Chapter_7_-_Measurement_Applications

advertisement

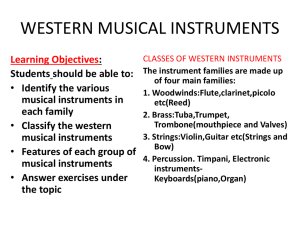

MEASUREMENT APPLICATIONS David Chu Richard Persaud Jeffrey Rousset Stephen Storey Overview • Current Value Accounting • Financial Instruments • 2007-2008 Market Meltdown • Derivative Instruments • Reporting on Risk • Accounting for Intangibles Current Value Accounting • Value-in-Use • Business Model • Fair Value • Exit price (opportunity cost) • 3 Levels Accounts Receivable & Payable • Current accounts receivable • Net of allowance for doubtful accounts • Accounts payable • Approximates present value • Discount factor ignored Cash Flows Fixed by Contract • Effective interest rate • Amortized cost accounting • Finance lease contract • Lower of fair value leased payments or present value of minimum lease payments Lower of Cost or Market Rule • Usefulness • Conservatism Revaluation Option for Property, Plant, and Equipment • IAS 16 • Allows for revaluation option • Must keep updated Ceiling Test for Property, Plant, and Equipment • Impairment loss is recognized if Book Value is less than the Recoverable amount Differences: • IAS 36 • FASB Pensions and other Post-Employment Benefits • Defined pension plans (IAS 19) • Pension expense arising current period employee service to include the change in the discounted present value of expected future pension payments, including for any future compensation increases. • Implications for measurement approach Financial Instruments • Financial instruments are defined as follows: • A financial instrument is a contract that creates a financial asset of one firm and a liability or equity instrument of another firm. • Financial Instruments include: • Cash • An equity instrument of another firm • A contractual right to: • Receive cash or another financial instrument from another firm, or • Exchange financial instruments with another firm • A contractual obligation to: • Deliver cash or another financial asset to another firm, or • Exchange financial instruments with another firm IAS 39 Classification of Financial Assets • Available-for-Sale • Non-derivative instruments, valued at fair value. Most unrealized gains and losses included in OCI until the asset is disposed of. • Loans and Receivables • Non-derivative instruments, valued at amortized cost and are subject to an impairment test. Examples include bank loans. • Held-to-Maturity • Non-derivative instruments, valued at amortized cost and are subject to an impairment test. Firms intent is to hold until maturity. • Financial Assets at Fair Value through Profit and Loss • Includes all derivatives not held for hedging and non-derivative financial assets held for trading. These are investments in assets for the short term, with gains and losses included in net income. IAS 39 – Fair Value Option • The ability to designate instruments at fair value is permitted under IAS 39, called the Fair Value Option. • The Option gives firms the right, but not the obligation, to value financial assets and liabilities at fair value. • Once designated under this option however, the firm must continue to fair-value the instrument in future periods. • IAS 39 recognizes two categories for financial liabilities: 1. Financial Liabilities at fair value through profit and loss • Includes financial liabilities held for trading and other liabilities that the firm has designated to belong to this category 2. Other Financial Liabilities • Valued at cost or amortized cost. Examples include bonds outstanding Switching between Asset Classes • Firms can have strong incentives to switch between held-to-maturity and held-for-trading categories • Firms can immediately increase net income if the asset value has appreciated from its book value. • IAS 39 provides strong disincentives for this behavior • If a firm sells or reclassifies a significant amount of held-tomaturity securities, the firm is prevented from using the heldto-maturity category for at least two years. • This eliminates a firms ability to value instruments at amortized cost over that period of time. Why Not Always Use Fair Value? • Issue #1: If reliable measurements cannot be attained, then fair value is likely not going to be decision useful, despite being more relevant. • Issue #2: Other Financial items can also be difficult to value reliably. Financial institutions, specifically, face issues when valuing demand deposits, and their resulting intangibles, at fair value. This issue is in regards to core deposit intangibles. Issues Arising from Fair Value • Earnings Mismatch defined as: • Earnings volatility in excess of the real volatility facing a firm • Some firms utilize a natural hedge, where they hold financial assets and liabilities of similar duration and other characteristics to offset their impact on the firm • From a business perspective, an increase in interest rates decreases the fair value of a company’s interest bearing assets, but also decreases the fair value of the debt • The financial statements will only show the loss on the assets, and therefore makes earnings more volatile than the true value of the company • IAS 39 lets liabilities be fair valued only if it reduces this mismatch Fair Value Accounting in the U.S. • In the U.S., ASC 825-10-15 allows for fair-valuing liabilities, but does not restrict this option to only reducing mismatch situations • A company that has its debt downgraded by a credit agency will report a gain on its Income Statement • Implies that a loss by debt holders results in a more profitable firm as a whole. • Credit risk is a function of the business environment facing the firm and the fair value of its assets. As several balance sheet assets are recorded at cost, another mismatch situation occurs as these assets are not written-down to correlate with the downgrade. 