DiGiorno - krvorobyova

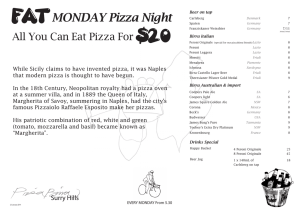

advertisement

Team Incredible Nestle took over DiGiorno in 2010 DiGiorno has remained the top-seller of frozen pizza since Frozen pizza market has become cluttered, so DiGiorno needs to continue to hold the consumer’s interest Overall, Americans eat about 23 pounds of pizza per year Restaurant, take out, or grocery store Pizza sales are increasing at a rate of 10% annually Growth: In 2005-2009, DiGiorno achieved a22% growth increase. Mintel predicts that it will continue to increase at about 4% annually during 2011- 2015. (Information from Mintel’s Pizza at Retail- US June 2011) Decline: In 2010, sales decreased by 1.1%. Mintel expects a 0.3% decline for 15-24 year-olds between 2011-2016. Results in an unfavorable future in younger demographics for pizza companies. Changes: Per Mintel’s custom consumer survey, two thirds (65%) of households with one child have eaten a frozen pizza in the last three months, compared to 72% of households with two or more children. Families with more kids tend to be the drivers for pizza sales. (Information from Mintel’s Pizza at Retail- US June 2011) Market Share DiGiorno Red Barron Tombstone California Pizza Kitchen Jack’s 29.4% 12.5% 10.9% 6.1% 5.7% Trends : • The South and Northeast hold the largest percentage of adults who eat frozen pizza. • DiGiorno pizza and sides, such as: “Pizza & Wyngs” and “Pizza & Cookies” • Families with more than three kids show a far greater tendency to eat pizza that involves some kind of preparation (Simmons). “New” DiGiorno options Combination packages: Pizza & Wyngz, Pizza & Cookies and Cheese Stuffed Crust Large portioned pizzas with various toppings and crust types and flavors Small single portion pizzas with various toppings and crust types and single pizza in a 200 calorie portion Price Compared to competitors, DiGiorno’s prices are similar to other high quality frozen pizza options Pizza & Wyngz, Pizza & Cookies and Cheese Stuffed Crust Although DiGiorno seems like the highest priced pizza, it promotes the quality of delivery pizza in their frozen entreesSmall single portion pizzas with various toppings and crust types and single pizza in a 200 calorie portion Supermarket/foodstore:14% increase with $3,360 in sales in 2010 Super-centers/warehouse: 38% increase with $1,746 in sales in 2010 Drug Stores: 50% increase with $50 million in sales in 2010 Other: 50% decrease with $106 million in sales in 2010 Current frozen pizza heavy users tend to be parents of large families, single men and teenagers. Heavy users are also teenagers, young singles (particularly men) and children old enough to prepare their own meals. Traditionalists: Under the age of 55 Not loyal to any one brand of frozen pizza. They are less interested in innovations such as high-protein, international flavors or gender specific. Most likely to indicate that compared to a year ago they are buying more pizza that is on sale and/or the best price. They are most interested in an affordable, frozen or take out pizza that is made with common ingredients Primary Target Families with at least 5 or more persons in the household Work full time (30+ hours) $75,000+ income These demographics are those who are already frequently purchasing DiGiorno. DiGiorno will be an easy solution to create a family social meal. Secondary Target: Males aged 18-24 At minimum hold a high school diploma At minimum work part time DiGiorno is going to be their go-to social meal with friends. This age group is 20% above average in terms of choosing frozen pizza. Newspapers: Americans spent 26 minutes on average reading the newspaper per day in 2011. It is a great source of reaching a wide variety of audiences. Internet: In 2010-2011, 77% of 10,000 adults aged 18+ used the Internet more than an hour a week for something other than checking their emails. Using keyword search optimization will keep DiGiorno at the top of the consumer’s mind while they search “frozen pizza,” “frozen meals,” “pizza” or “easy dinner” for instance. Television: The average American spends four hours and 39 minutes watching television per day. (eMarketer) Psychographics/Lifestyle: Public perception of frozen pizzas range from thinking the food is downscale, unhealthy and low Seasonal Sales: DiGiorno’s sales do not fluctuate too intensely from season-to-season, but sales are best during the winter and back to school months. Economy: The economy is in a transitioning phase, therefore this could reflect on sales of frozen-pizzas Dependent on