upgrade Beta test in Portsmouth in August Flash upgrade remaining fleet during September Operational improvement plan • Berkshire Red 8 Performance Increase resource allocation (plus 2 RRVs) Increase focus on East Berks/South Bucks interface Provide improved dispatch/communication with “named” PPs Improve use of CFR/Co Responder/Static site number Rebalance dispatch sector (on patient flows and resources) Q4 • Hampshire Red 19 Performance Increase resource capacity – North Hants (protected cover) Improve use of CFR/Co Responder/Static site number Increased social standby capacity Increase vehicle availability to match new rotas Risks • Activity – Planning for +4% v current +6% • Fleet – High VOR rates/New rosters • Weather – Bad winter • Abstraction Rates – Managing to plan • Hospital delays – CEO contact – SHA & Commissioner support Conclusions • Confidence in achieving quarterly (National) A8 and A19 targets • EOC staffing action plan in place • Berkshire Red 8 recovery plan in place • Hampshire (cluster) Red 19 action plan in place • Action plans and contingency in place to mitigate if demand continues above expectation • Action plan in place to strengthen fleet position • Main risks associated with Red1 and demand