2007-2008 Market Crash • Following the market meltdown, several firms reported huge fair value write-downs of their assets due to illiquidity issues and the increased cost of insurance through Credit Default Swaps. • Managers and Regulators felt that the accounting policies at the time were excessive and forced down the value of even unaffected investments. • In the face of this difficulty, standard setters (IASB and FASB) introduced two modifications in 2008 • Firms could determine fair value based on their own cash flow estimates and risk-adjusted discount rate • Firms could reclassify certain assets in “rare circumstances” IFRS 9 Replaces IAS 39 • Effective January 1, 2013, IFRS 9 will permanently replace IAS 39 which was a temporary measure • All financial assets are to be recorded at fair value at acquisition, and may be subsequently converted to the amortized cost basis if the objective of the firm is to collect the interest and principal. This reduces the number of possible accounting methods to two • Gains and losses on financial assets are generally recorded in net income • Assets that were originally held to collect interest and principal and were sold prior to maturity, may be recognized through profit and loss unless transactions of this nature occur too often, in which case the company will have to use fair value accounting • Ultimately IFRS 9 backs off from its harsh stance on fair value accounting for financial instruments Derecognition and Consolidation • Off-balance sheet financing concealed much of the risk borne by financial institutions leading to the ’07-’08 crash • Derecognition – Financial institutions engage in securitization to lower the leverage on their Balance Sheet • Consolidation – The extensive use of Special Purpose Entities (SPEs) blurred the boundary between what should be consolidated on the financial statements and what you be left off Derivative Instruments • Derivative Instruments rely on some underlying price, interest rate, etc… • Derivatives allow for high amounts of leverage as minimal initial cash outflow • Manage Risk • Speculate • Industry has moved from historical cost method to fair value method Option Fair Value Pricing • Use expected value to determine fair value • Black/Scholes pricing formula • Current market price of shares • Variability of return of the share • Exercise price of the share • Time to Expiration • Risk free rate Derivative Instruments • Derivatives used to protect against risks • Fair value hedges used as a hedge against an asset or liability • Cash flow hedges to hedge anticipated transactions Why firms manage risk 1. CAPM model does not include estimation risk 2. Ensure cash is available when needed 3. Derivatives used to speculate 4. Hedging may prevent large losses Firm risks • Interest rate risks for financial institutions • Greater volatility of full fair value income negatively related to hare price • Sensitivity analysis of risk • Value at Risk Accounting for Intangibles • Intangible assets are capital assets that do not have • • • • physical substance – ex: patents, trademarks If purchased or self-developed, intangibles may be treated like property, plant & equipment and are valued at cost and amortized over useful life If acquired through business combination, cost is equal to fair value and subject to the ceiling test Costs of developing a product resulting from research may be capitalized if the results of the research are technically and commercially feasible and costs can be measured reliably Due to recognition lag, intangibles appear through the income statement Purchased Goodwill • Goodwill is the difference between the fair value of the tangible and identifiable intangible assets and the liabilities of the acquired company, and the purchase price paid by the acquiring company for consolidated financial statements purposes Purchased Goodwill example A Ltd. Balance Sheet As at January 1, 2011 Capital Assets $500 ___ $500 Liabilities Equity $100 400 $500 Purchased Goodwill example cont’d Z Ltd. Balance Sheet As at January 1, 2011 Capital Assets $300 ___ $300 Liabilities Equity $140 160 $300 Purchased Goodwill example cont’d A Ltd. Balance Sheet (Post-Acquisition) As at January 1, 2011 Capital Assets, excluding Z Ltd. Investment in Z $500 400 $900 Liabilities $100 Equity 800 $900 A Ltd. purchases all 160 shares of Z Ltd. in exchange for 40 shares of A’s stock valued at $10/share Purchased Goodwill example cont’d A Ltd. and Subsidiary Consolidated Balance Sheet As at January 1, 2011 Capital Assets, exclude goodwill $840 Goodwill 200 $1040 Liabilities Equity $240 800 $1040 Assume Z. Ltd.’s capital assets fair value were $340 and its liabilities were $140. Goodwill is purchase price ($400) less the fair value of net assets ($200) Self-Developed Goodwill • No readily identifiable transactions exist to determine the cost of self-developed goodwill • Lev and Zarowin (1999), suggest capitalizing the accumulated costs of R&D projects if it can be tested through working models or successful clinical trials • Standard setters are reluctant due to concerns about reliability • Clean Surplus Model (chapter 6) may be used to determine expected present value of future abnormal returns Accounting for Goodwill • New governance and accounting rules place attention on • • • • the fair value of balance sheet intangibles GAAP no longer requires goodwill to be amortized Fair value of goodwill and useful life of other intangibles need to be assessed yearly to an annual impairment test Companies may get independent valuation specialists to review management’s reports Should lead to more credible financial reporting and realistic pricing practices Question What are the two bases of current value measurement? Answer Value-in-Use and Fair Value Question What are the challenges for the measurement approach? a) Estimates b) Reliability c) None of the above d) A and B Answer d) A and B Question • Which of the following classifications of financial assets is not allowed in Canada, under the current IAS 39. • Available-for-Sale • Loans and Receivables • Held-to-Maturity • Financial Assets at Fair Value through Profit and Loss • Mark-to-Market Answer • Mark-to-Market Question • What is a natural hedge? Answer • Some firms utilize a natural hedge, where they hold financial assets and liabilities of similar duration and other characteristics to offset their impact on the firm • From a business perspective, an increase in interest rates decreases the fair value of a company’s interest bearing assets, but also decreases the fair value of the debt Question • Why cant standard setters demand that financial assets are always measured at fair value? Answer • Fair value may not be reliable for certain securities for which there is little or no market. Issues also arise in regards to how intangibles should be fair valued when valuing deposits at financial institutions. Question • What are the two types of goodwill? Answer • Purchased • Self-Developed Question • Is goodwill amortized? Answer • No, it is subject to the annual impairment test