whether people will feel like splurging more, or if staying in is best for saving money. Groups: Single women, older couples and middle to old people purchase DiGiorno frozen-pizzas less than other groups. Regions: Sales for DiGiorno frozen-pizzas vary depending on region. There are many opportunities for growth. Marketing Objectives DiGiorno’s ultimate goal: Increase market share from 29.4% to 31.4% within 2012-2013. This represents $723 million of total sales. In doing so, coupon promotions will be incorporated once a month for either two for $2.00 and two for $1.50. Advertising Objectives To reinforce the perception that DiGiorno is the highest quality of frozen pizza, “It’s not delivery, It’s DiGiorno.” To encourage current users to make multiple purchases instead of single purchases. To increase awareness of how DiGiorno is the highest quality of frozen pizza for . To remind current users of brand loyalty, instead of attempting to attract the non-users. Desired Reach and Frequency Levels High months: Reach: 94 Frequency: 13 Low months: Reach: 70 Frequency: 2 Continuity Pattern: Pulsing High months: Winter months, popular sporting months, back to school months (January, February , March and August) Low months: April, May, June, July, October, November and December High month allocation: $29,330,400 ($7,332,600 per month for 4 months)Winter months, popular sporting months, back to school months (January, February , March and August) Low month allocation: $20,451,200 ($2,556,400 per month for 8 months)April, May, June, July, October, November and December Television Network Budget: $3,145,400 Percent: 6% Spot Percent: 18.40 Cable Budget: $9,215,600 Budget: $2,091,600 Percent: 4% Although the internet has become a new source to watch videos, television is still the most popular way to watch videos despite the growth of sites such as YouTube and Hulu (Mintel). Advertising DiGiorno on television will be an appropriate medium because ads for staple versus luxury products are more accepted to viewers. This is especially important for our secondary target audience, since men have been found to be more open to television ads and more engaged with them. If a single man sees our ad, he might be more receptive to the message Radio Budget: $2,278,200 Percent: 4.60% According to Arbitron radio market rankings for spring 2012, the top markets for radio listeners in the South and East Central regions are: Dallas-Ft. Worth, Houston-Galveston, Atlanta, Detroit, Miami-Ft. Lauderdale-Hollywood, Tampa-St. Petersburg-Clearwater, Charlotte-Gastonia-Rock Hill, San Antonio, Cincinnati and Cleveland. Based on the ratings, we have decided to use these areas to advertise to our consumers. Since each market has different top genres, radio spot advertising will vary per DMA. Magazine Budget:$2,243,400 Percent:4.50% Consumers have to purchase magazines, so they are more likely to pay attention to content such as ads.(Mintel) Newspaper Budget: $15,889,500 Percent: 31.89% Print advertising has the next greatest reach after television most notably in RoI where almost half of all consumers pay attention to adverts in newspapers and magazine (Mintel). 5% of consumers use the newspaper as a primary source when checking for sales ads and 41% check the newspaper regularly before shop. Due to these facts, we decided to use newspapers, especially since a lot of subscribers obtain the newspaper for coupon and sales in general. Internet Budget: $4,067,800 Percent: 8% We will target mother’s through social media because they are: 5% use social media 31% more likely than the general population to become a fan or follow a brand 27% more likely to comment on others’ postings 24% more likely to become a fan or follow a celebrity 37% more likely to post photos33% more likely to post status updates This will allow to have a strong position to be remembered, have more people follow the brand and eventually purchase the product Outdoor Budget: $4,888,000 Percent: 9% Billboards will serve as reminders for primary target and urge consumers to purchase product on the way home for dinner. Outdoor has the highest reach and frequency. 42% of respondents noticed ads last week ¾ noticed billboards 18-24 year olds are more likely to notice transportation ads 25-54 are more likely to notice billboards Direct Mail Budget: $6,791,600 Percent: 13.6% According to Ballantine Corp. stated that Direct Mail is still considered to be important in B2B marketing. Although it doesn’t hold the “flash” the latest social media trend, it still works. Thank you!